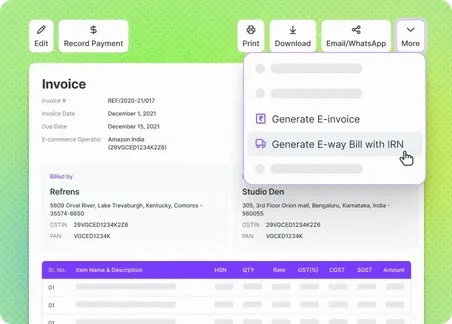

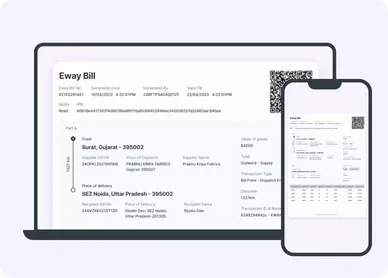

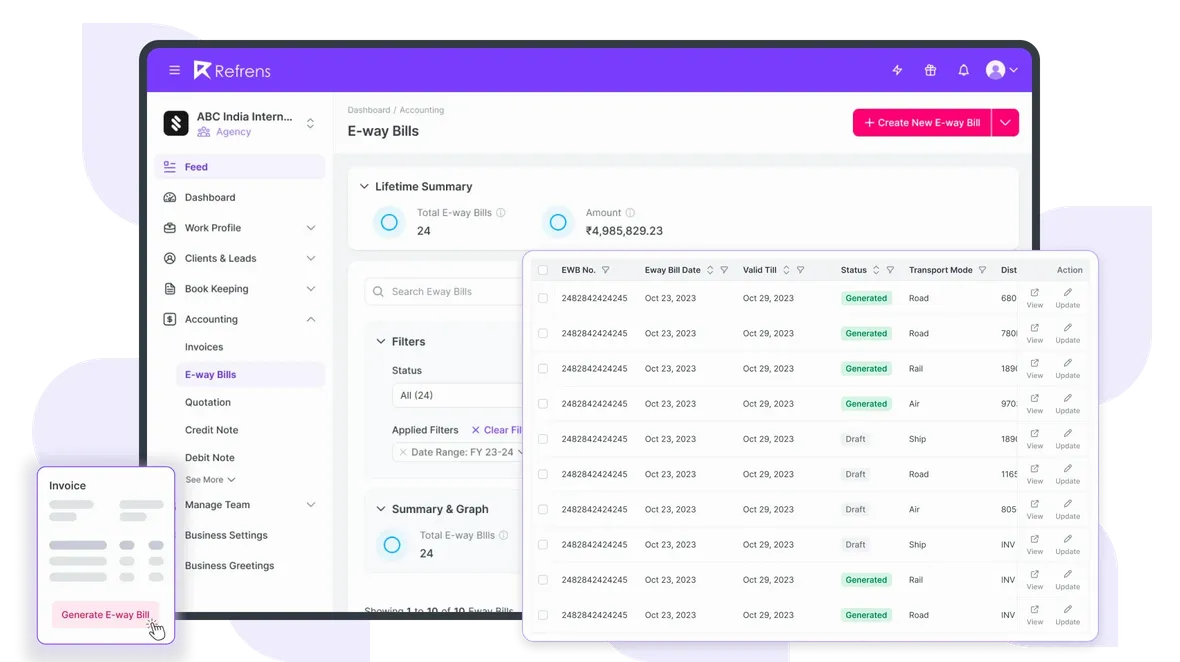

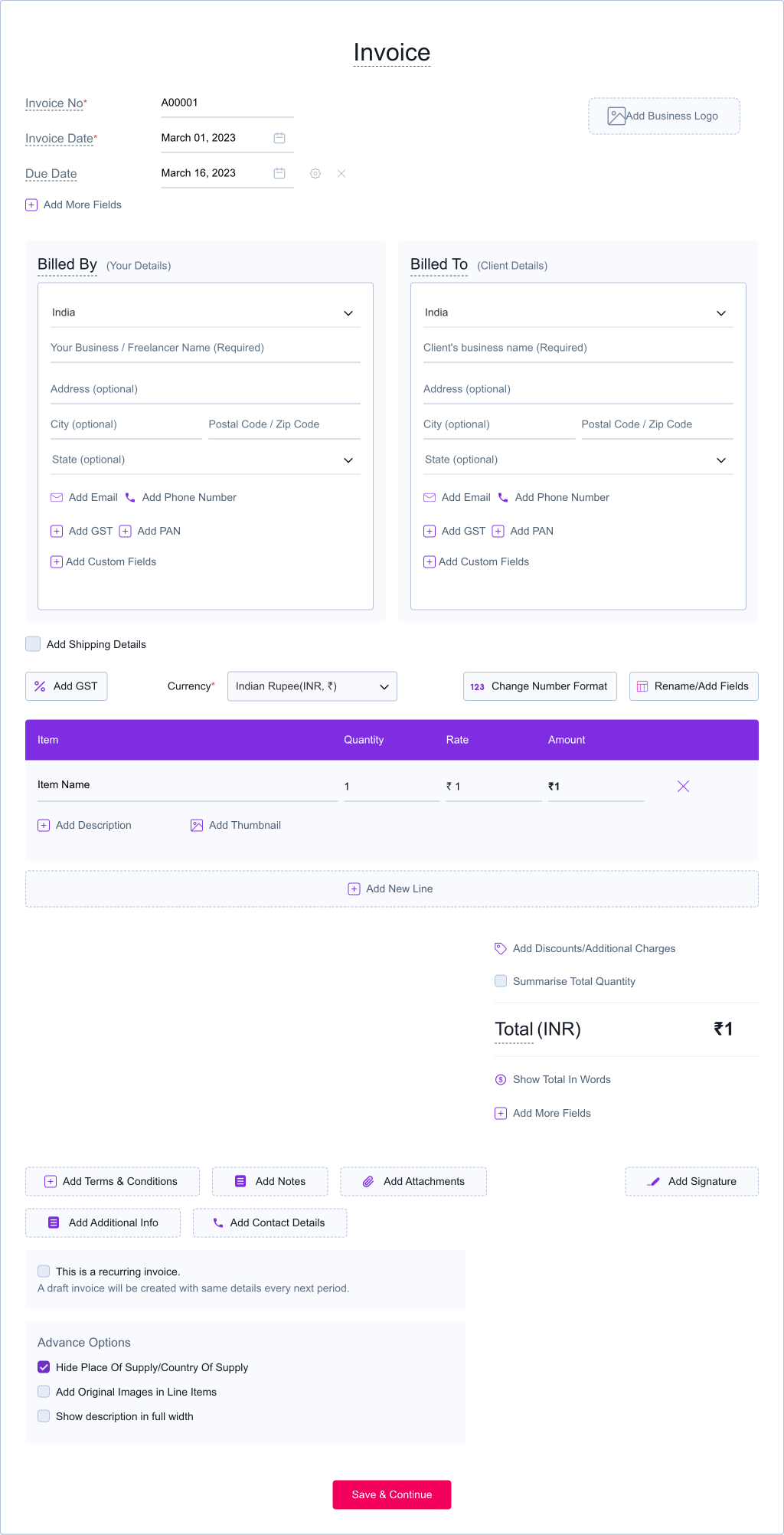

We are using Refrens for generating both E-invoicing and e-way bills, and we keep recommending it to our business partners.

HimanshuFounder, Packaged Food

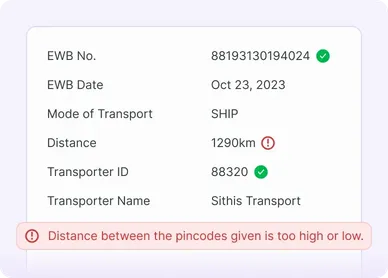

Earlier it used to take 10 minutes to generate an E-way bill from the portal. With Refrens it only takes a few seconds!

