Core Accounting Features

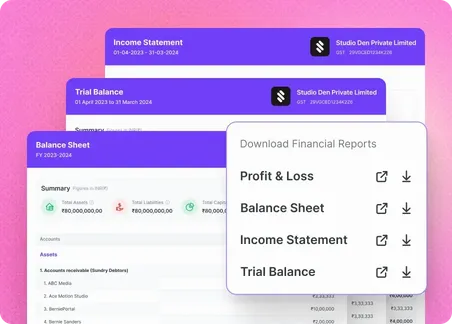

General Ledger

Refrens offers a clear picture of your assets, liabilities, income, and expenses, making it easy to maintain accuracy across your books. You can access and update your ledger anytime, ensuring decisions are always based on the latest data.

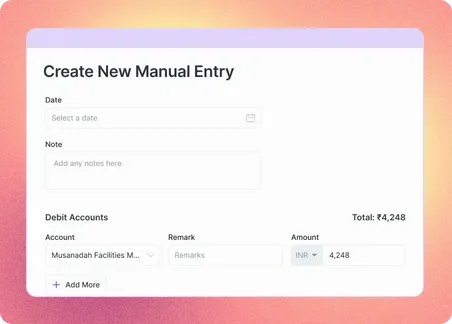

Journal Entries

Journal entries record every business transaction in chronological order, showing exactly which accounts are debited and credited. In Refrens, this process is streamlined through an intuitive interface, making it easier for businesses to maintain compliance and accuracy.

Chart of Accounts

Refrens cloud accounting software comes with a ready-to-use chart of accounts tailored for small businesses in India. You can add, edit, or group accounts based on your unique operations, ensuring accurate classification of every transaction.

Voucher Books

Voucher Books in Refrens allow you to log payments, receipts, and other transactions requiring approval, backed by supporting documents.

Account Groups

Account Groups classify related ledger accounts, enabling better financial analysis. In Refrens, this makes it simple to create consolidated reports and track spending patterns over time, directly within your accounting software.

Audit Trail

The Audit Trail in Refrens tracks every change made in your accounts - who made it, when, and why. This transparency is not only good business practice but also a legal requirement for accounting software in India to qualify for audited reports.

Ledger Statements

Ledger statements provide a detailed view of all transactions for a specific account, along with the current balance. Refrens’ cloud-based system lets you access these statements anytime, helping you track receivables, payables, and other key metrics without delays.

Accounts Receivable (AR) Features

Invoicing & Billing

Refrens lets you create GST-compliant invoices quickly, whether for one-time or recurring payments. Templates are fully customizable with your branding, making your invoices look professional. Automated recurring billing ensures you never miss a payment cycle.

Invoicing & Billing SoftwareOnline Payments

Invoices come with built-in payment links so clients can pay instantly using multiple options. This reduces payment friction and speeds up collections. Automated due-date reminders ensure follow-ups happen without manual effort.

Create Invoice & Get Paid OnlineClient Management

All client details, past transactions, and outstanding balances are stored in one place. This eliminates the need to juggle spreadsheets and emails. You can access complete histories to personalize communication and improve relationships.

Client Ageing Reports

The system categorizes overdue payments into time brackets like 0–30, 31–60, and 61+ days. This makes it easy to prioritize high-risk accounts. By acting early, you improve recovery rates and reduce bad debts.

Cashflow Tracking

Refrens show how much cash is expected, received, and overdue. This helps you make smarter spending decisions and plan for upcoming expenses. Real-time updates mean you always know your liquidity status.

Outstanding Tracking & Reminders

Track every unpaid invoice with clear status indicators. Refrens sends automatic reminders at set intervals so you can focus on business instead of chasing payments. This increases the likelihood of on-time settlements.

Integrated Sales CRM

Sales data flows directly into your accounting records, connecting deals with invoices. This eliminates manual entry and reduces errors. You can track revenue performance alongside payment collection efficiency.

Accounts Payable (AP) Features

Vendor Management

With Refrens accounting software, you can store all vendor details, purchase history, and payment records in one centralized dashboard. This helps you track supplier invoices, compare prices, and build stronger vendor relationships without juggling multiple spreadsheets.

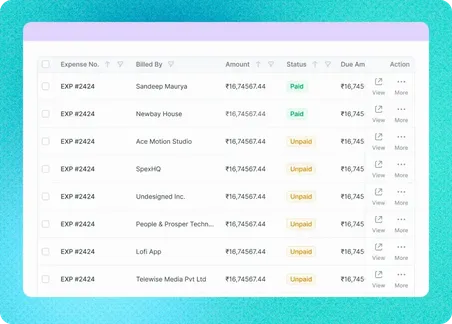

Expense Tracking

Easily record, categorize, and analyze every business expense using our online accounting software. By knowing exactly where your money is going, you can control costs, identify unnecessary spending, and plan future budgets more accurately.

Business Expense Management SoftwarePayment Scheduling

Plan and schedule payments to vendors with ease, avoiding late fees and maintaining goodwill in the market. Our cloud accounting software ensures that recurring bills are paid automatically on time, while giving you full visibility into upcoming payment commitments.

