If you are searching for invoicing software, especially for a small business then you have come to the right place. This blog is your go-to resource about the best small business invoicing software options available out there.

We’ll dive deep into each software knowing about its key features, pricing plans, user ratings, and reviews, giving you a comprehensive understanding of what each one has to offer. Let’s get started then!

Small business invoicing software reviews: A Quick Glance

| Software | Starting Price | Average Rating | Trial Period | Free version |

| Refrens | ₹100/month | 4.9⭐ | Upto 10 documents | Upto 50 documents |

| Zoho | ₹749/month | 4.7⭐ | 14 days | No |

| FreshBooks | $7.60/month | 4.5⭐ | 30 days | No |

| QuickBooks | $6/month | 4.3⭐ | 30 Days | No |

| Paymo | $5.9/month | 4.7⭐ | No | Yes |

| Xero | $54/month | 4.4⭐ | Yes | No |

| Waves | $20/month | 4.6⭐ | No | No |

Key Features to Consider :

Here are the key features to consider while choosing invoicing software for small businesses –

- Ease of Use: Look for an intuitive interface that simplifies the creation and customization of invoices, along with user-friendly features for managing clients and projects.

- Automation: Seek features that allow for the automation of recurring invoices and payment reminders, as well as options for automated invoice sending and receiving.

- Customization: Ensure the software offers flexibility to create invoices reflecting your brand identity, along with customizable templates for invoices and estimates.

- Payment Processing: Choose software that integrates with online payment gateways for secure client payments and can accept multiple currencies.

- Additional Features: Consider software with expense tracking and time tracking capabilities, along with inventory management functionalities if needed. Look for reporting and analytics tools for financial insights and integration with other business applications such as accounting software.

- Budget: Evaluate pricing plans offered by different software options, and select a solution that aligns with your business needs and budget.

- Security: Prioritize software with robust security measures in place to protect your financial data.

List of 7 Best Small Business Invoicing Software

1. Refrens – Accounting & Invoicing Software for Small Business

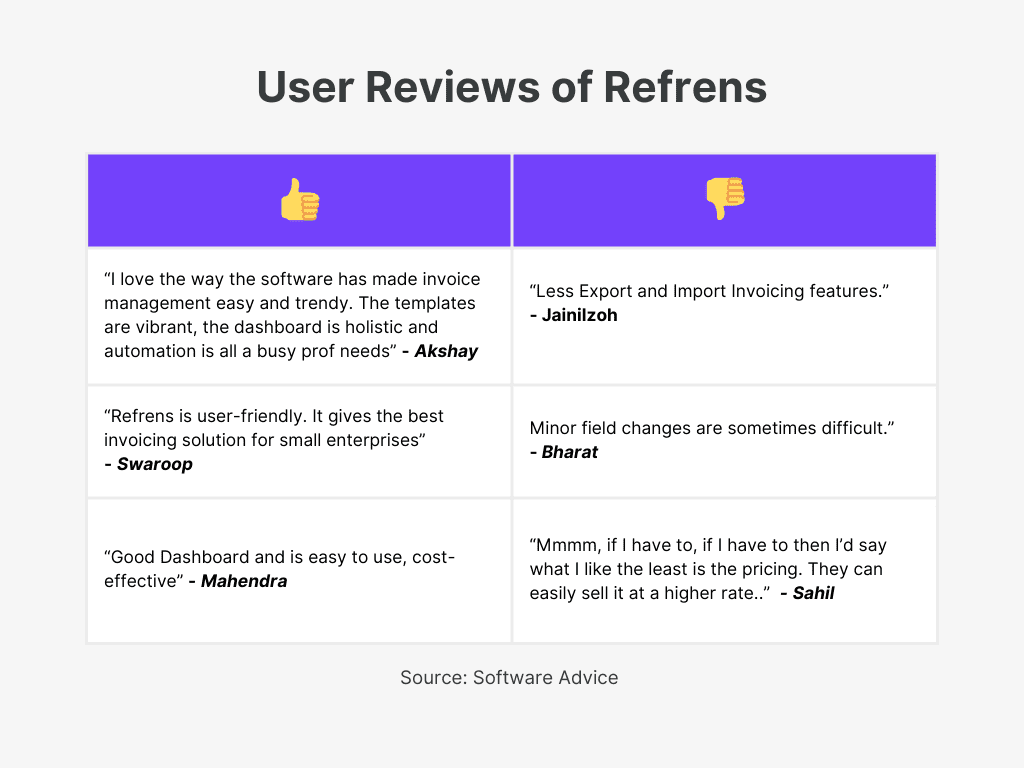

Refrens emerges as one of the best billing software, catering to over 150,000 businesses globally with its robust online platform. Offering a comprehensive array of features, Refrens simplifies financial tasks by providing an intuitive interface for effortless invoice creation, seamless payment tracking, and efficient expense management, all within a unified platform.