Shivansh TulsyanCEO, Binny Textiles

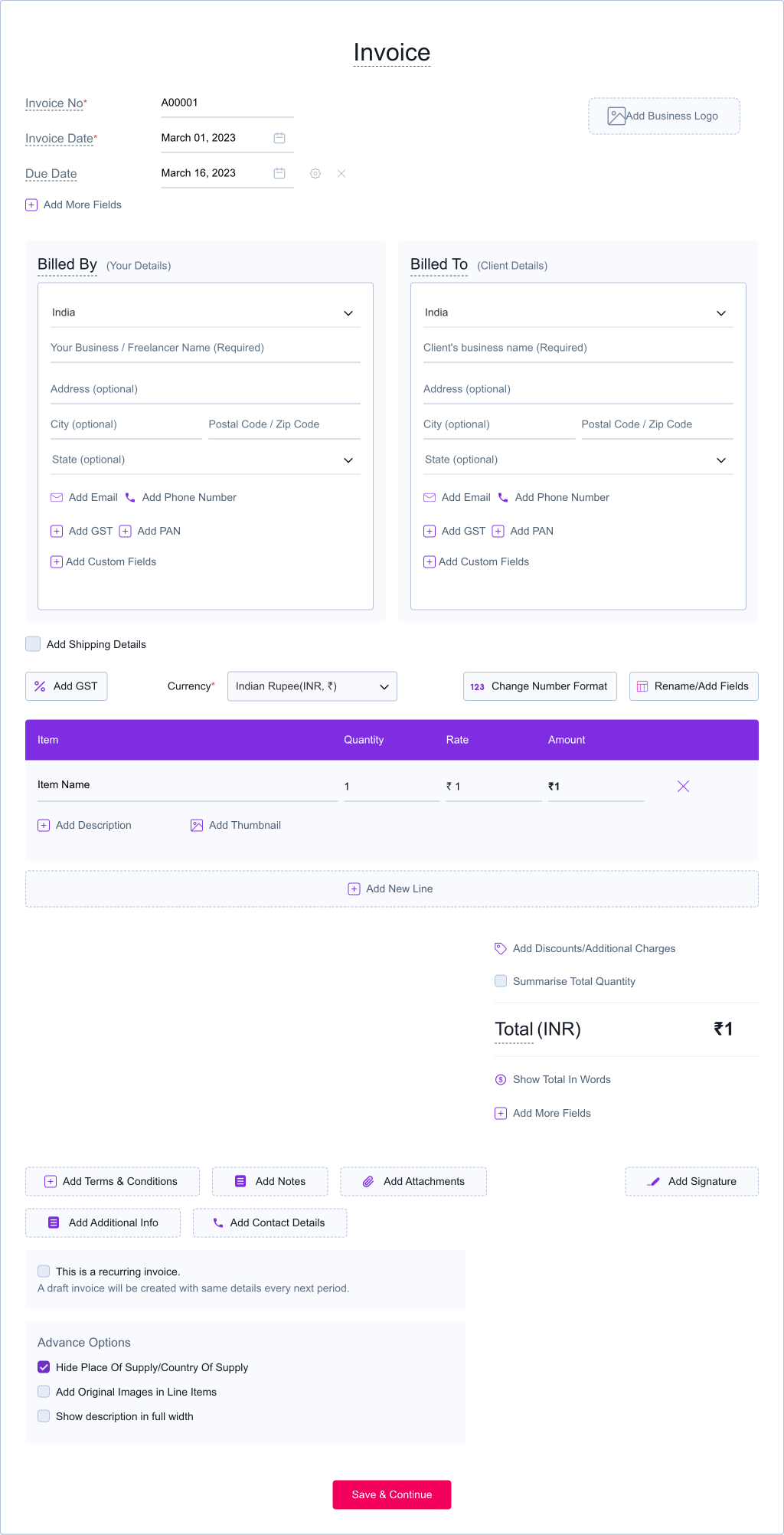

We switched to Refrens after trying a few other software. Refrens is definitely easier to use.

Harsh S.Trader, Textiles Trading