Create Your First FREE GST Invoice

✅Create GST invoices, quotations, credit/debit notes, etc in seconds!

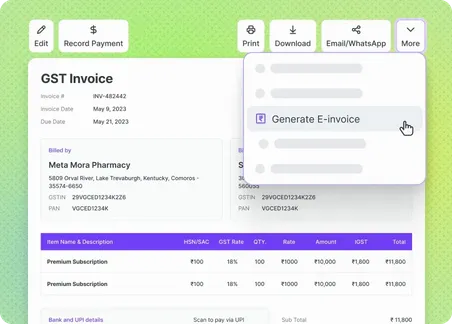

✅Convert invoices into E-Invoices & E-way bills in one click.

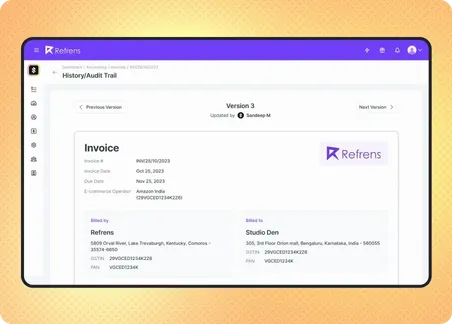

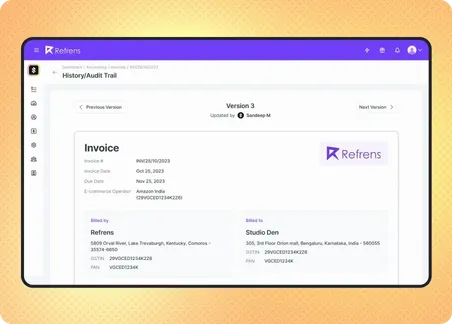

✅Get a detailed audit trail of all the changes made to your invoice.

✅Ensure 100% compliance with the government regulations with automated GST reports.

✅Automatically verify GST details like GST Number, Status, Tax Type, etc. of your clients & vendors for safer business.

✅Get CFO level business insights with Refrens AI

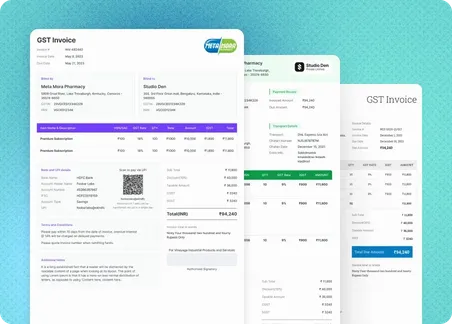

✅Highly customizable - from font, colour, font size, to columns, formulas & custom fields.

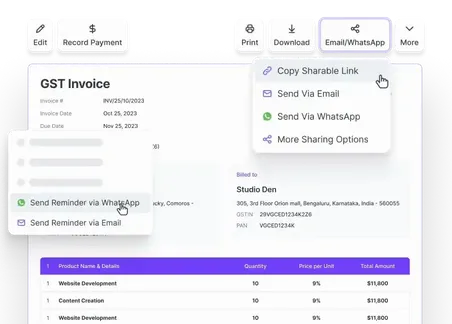

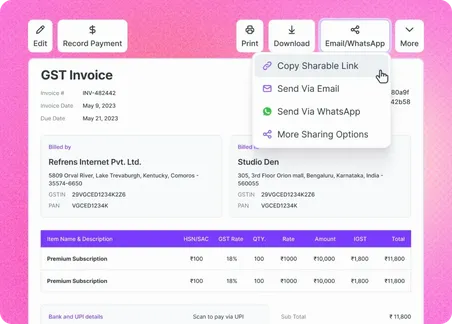

✅Share via WhatsApp or email in one click.

✅Automatically send payment reminders & create recurring invoices.

✅Manage invoice approvals with custom workflows.

