The world is rapidly moving towards digitization, and the GST Council is no exception. To promote this digital shift, the council has mandated that businesses with an annual turnover of over 5 crores must use e-invoices for B2B supplies.

The main objectives behind this initiative are to enhance transparency, curb tax evasion, and streamline invoicing processes.

Hence, to aid businesses in this transition, numerous e-invoicing software solutions have emerged. In this article, we will explore the top e-invoicing software available in the market.

Here’s a table summarizing the top e-invoicing software along with their user ratings, starting prices, free plans availability, and trial periods:

| Software Name | User Rating (Capterra) | Starting Price | Free Plan Available | Trial Period |

|---|---|---|---|---|

| Refrens | ⭐ 4.9/5 | Paid plans start at ₹3900/year | Yes | Yes |

| Zoho | ⭐ 4.3/5 | Standard Plan: ₹8988/year | Yes | 14 days |

| Tally | ⭐ 4.4/5 | Silver Rental: ₹9,000/month | No | N/A |

| Masters India | ⭐ 4.3/5 | Custom pricing | No | N/A |

| Swipe | ⭐ 4.0/5 | PRO Plan: ₹1899/year | No | 14 days (available for higher plans) |

This table provides a concise overview of the top e-invoicing software options to help businesses make informed decisions.

But before we delve deeper into these software, let’s understand the need for e-invoicing.

Importance of E-Invoicing

The e-invoicing mandate rolled out by various governments globally represents a significant shift towards digital transformation in how businesses operate worldwide. Here are some key reasons why e-invoicing is crucial:

- Enhanced Compliance: Governments worldwide have mandated e-invoicing to ensure businesses comply with tax regulations. This system helps in real-time reporting of B2B invoices to the tax authorities, reducing the chances of tax evasion and fraud.

- Improved Transparency: E-invoicing promotes transparency in financial transactions. Every invoice is tracked and verified, making it easier for authorities to monitor business activities and detect discrepancies.

- Streamlined Processes: By automating the invoicing process, businesses can significantly reduce the time and effort required to generate, send, and process invoices. This leads to faster turnaround times and more efficient workflows.

- Cost Reduction: E-invoicing eliminates the need for paper invoices, postage, and manual handling, resulting in substantial cost savings. It also reduces the likelihood of errors associated with manual data entry, which can be costly to correct.

- Faster Payments: Since e-invoices are digitally created, they speed up the approval and payment process. With electronic records, businesses can quickly reconcile invoices, leading to faster payment cycles and improved cash flow.

- Environmental Benefits: Reducing the use of paper and physical storage contributes to environmental sustainability. E-invoicing is an eco-friendly alternative that aligns with the growing emphasis on green business practices.

Features to Look for in Top E-Invoicing Software

Choosing the right e-invoicing software is key for smooth business operations. Here are some important features to look for:

- Compliance with Government Rules: Ensure the software meets your country’s e-invoicing regulations. It should create invoices with all necessary information and formats required by the government.

- User-Friendly Interface: The software should be easy to use with a simple and clear interface. This helps users quickly learn and efficiently use the software.

- Automated Invoice Creation: Look for software that automates creating and sending invoices. Automation saves time and reduces the chance of errors.

- Real-Time Tracking and Reporting: The software should provide real-time updates on invoice status and detailed reports. This includes notifications for when invoices are received, approved, and paid.

- Data Validation and Error Checking: Ensure the software checks for errors or missing information before submitting invoices. It should easily highlight and allow for correction of any mistakes.

- Support for Multiple Currencies and Languages: If your business operates internationally, the software should support different currencies and languages. This helps in creating invoices that meet the needs of various countries and clients.

- Secure Data Handling: Security is crucial for financial data. Ensure the software has strong security measures like encryption and access controls to protect your information.

- Bulk Invoice Upload and Management: For businesses that handle many invoices, the software should allow bulk uploading and managing multiple invoices at once.

- Reliable Customer Support:

Good customer support is essential. Ensure the software provider offers reliable support options like live chat, email, phone support, and helpful documentation.

By focusing on these features, you can choose e-invoicing software that not only meets compliance requirements but also improves your business efficiency and accuracy.

List of Top E-Invoicing Software

Let’s delve into the list of top e-invoicing software available in the market –

1. Refrens: Top E-Invoicing Software

First up we have Refrens, a budding software that is increasingly becoming a favorite of businesses of all sizes in 178 countries, with an impressive user base of 150,000.

It stands out for simplifying complex tasks like invoicing and offers cost-effective and time-saving e-invoicing software. Additionally, it caters to e-invoicing needs for Export and SEZ businesses and can generate IRN for Credit Notes and Debit Notes as well.