Key Features:

- Automated Invoicing: Effortlessly create professional invoices with a customized look that reflects your brand.

- Seamless Sharing: Reach your clients on their preferred platform with one-click sharing via WhatsApp integration, email, secure link, PDF, or even physical print.

- Complete Customization: Design invoices that match your brand perfectly with customizable templates, colors, fonts, and layouts. Add your logo, headers, and footers for a consistent brand image.

- Recurring Invoices on Autopilot: Save time and ensure on-time payments by automating invoices for recurring services.

- Streamlined Workflow: Convert quotes into invoices with a single click, eliminating unnecessary steps.

- Simplify Tax Compliance: Generate e-invoices and access essential tools to effortlessly manage your finances and generate insightful reports. Plus, Refrens helps with GST filing in India by generating GSTR-1 reports with a single click.

- Improved Cash Flow: Reduce the risk of late payments with automated payment reminders sent via WhatsApp and email.

- Security: Secure cloud storage keeps your financial data safe and easily accessible.

- Free to Start: Get started with Refrens for free and enjoy unlimited invoicing with essential tools. Upgrade to paid plans as your business grows and your needs evolve.

With its ease of use, automation features, and focus on customization, Refrens is a powerful solution for small businesses looking to streamline their finances and get paid faster.

Additional Features:

In addition to its core features, Refrens offers a range of supplementary capabilities to enhance your invoicing experience further. These include e-invoicing software, IRN Generation, Lead Management Software, Auto Conversion of Documents, Inventory and Expense Management Software, Reporting, Bookkeeping Software, Accounting, Sales CRM Software, GST billing software, and more. With these additional features, Refrens provides a comprehensive solution to streamline various aspects of your small business operations.

Pricing:

- Free Plan: free plan for small businesses to create up to 50 documents/year

- Premium Plan: Pricing starts from as low as ₹100/month or $2.5/month depending on the number of users & features

Rating:

- Capterra: 4.8⭐/05

- G2: 4.6⭐/05

- Software suggests: 4.8⭐/05

- Software Advice: 5⭐/5

- Get app: 4.9⭐/5

2. Zoho – Free Invoicing Software For Small Business

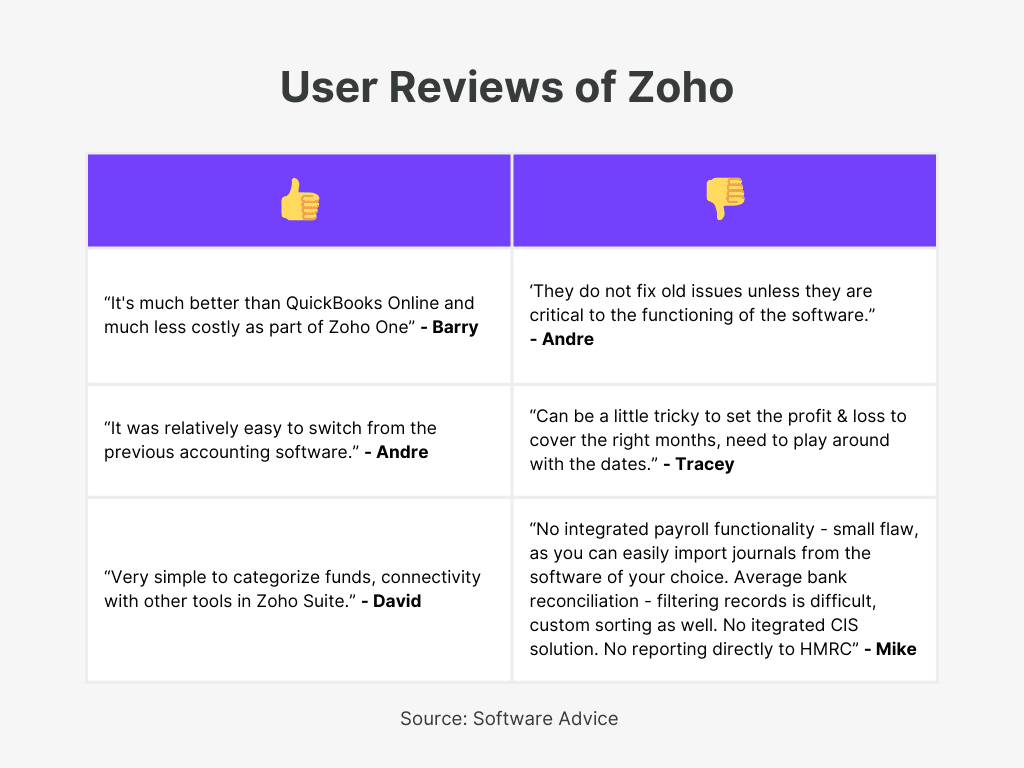

Zoho is a top accounting and inventory management software providing serving more than just invoicing to small businesses.

With Zoho Invoice, users can opt for either on-premises or cloud-based versions, providing flexibility to align with their preferred deployment methods.

Key Features:

- Invoicing: Streamline the invoicing process with professional-looking invoices, automated payment reminders, and seamless online payment acceptance.

- Recurring Invoices: Easily set up automated invoices for regular billing cycles, perfect for ongoing services like travel arrangements.

- Customizable Templates: Create personalized invoices that reflect your brand identity, utilizing customizable templates for a polished appearance.

- Online Payments: Expedite payment collection by offering diverse online payment options to clients.

- Expense Tracking: Efficiently manage and track expenses to maintain accurate financial records.

- Client Portal: Foster collaboration and communication with clients through a dedicated portal for accessing invoices.

- Time Tracking: Manage hourly fees or time-based services with ease through integrated time-tracking functionality.

- Automated Reminders: Send timely payment reminders to clients for efficient follow-ups and settlements.

- Multi-Currency Support: Enable seamless transactions with international clients by supporting multiple currencies.

- Mobile Accessibility: Access billing information and manage invoices on the go, essential for mobile business operations.

- Integration with Other Apps: Enhance efficiency by integrating Zoho Invoice with other business applications for streamlined processes.

In summary, Zoho Invoice offers a robust set of features tailored to meet the invoicing needs of small businesses, ensuring efficiency, professionalism, and flexibility in managing financial tasks.

Additional Features:

In addition to its core features, the platform offers a range of supplementary functionalities, including CRM, inventory management, lead management, sales automation, pipeline management, accounting, invoicing, expense tracking, task management, Gantt charts, time tracking, email hosting, calendar, contacts, and task management.

Pricing: Free

Rating:

- G2: 4.1⭐/5

- Capterra: 4.3⭐/5

- Get app: 4.3⭐/5

- Software Advice: 4.5⭐/5

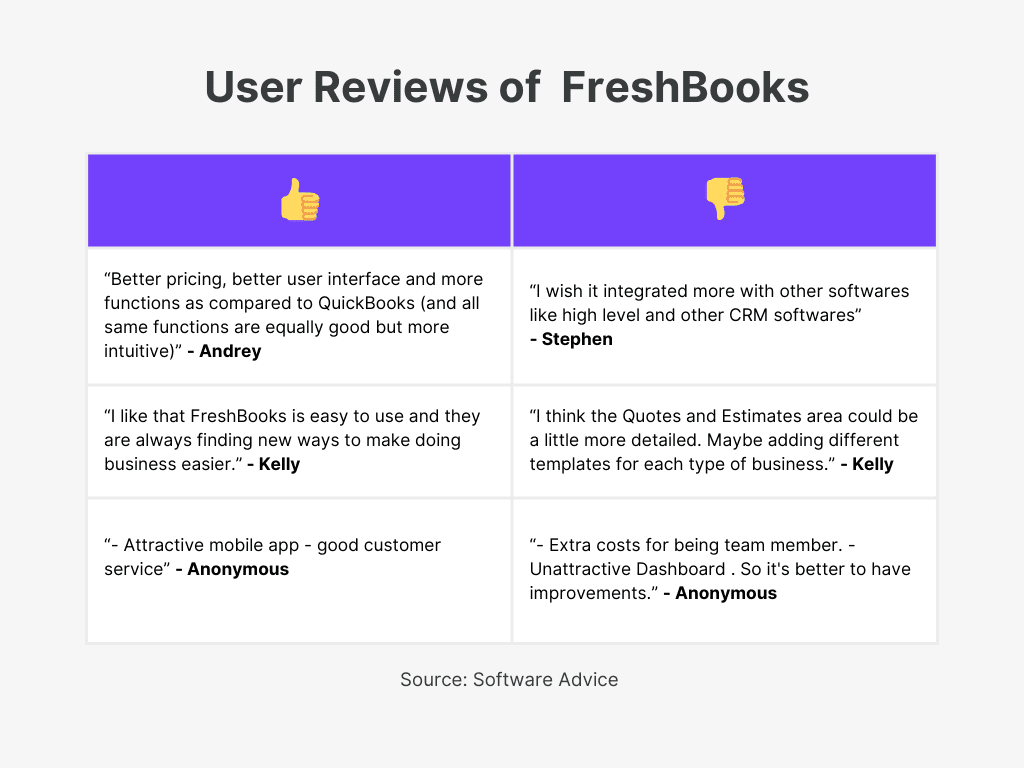

3. Freshbooks – Small Business Invoicing Software

FreshBooks, a top choice for small business invoicing software with client management, excels with its intuitive interface, which simplifies invoicing and client management tasks for small enterprises and independent professionals. It is also regarded as one of the best plumbing invoicing software options available, catering specifically to the unique needs of plumbing businesses.

It boasts features such as expense tracking, time management, and collaboration tools, presenting a comprehensive solution for efficient financial management.

Key Features:

- Invoicing: A straightforward interface ensures easy and professional invoice creation.

- Recurring Invoices: Automate recurring invoices for subscription-based or regular services.

- Expense Attachment: Directly attach expenses and receipts to invoices for transparent billing.

- Time Tracking for Invoicing: Easily track billable hours and convert them into invoices seamlessly.

- Multi-Currency Invoicing: Invoice clients in their preferred currency with automatic conversion support.

- Late Payment Reminders: Consists of automated invoice reminder tool for overdue payments to ensure a steady cash flow.

Additional Features:

In addition to its core functionalities, FreshBooks offers a range of supplementary features tailored to enhance financial management for small businesses and freelancers.

These include double-entry accounting, bank reconciliation, proposal, and estimate creation, client retainers, report generation capabilities, and convenient mobile applications for on-the-go access and management.

Pricing

- Trail Period: 30 days

- Lite: $7.60/month

- Plus: $13.20/month

- Premium: $24.00/month

- Select: Contact for the pricing

Rating

- Capterra: 4.5/⭐5

- Software Advice: 4.5⭐/5

- G2: 4.5⭐/5

- Get app: 4.5⭐/5

- Software Suggest: 4.7⭐/5

4. Quickbooks – Best GST Invoicing Software

QuickBooks, felicitated as one of the best small business invoicing software with time-keeping functionalities, offers robust accounting features tailored for small to medium-sized enterprises.

Key Features:

- Professional Branding: Generate online invoices that reflect your brand’s identity using customizable tools and templates.

- GST Compliance Made Simple: Easily generate tax invoices with pre-built data fields tailored to tax regulations.

- Automated Recurring Invoices: Save time and ensure timely payments by setting up automated recurring invoices.

- Batch Invoicing Efficiency: Send multiple invoices daily in batches through WhatsApp, email, or print for improved efficiency.

- GST Bill Tracking and Reminders: Stay on top of pending GST bills and send automated reminders to ensure prompt payments.

- Real-time Cash Flow Management: Keep track of your cash flow in real-time and effortlessly generate statements for financial insights.

Additional Features

In addition to the core features, small business invoicing software offers cloud accounting, online banking integration, detailed reports, inventory management, and a range of apps and add-ons for enhanced functionality.