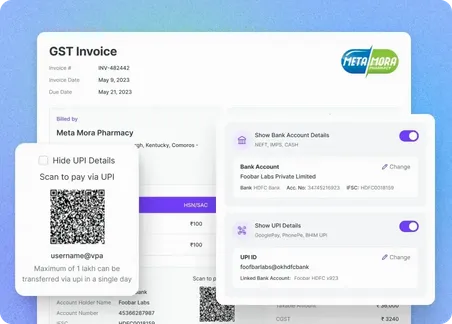

✅Collect domestic & international payments via integrated Payment Gateway.

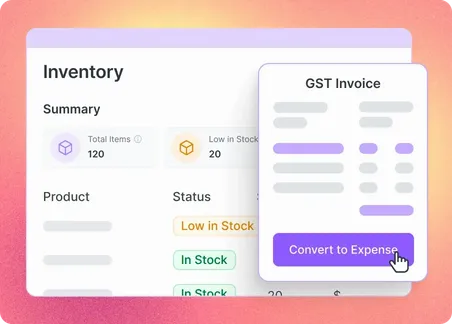

✅Automatically update inventory and pass journal entries whenever an invoice is created.

✅Industry-first AI Accounting Agent

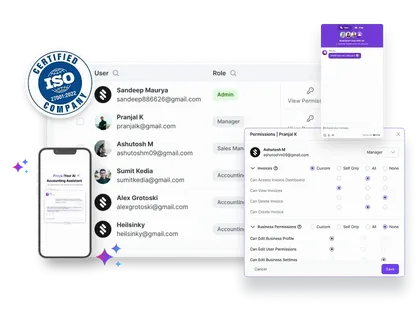

✅ISO certified with high-end data security

✅Awarded as Easiest to Use Software by Capterra

✅24*7 Human Support via call, live chat, email, and WhatsApp

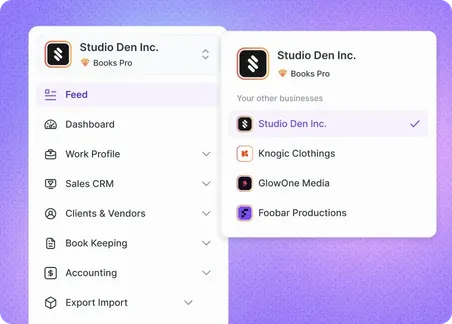

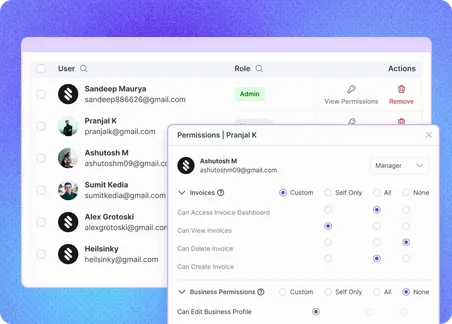

✅Role-based access control with customised permissions

✅Manage multiple businesses from a single dashboard

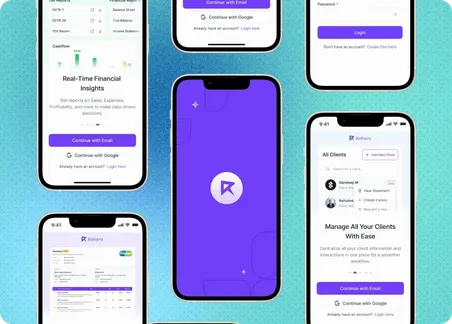

✅Cloud-based with a mobile application, so you can access your data anytime, anywhere