Payables Reporting / Ageing Report for Vendors

Get detailed, real-time reports of all pending vendor payments along with due dates. This helps prioritize bills, manage credit terms with different suppliers, and maintain healthy business relationships.

GST & Compliance Features

GST Compliant Invoicing

Create invoices that fully meet GST requirements with automated tax calculations, correct HSN/SAC codes, and client/vendor details fetched directly using GST numbers.

GST Invoice MakerGST Filings Support

Prepare and file GST returns effortlessly with automated classification of invoices into B2B, B2Cs, EXPWOP, and other categories. This saves time, improves accuracy, and helps avoid penalties for late or incorrect filings.

GSTR-2B Reconciliation

Easily match your purchase records with GSTR-2B data from the GST portal to ensure accurate Input Tax Credit (ITC) claims. This minimizes mismatches in returns and ensures you claim the maximum eligible ITC

E-invoicing

Generate e-invoices instantly and upload them to the government portal without extra steps. Supports bulk and automated e-invoicing through APIs, ensuring faster compliance and error-free submissions.

eInvoicing SolutionE-way Bill Generation

Quickly create e-way bills for goods movement directly from the software, with automatic distance calculation from the e-way bill portal.

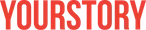

eWay Bill Generation SoftwareTDS Reports Section-Wise

Generate detailed section-wise TDS reports for both payout and payment receipts, making it easier to track deductions and liabilities, ensuring accurate TDS return filing.

Inventory Management Features

Inventory Tracking

Monitor stock levels in real time to avoid shortages or overstocking. The system automatically updates inventory after each sales or purchase transaction, ensuring accuracy without manual effort.

Inventory Management SoftwareMulti-Warehouse / Branch Management

Manage inventory across multiple warehouses or branch locations from a single dashboard. View stock availability, movement, and valuation without switching systems.

Warehouse Management SoftwareStock Transfer Between Warehouses

Record and track goods moved from one warehouse to another with complete accuracy. This ensures your inventory records remain consistent across locations.

Stock Transfer SoftwareStock Valuation & Reports

Get precise inventory valuation for better decision-making. The software calculates COGS (Cost of Goods Sold) and closing stock automatically, helping in audits, credit assessments, and compliance with statutory regulations.

Banking & CashFlow Features

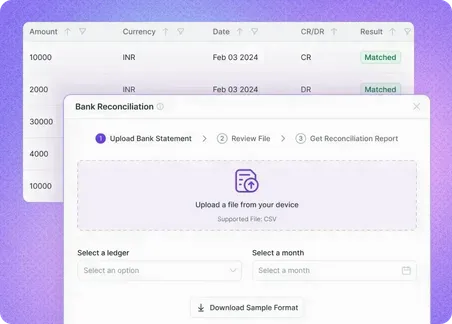

Bank Reconciliation

Easily match your bank statements with your accounting records to ensure complete accuracy. Refrens supports one-to-many and many-to-many transaction matching, along with reconciliation for multiple payment accounts. Instantly detect missing entries, correct cash and bank balances, and create ledger entries for unmatched transactions directly from the reconciliation screen.

Cash Flow Management

Monitor every inflow and outflow to keep your business financially stable and maintain healthy liquidity. Gain real-time insights into available funds, plan upcoming expenses with confidence, and understand how liquidity is utilized, whether for working capital, asset purchases, or financial investments.

Transaction History & Balances

Access the complete history of transactions and current balances for any account with a single click. Designed especially for accounts receivable and payable, this feature helps you quickly review customer or vendor payment records, verify balances before finalizing accounts, and effortlessly transfer closing balances as opening entries for the next financial year.

Reporting & Analytics Features

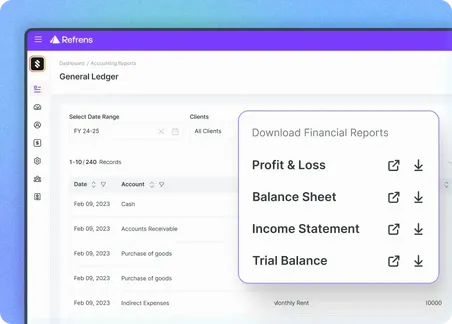

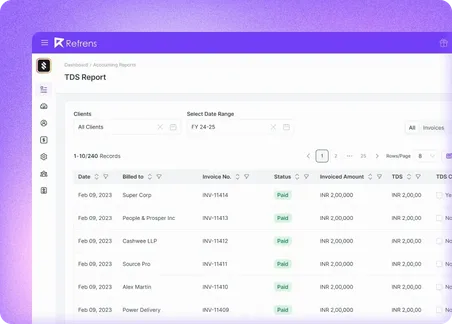

Financial Reports (P&L, Balance Sheet, etc.)

Instantly generate key financial statements like Profit & Loss, Balance Sheet, Trial Balance, Daybook, and Cashflow Reports to get a complete view of your business’s financial health.

