Invoicing is essential to any business – be it an upstart trying to secure its first sale or an established one looking for ways to boost profits. Invoicing software features are a key consideration in this process.

Web Expenses indicates that nearly half (48%) of businesses receive and process more than 500 invoices per month. Managing invoices efficiently is crucial to maintaining financial stability and building strong vendor relationships. One of the primary features of invoice management software is to manage this volume effectively.

However, manual invoice processing can be time-consuming and error-prone, leading to delays in sending timely payments.

Market reports predict that by 2030 the invoicing software market will generate USD 4.6 Billion at a growing annual rate of 8.5% between 2023 and 2030. This growth is driven by the increasing need for automated and digitized financial processes in businesses, making invoice software evaluation an essential task.

The benefits of automated invoice management software can be overstated as it offers an effective solution to streamline this process and enhance productivity.

However, choosing the right cover for your business can be overwhelming, with many options, even when we consider choosing the top billing software. Here, understanding the features of invoice management software becomes critical.

So how can you know which invoice management software is for your company?

In this blog, we will discuss essential factors and elements to consider while selecting an invoice for management software.

Key Factors Of Invoice Management Software

1. Shall Have an Intuitive, User-Friendly Interface

An intuitive software user experience design is necessary for smooth adoption and optimal use. This is a vital feature of invoice management software

Your invoice management system should feature an intuitive user experience with clear navigation and control options for an optimal experience.

Your team members should easily locate and perform tasks without needing clarification on complex menus or confusing designs.

Hence, a user-friendly interface leads to increased productivity as it saves time that could have been spent on learning to operate software applications.

Partnering with a software development service provider allows your organization to design customized invoice management software tailored to specific requirements.

Furthermore, Digital platforms also facilitate an effortless onboarding experience without needing extensive training sessions.

2. Ensures Business Growth with Scalable, Flexible Software

Selecting software solutions with the capacity for scaling and flexibility ensures it can keep pace with the growth of your business.

As your company expands and its invoicing basic needs increase, its software should adapt accordingly without hindering performance or increasing the volume of bills generated.

Imagine that in just one year, your transaction volume doubles or triples!

The software should adapt seamlessly to handle the higher load, preventing slowdowns or disruptions in invoicing operations.

Scalability and flexibility will protect against future headaches as your business flourishes, saving headaches as the growth accelerates.

3. Automates Data Capture for Efficiency

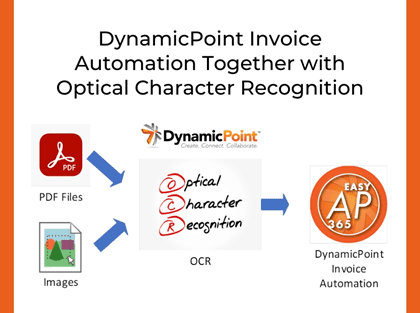

Automated data capture has proven to be an indispensable asset to modern invoice management.

Imagine having access to an OCR software like Docsumo or Cardscanner.co that is capable of scanning and extracting key invoice information like invoice numbers, amounts, and dates into an automated system.

With such a tool at their fingertips, teamwork becomes effortless as data enters automatically into it without manual intervention!

Instead, this software quickly captures all relevant details – without human error – speeding up and streamlining the invoicing process significantly.

As soon as a vendor submits an invoice, this software reads and records all pertinent data automatically.

Hence, allowing your team to focus on more strategic financial tasks.

4. Achieves Effortless System Integration

Efficient invoice management hinges on seamless integration with your existing systems.

Good invoice management software seamlessly connects with your accounting and ERP platforms, ensuring real-time data synchronization.

Such integration eliminates data silos and prevents the need for duplicate entries.

Your invoice management system should instantly reflect the invoice approved in your accounting system, updating the financial records in real-time.

Hence, these cohesive financial operations simplify operations by making all information readily accessible, streamlining collaboration between departments, and allowing all to stay current on relevant data.

5. Customizes Workflows for Business Specifics

Customizable workflows enable businesses to tailor specifically to the requirements of their operations and more easily adapt than static solutions to business growth.

However, companies should select an invoice management software solution that offers flexible approval processes that fit perfectly into their unique organization’s workflows and specific requirements.

Your organization can set specific approval hierarchies, determine how many approvers it requires, and even define routing criteria for invoices based on various parameters.

So, when a high-value invoice needs multiple approvals from various stakeholders, the software can automatically route it accordingly.

Hence, customizable workflows are important for tailoring invoice processing specifically to the structure and approval policies of your organization.

6. Utilizes Automated Invoice Matching for Accuracy

Automated Invoice Matching saves time while guaranteeing accuracy.

Invoice Systems automatically match invoices to one another in real-time to prevent payment mistakes and prevent errors.

With this functionality, the software automatically cross-references incoming invoices against purchase orders and receipts for processing.

Imagine receiving an invoice for a purchase; your team receives it, and it goes into their system automatically to check that invoice and purchase order match up perfectly with the receipts.