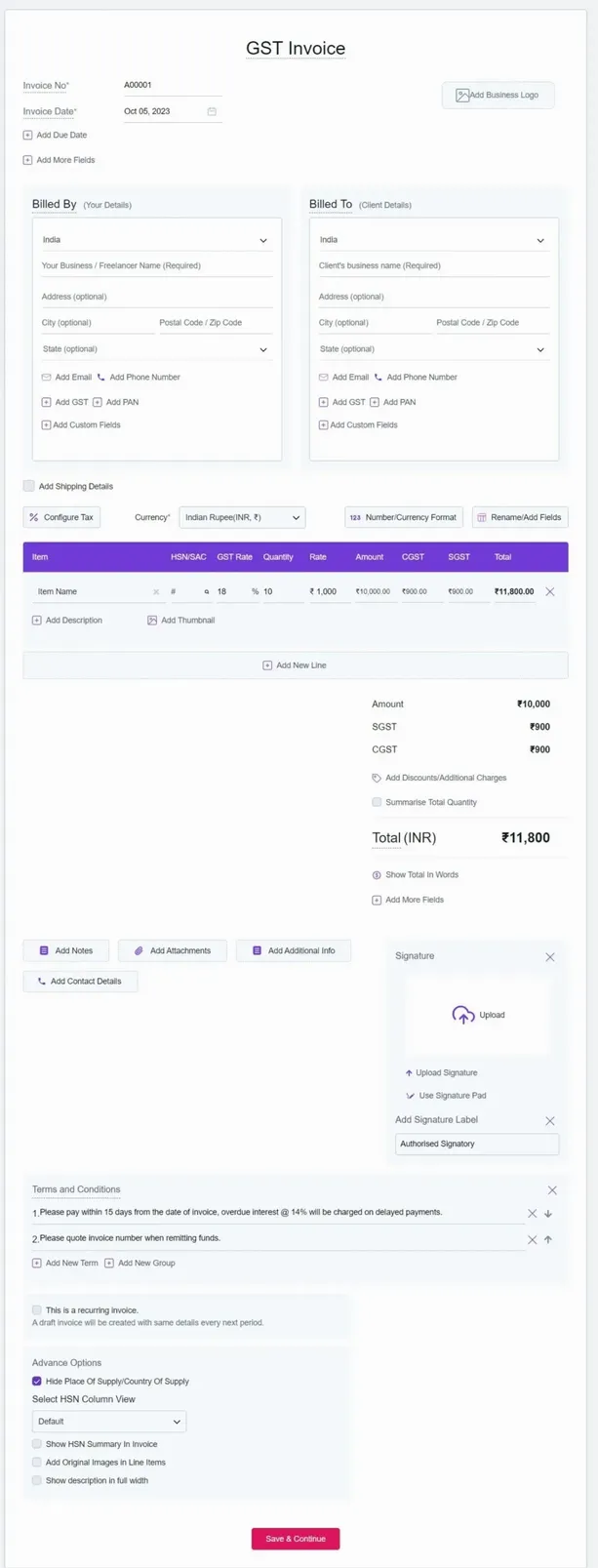

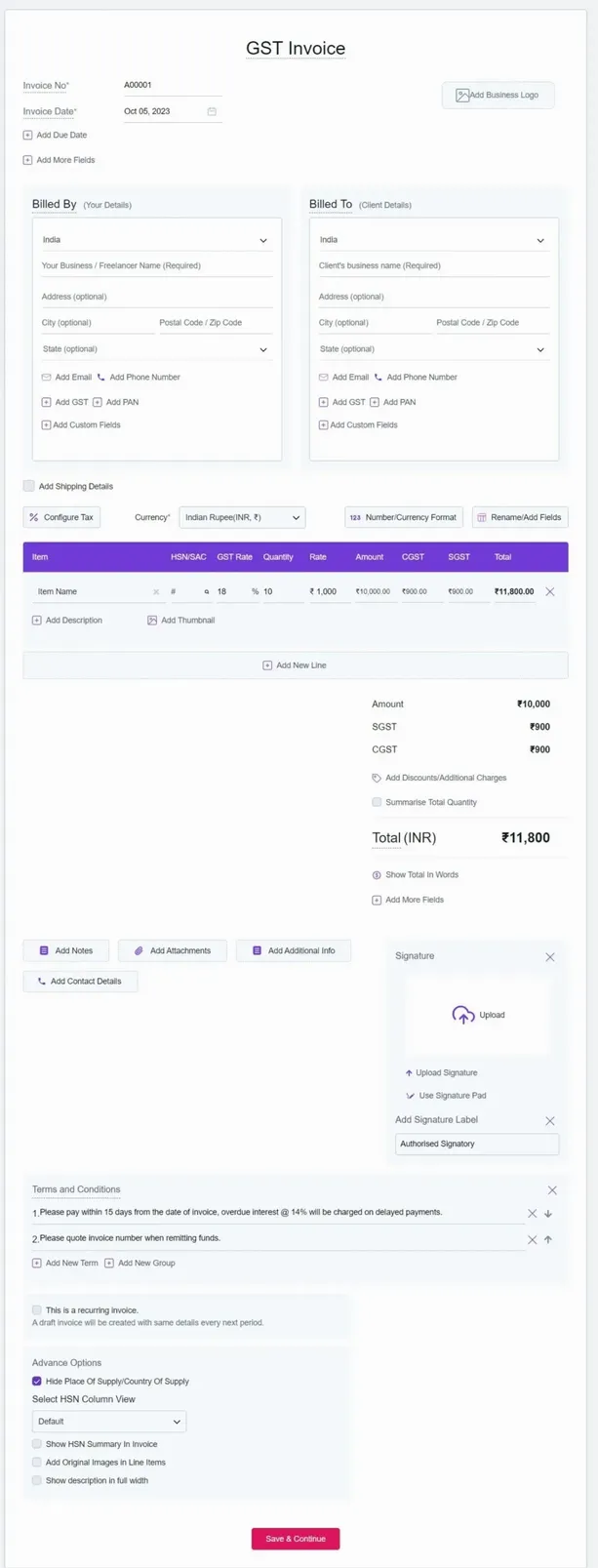

Create invoices with IGST, CGST, and SGST applied accurately. Add HSN/SAC codes, multiple tax rates, reverse charge, and other GST fields directly into your bills.

Generate, download, and cancel e-invoices and e-way bills in bulk. Automate the process with invoice APIs and avoid switching between multiple government portals with e-invoicing software

Verify GST numbers, status, tax type, and legal details of your clients and vendors instantly to reduce errors and ensure safe transactions

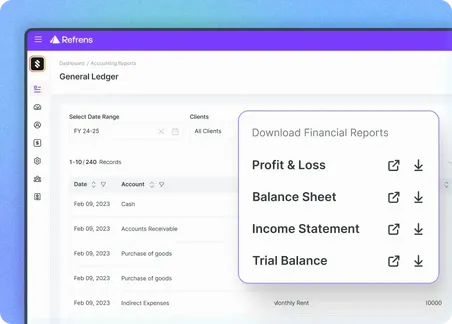

Generate GSTR-1 and GSTR-2B reports, perform automated 2B reconciliation, and access HSN/TDS summaries in submission-ready formats. Eliminate manual data preparation

Whenever you generate invoices, stock levels are updated in real-time. Batch-wise tracking, expiry monitoring, and warehouse-level stock control ensure accurate reporting and inventory management.

Manage invoice approvals with internal workflows, role-based access control, and document locking to keep GST records accurate and tamper-proof.

Track every change made to your invoices—who modified it, when, and how—for full transparency and compliance during audits

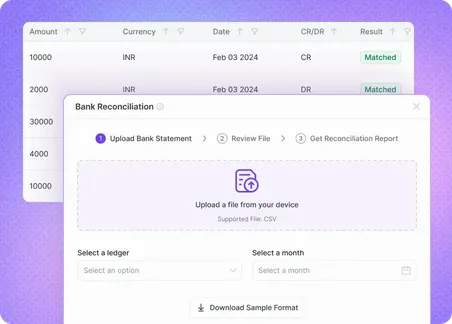

Add UPI IDs, QR codes, and payment links directly to invoices. Accept domestic and international payments through integrated gateways while automatically reconciling transactions