Accounting Reports

Maintain accurate bookkeeping and compliance with detailed accounting reports, including Client/Vendor-wise, Line Item-wise, Payment, TDS, HSN/SAC, and Ageing Reports.

Analytics Dashboards

Get visual insights through intuitive charts and graphs. Generate Product-wise and Project-wise P&L reports.

Receivables & Payables Summary

View all customer dues and vendor payments in one consolidated dashboard to stay on top of cash flow.

Automation & Workflows Features

Workflow Automation (Payment Follow-ups, Approvals, etc.)

Workflow automation ensures that key accounting processes like payment reminders, invoice approvals, or quotation validations happen without manual effort. This keeps operations smooth, improves client communication, and prevents delays in approvals.

1. Sending overdue payment reminders automatically, improving collection rates.

2. Streamlining invoice and quotation approvals without constant follow-ups.

3. Introducing workflow processes like RFI (Request for Information) or RFQ (Request for Invoice) for structured communication.

Automated Ledger Entries

Whenever a transaction is recorded, the software can instantly create the necessary ledger entries without requiring manual input. This eliminates data entry errors and ensures books stay accurate in real time.

Recurring Invoices or Expenses

For businesses with regular billing cycles or fixed expenses, recurring entries automate these transactions at set intervals. No need to re-enter the same details every month.

Collaboration & User Access Features

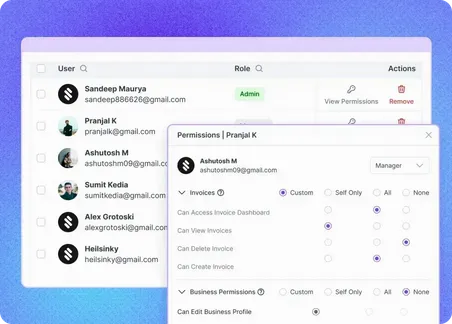

User Access Control (Roles and Permissions)

Define exactly who can view, edit, create, or approve specific financial data in your cloud accounting software.

1. Giving accountants access only to reports, without exposing client/vendor details.

2. Protecting sensitive business information from unauthorized users.

3. Restricting salespeople so they can only view or edit documents and leads they’ve created themselves.

Role-Based Permissions

Assign predefined roles such as admin, accountant, or sales staff, each with custom access rights.

1. Allowing sales teams to create invoices but not approve or process payments.

2. Limiting access to confidential financial reports while still enabling day-to-day work.

Audit Logs of Changes

Track every single modification - who did it, when, and what changed, for complete accountability.

1. Maintaining an audit trail for compliance and transparency.

2. Investigating unusual or suspicious changes in your accounting records.

Team Collaboration

Enable multiple team members to work on the same financial data with real-time updates in your accounting software in India.

1. Sales and accounts teams collaborating on client billing.

2. Multiple accountants preparing year-end financial reports simultaneously without version conflicts.

Integrations & API Features

IndiaMART & TradeIndia Integration

Seamlessly sync leads, orders, and customer data from IndiaMART and TradeIndia into your accounting software. This eliminates manual data entry and speeds up order-to-invoice conversion.

Creating invoices instantly from marketplace orders, tracking sales performance from B2B portals.

WhatsApp Sharing

Send invoices, payment links, reminders, and financial reports directly via WhatsApp in just a few clicks. This ensures faster client communication compared to email, leading to quicker payments.

Quickly sharing payment reminders, sending invoices without email delays.

Shopify Integration

Connect your Shopify store to automatically sync orders, payments, and customer details into your accounting system. This ensures accurate bookkeeping and instant invoice generation for every online sale.

Auto-generating invoices for online orders, keeping payment records up to date.

Payment Gateway Integrations (Cashfree)

Accept payments directly from your invoices via integrated gateways like Cashfree. Clients can pay instantly via UPI, cards, or net banking, while payment status updates in real time within the system.

Enabling instant client payments and automatically tracking payment status.

Invoicing API

Embed invoicing functions directly into your own apps, websites, or CRM using our secure API. This enables automated billing processes without the need to switch between multiple platforms.

Automating invoice creation from your systems, linking invoicing with external CRM tools.

Additional Capabilities

Cloud Accounting

Refrens is a fully cloud-based accounting software, making it easy for businesses to start using without any installation or setup. No manual updates required. Automatic cloud backups. No need to store files locally. Access from any device with an internet connection.

User-Friendly Accounting

India’s most intuitive accounting software, so simple that even non-accountants can start using it from day one. The interface is designed for speed, clarity, and minimal learning curve.

Mobile App

Not just for desktops, access your accounts anytime, anywhere with the Refrens Android and iOS apps. Perfect for business owners and teams on the move.

Secured Data

Your financial data is protected with strict security protocols and ISO-certified infrastructure. All compliance norms are followed to ensure safety and privacy.

Scalability

Designed to grow with your business. Start small and scale up without ever needing to switch to another accounting software.

Affordable Accounting

Refrens offers all essential accounting features, including inventory, sales CRM, and workflow automation - at one of the most competitive prices in India. High value without high cost.