Any discrepancies will be highlighted, prompting your team to resolve them before payment.

Automated matching simplifies and expedites verification, decreasing manual intervention and the risk of over payments or double payments.

7. Gets Updated with Real-Time Notifications

Real-time notifications are an integral component of invoice management software.

Imagine having an invoice status update system that instantly informs your team when something changes.

These notifications keep everyone on track and guarantee no invoice is left behind.

For example, your accounts payable team receives a notification when an invoice is approved, prompting them to schedule the payment promptly.

Real-time notifications in invoice systems enable your teams to stay organized and minimize delays associated with invoicing processes.

There are many software managing invoice approval workflow just to streamline this process. You can choose the best suitable for your business and streamline invoice management within your company.

8. Offers a Vendor Self-Service Portal

Integrating your invoice software with a vendor self-service portal is the best way to manage vendors.

This feature allows vendors to communicate directly with the finance department regarding invoice statuses.

Vendors can use this portal to check payment details or resolve discrepancies without contacting your team directly.

Furthermore, vendor self-service portals enhance collaboration, and transparency and save time by expediting responses to vendor queries rapidly.

Hence freeing up your finance team to focus on more strategic tasks.

By integrating the portal, your company will be able to increase efficiency and productivity as it will make communications easy and strengthen vendor relationships.

9. Integrates Easily with Payment Gateways

Look for software that seamlessly connects with popular payment gateways to facilitate payments more smoothly.

Your invoice management invoice should enable direct payments, saving time and lowering the risk associated with manual errors.

Seamless integration allows your team to initiate payments easily with just a few clicks, and the system tracks payment status instantly.

For example, the software offers payment via a secure payment gateway when an invoice is approved and processed hassle-free for both teams and vendors.

Hence the integration of payment gateways with invoice systems ensures a transparent payment process and further leads to maximizing financial efficiency.

10. Sends Timely Payment Reminders Automatically

Real-time invoice reminders are one of the most important features of invoice management software.

Picture a scenario where your team no longer needs to manually send reminders to clients or vendors about upcoming due dates.

Hence with software integrated with invoice reminders, users will never miss any important updates. This saves time, ensures timely payments, and improves cash flow.

The system may, for example, send a friendly reminder to the client, gently reminding them to pay their invoice within three days.

This proactive approach reduces the risk of delayed payments and strengthens your financial stability.

11. Ensures Smooth Data Migration

Data migration must occur seamlessly for a smooth transition when migrating to new invoice management software.

Ideal migration should proceed without the loss of valuable historical financial data.

You could consider having your software provider help facilitate a smooth transfer from an old platform to the new, with invoices, payment records, and all pertinent files effortlessly being moved over.

Thus, you avoid manual data entry or potential data inconsistencies.

Data migration should go smoothly to maintain continuity in your invoicing process and minimize disruption during the transition.

12. Provides Early Payment Discount Incentives

Early payment discounts may encourage companies to settle invoices promptly and increase early settlement rates.

Utilizing this feature, you can discount vendors if payment arrives before its due date.

Assume, for instance, a vendor offered customers 2-3% savings if payment came early – using this tool allows for that discount!

Your invoice-processing software should automatically calculate and display discounted amounts upon approval.

Hence encouraging early payments by offering discounted payments as incentives for early payment discounts.

13. Gains Insights with Analytics and Reporting

A company’s financial status can only be known by analyzing its financial reports.

Think of having a system that provides comprehensive reports that help you track invoicing trends, pending payments, and vendor performance.

And the most exciting part? You can easily customize your reports to view key metrics for your business within the invoice systems.

Moreover, it provides the capability of tracking changes in payables and receivables over time through the invoice system.

This will provide valuable insight that allows for informed decisions regarding cash flow optimization.

Additionally, tracking vendor performance helps you identify the most reliable suppliers and even negotiate them on better terms.

Hence, by embracing analytics and reporting, you’re empowering your team to take data-driven actions, which will result in boosting efficiency and maximizing your business’s financial potential.

14. Maintains Strict Data Security

Data security should always come first when looking at invoice management software. Any software used must adhere to stringent security protocols, including regular security assessments of cloud environments when handling sensitive financial data.

As part of its encryption processes, this system should implement data protection algorithms that safeguard transmission and storage – giving your company’s financial information peace of mind.

For instance, the system should utilize encryption to protect data during transmission and storage, safeguarding it from potential breaches.

Think about the peace of mind you would experience knowing your company’s financial data is safe and secure within the software.

Robust data security measures protect your business against cyber threats like identity theft and phishing to ensure you comply with data protection laws.

Hence, vendors and clients are more likely to trust you and your business.

Wrapping Up

It is evident how an invoice management system can significantly improve your business’s productivity and profitability.

With the software in place, you will experience reduced errors, save time, and accelerate the invoicing process.

Investing in the right invoice management software can be a game-changer, revolutionizing your invoicing experience.

Hence leading to enhanced efficiency and ultimately contributing to your company’s overall success and financial stability.