Each invoice automatically updates journal entries and ledgers, ensuring your accounts and GST records are always in sync

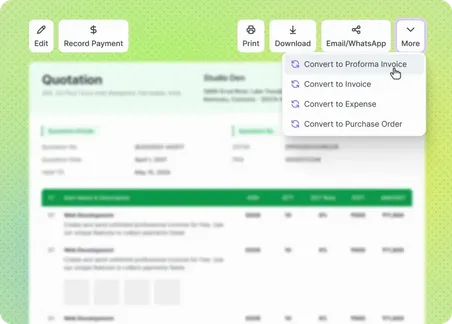

Refrens GST billing software lets businesses convert quotes and proforma invoices into final invoices with one click, and easily generate credit notes, debit notes, and receipts, simplifying financial processes.

Refrens invoicing software lets businesses easily share invoices via email, WhatsApp, or a direct link, and also offers PDF downloads and scheduling for streamlined, transparent invoicing.

Stay on top of your invoices anywhere with Refrens mobile app, allowing you to create and send GST invoices on the go for smooth, efficient business management.

Refrens is the best GST billing software for small businesses in India. Here are some of the simple reasons why you should also opt. for Refrens gst billing software.

User-Friendly Interface: Refrens has a highly intuitive and easy-to-use interface, making it accessible for businesses of all sizes, including those without extensive technical expertise.

E-Invoicing and IRN Generation: Refrens simplifies the e-invoicing process by automating the generation of Invoice Reference Numbers (IRN), ensuring compliance with government regulations.

GST Compliance: The software seamlessly integrates GST regulations, automatically calculating CGST, SGST, and IGST, helping businesses generate GST-compliant invoices effortlessly.

Affordable Pricing: Refrens offers cost-effective pricing plans that cater to the budgets of small businesses and SMEs, making it a pocket-friendly solution.

Cloud-Based Accessibility: Refrens operates on the cloud, allowing businesses to access and manage their invoices from anywhere, promoting mobility and flexibility.

Comprehensive Financial Reporting: The software provides detailed financial reports, empowering businesses to analyze their financial health and make informed decisions.

Simplified GSTR Report Generation: Refrens streamlines the process of preparing accurate GST returns, reducing the complexity of tax compliance.

Advanced Inventory Management: The software offers features to track stock levels, monitor item movements, and automate stock-related transactions, enhancing operational efficiency.

E-way Bill Integration: Refrens integrates with e-way bill systems, simplifying the generation and management of e-way bills, ensuring compliance with transportation regulations.

Yes, you can easily accept payments using Refrens. Refrens offers an integrated payment gateway that allows you to accept various digital payment methods directly within the software. This includes options like IMPS, NEFT, RTGS, UPI, debit/credit cards, and net banking. The payment gateway is seamlessly integrated with the invoicing and accounting features of Refrens.

We are an ISO certified organisation. We take utmost care of data security & privacy. Our systems are frequently updated with the latest security updates to ensure that your data is safe and secure. Do check out our detailed privacy policy here.

Yes, we provide instant & reliable support over chat, email, and phone. We will also provide a dedicated account manager to help you out whenever required.

Yes, you can easily generate e-invoices in just a couple of clicks using Refrens’ e-invoicing feature.

Absolutely! Our software is designed to seamlessly adapt and scale alongside your business, ensuring that it meets your evolving needs at every stage of growth. We are also committed to continuously enhancing the software by rigorously adding new features, functionality, and improvements so that your business can always stay ahead of the curve.

As your business expands, our software can accommodate an increasing number of users, manage larger volumes of data, and handle more complex tasks without compromising on performance or efficiency. We regularly update our software to incorporate new technological advancements, industry best practices, and customer feedback, ensuring that you always have access to the latest and most innovative solutions.

Additionally, our cloud-based infrastructure offers unparalleled scalability and reliability, with the ability to adjust resources on-demand to cater to your business's specific needs. This means that you can be confident that our software will support your growth without any disruption or downtime.