Pricing

- Easy Start: $6/month

- Essential: $12/month

- Plus: $14/month

- Advance: $28/month

Rating

- Capterra: 4.4⭐/5

- G2: 4.3⭐/5

- Get app: 4.4⭐/5

- Capterra: 4.3⭐/5

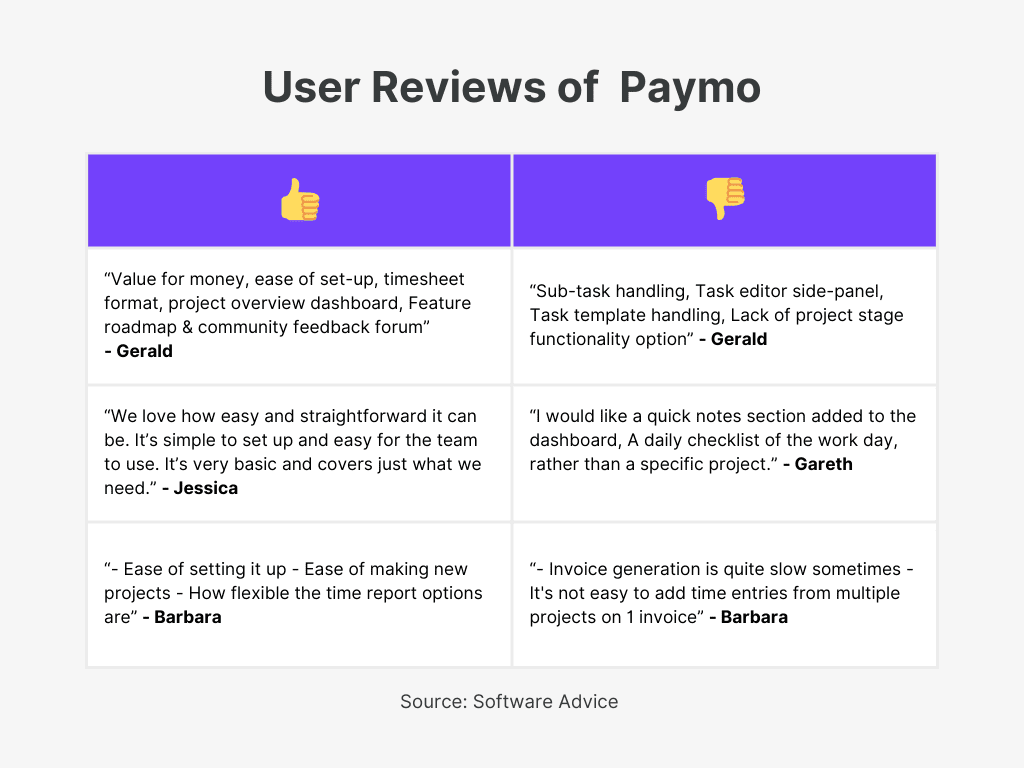

5. Paymo – Invoice Automation Software

Paymo stands out as an excellent invoicing software for professional services and small businesses. Recognized as the best purchase sales invoice software, it provides a comprehensive platform that integrates project management, precise time tracking, client invoicing, and profitability assessment, all within a unified workspace.

Key Features:

- Professional Invoices: Create polished invoices directly from timesheets or projects, ensuring accurate billing representation.

- Global Compatibility: Support for multiple languages and currencies.

- Recurring Invoices and Reminders: Set up recurring invoices and automatic payment reminders for streamlined invoicing processes.

- Online Payment Integration: Seamlessly integrate with online payment gateways like PayPal, Stripe, and Square for secure and direct client payments.

- Real-time Tracking: Monitor invoices in real-time, enabling users to track client views and payment status.

- Customizable Templates: Utilize customizable invoice templates to maintain a consistent and branded appearance.

- Financial Reporting: Generate detailed financial reports, including profit and loss statements, for a comprehensive view of business finances.

Additional Features:

In addition to invoicing, Paymo offers time tracking, task management, planning, resource management, file handling, collaboration, and robust analytics. These features empower small businesses to streamline operations and boost productivity effectively.

Pricing:

- Starter: $5.9/month/user

- Small Office: $10.9/month/user

- Business: $16.9/month/user

Rating

- G2: 4.6⭐/5

- Capterra: 4.7⭐/5

- Software Advice: 4.5⭐/5

- Get app: 4.7⭐/5

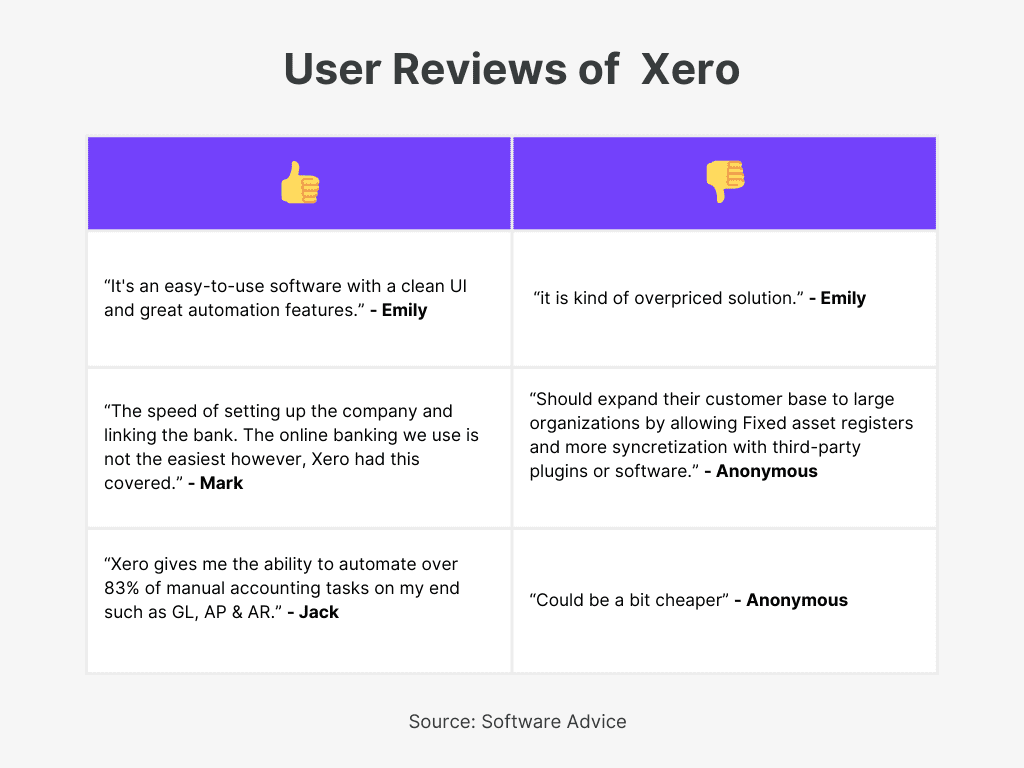

6. Xero: Best Online Invoicing Software

Xero is another invoicing software for small businesses recognized for its comprehensive features. Trusted by over 4.16 million subscribers globally, Xero streamlines the invoicing process, saving small businesses’ time and effort.

Key Features:

- Professional Invoices: Customize invoices with your logo, business name, contact details, and payment terms.

- Send Anywhere, Anytime: Create and send invoices from mobile or desktop as soon as the job is done.

- Invoice Tracking: View the status of your invoices, including unsent, sent, paid, or overdue.

- Automated Reminders: Set up automatic payment reminders for late payments.

Additional Features:

Multi-Currency Support, Recurring Invoices, Expense Management, Detailed Reporting

Pricing Plans:

- Free Plan: There is no free plan, just a free trial

- Premium Plan: Pricing varies from $25 – $54/month depending on the number of users & features.

Ratings:

- Capterra: 4.4⭐/5

- G2: 4.3⭐/5

- Software Advice 4.5⭐/5

- Get app 4.4⭐/5

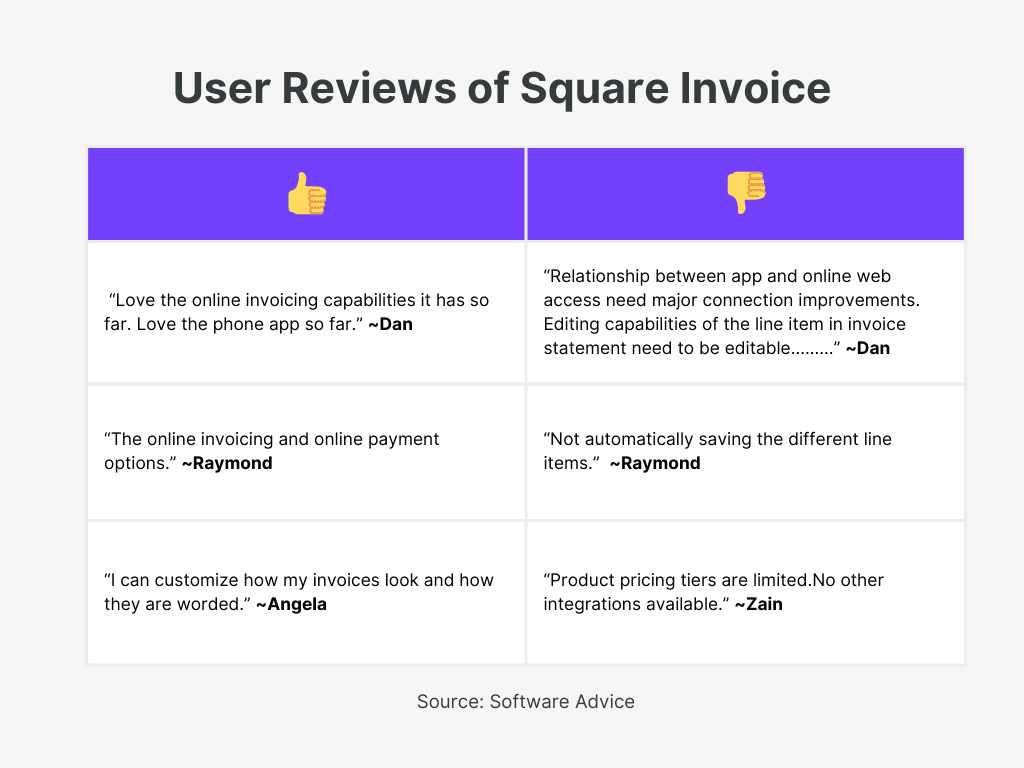

7. Square Invoice: Best Cloud-Based Invoicing Software

Square Invoices is top invoice generator software designed to help you manage all your invoicing needs. With Square Invoices, you can send estimates, create contracts, request payments, and more, all backed by the robust Square ecosystem.

Key Features:

- Automated Billing: Set up recurring billing and automatic reminders for upcoming or overdue payments.

- Flexible Payment Options: Accept payments via credit card, Apple Pay, Google Pay, Cash App Pay, ACH bank transfer, or Afterpay, both in person and online.

- Automated Tasks: Set up recurring billing and auto-reminders for upcoming or late payments to reduce manual effort.

- Real-Time Tracking: Monitor the status of your invoices in real-time, from delivery to payment, via desktop or mobile app.

- Insightful Reporting: Access detailed reports on your business performance, covering all locations, employees, items, and services.

Additional Features:

Custom layouts and templates, multi-package estimates, milestone-based payments, auto-convert estimates to contracts, custom fields, project management.

Pricing:

- 2.9% + $0.30 per transaction for online card payments.

- Plus plan: $20/month

Rating:

- Get app 4.7⭐/5

- G2 4.6⭐/5

- Capterra 4.7⭐/5

Conclusion:

In conclusion, this blog post explored seven of the best invoicing software options available for small businesses. Each platform offers unique features and functionalities, catering to a variety of business needs and budgets. Whether you prioritize robust accounting features, seamless automation, or user-friendly design, there’s an invoicing solution perfectly suited to streamline your financial processes and empowe

Read more:

- Top 5 Invoicing Software For Multiple Business

- Top Locksmith Invoice software

- Best Supplier Invoice Software

- Top Waste Collection Service Invoice Software

- Top Desktop Based Accounting Software

- 7 Best Invoicing Software for Appliance Repair Business

- Best Car Sales Invoice Software: Features and Comparisons

FAQs

- What is the best way to send invoices to small businesses?

For small businesses, email is the simplest way to send invoices(like those offered by Refrens). Use templates and consider invoicing software for easier sharing.

- Is Excel good for Invoicing?

Excel can be used for invoicing and offers some customization options for client needs. However, it lacks automation and features found in dedicated invoicing software.

- How do I create my Invoice?

Create an invoice with your logo, invoice number, and date. List your client’s details, then itemize services with descriptions, quantities, and prices. Include any taxes and the total due. Finalize with payment terms and any additional notes.

- Why do invoices take 30 days?

While net 30 terms originated as a reflection of manual invoice processing times, they now serve a dual purpose: providing businesses with a buffer and extending short-term credit to their clients.

- What is the minimum monthly billing?

Minimum monthly billing is the lowest amount you need to pay each month to keep an account active, like a credit card or subscription. It’s different from your total bill amount or current balance.

- What is the PO number on the invoice?

The PO number on an invoice links it to a specific purchase order, helping both buyer and seller track what was ordered and the agreed price. It’s a reference code, not an invoice number.