You can generate bulk IRNs to create multiple e-invoices at once, making compliance quick and easy. The software also offers top e-way bill generation software, simplifying the process even further. With the User Access Control feature, you can manage and control user access, ensuring your data stays secure. Additionally, the software offers 24/7 support, assisting whenever you need it.

With Refrens, you can save and reuse your information, avoiding repetitive data entry. The software also validates your data to ensure accuracy, highlighting errors or missing fields for easy rectification. What’s more? Seamlessly cancel e-invoices with just a few clicks.

Moreover, Refrens allows you to send invoices and other documents through platforms like WhatsApp and email. It also makes sending invoice reminders a breeze and significantly improves the payment collection process, for which it offers a wide array of payment methods for added convenience.

Hence, the software’s user-friendly nature has earned it the distinction of being awarded the best accounting software for “ease of use” by Gartner.

Beyond e-invoicing, Refrens streamlines various operations, reduces administrative burdens, and enhances efficiency, making it a one-stop solution for all your business needs. It offers robust accounting software, and intuitive Sales CRM, and also helps manage multiple businesses at a single platform.

Pricing:

- Basic Plan: Up to 50 documents per year at no additional cost.

- Book Essential: ₹3900/year (offers unlimited documents, customizable invoice and quotation templates, enhanced communication, inventory management, and team expansion)

- Books GST: ₹7500/year (offers features like automated GSTR-1 reports, e-invoicing, and e-way bills, plus upcoming features for GSTR filing and team expansion.)

- Books Pro: ₹8500/year (This package offers customized roles, full financial reporting, ledger syncing, personalized onboarding, domain emails, and supports five team members)

Rating:

- Capterra: ⭐4.9/5

- G2: ⭐4.6/5

- Software Advice: ⭐4.8/5

- Get App: ⭐4.8/5

| 👍 | 👎 |

| “Refrens.com’s invoice feature is a game-changer for small businesses. .” ~Jitender | “Needs an app desperately. This would help with invoicing on the go” ~Muaaz |

| “Ease of invoicing with Refrens. It has all the basis features required for daily invoicing..” ~Preety | “Multiple GST handling of own business should be more flexible..” ~Preety |

| “Refrens is user-friendly. It gives the best invoicing solution for small enterprises” ~Swaroop | Minor field changes are sometimes difficult.” ~Bharat |

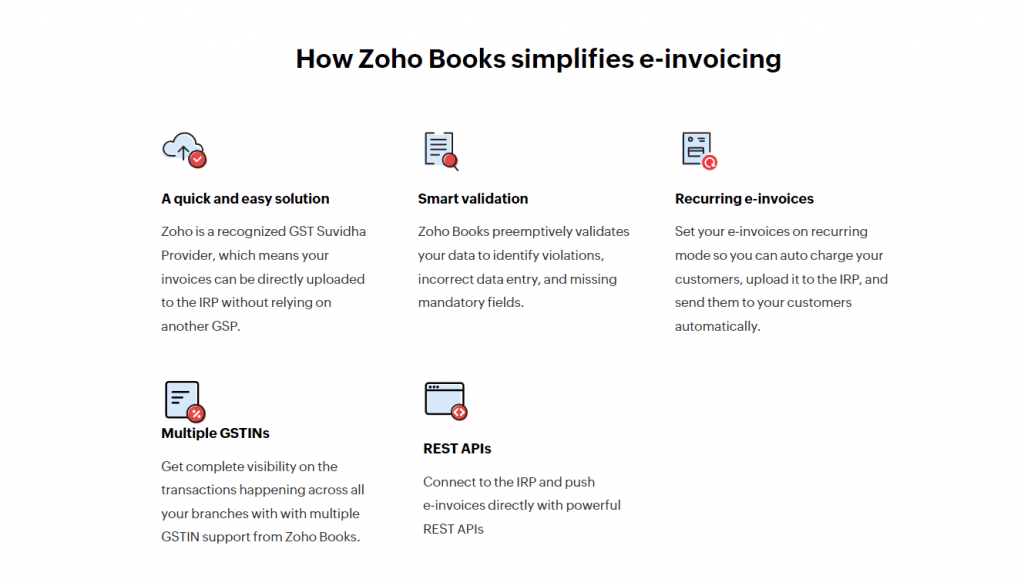

2. Zoho E-invoicing Software

Zoho is an invoicing software for small businesses that offers easy e-invoicing creation. It has gained the trust of many businesses, offering a comprehensive suite of financial services.

As a recognized GST Suvidha Provider, it allows you to directly upload your invoice into IRP, eliminating the need for additional trips to other GSP portals.

Zoho Books, part of the Zoho suite, offers accounts receivables software, along with inventory tracking, banking transactions, timesheets, contact management, and report generation. It provides a holistic overview of a business’s financial health.

To cater to diverse businesses, Zoho offers a range of affordable pricing plans and mobile apps for iOS and Android, enabling users to manage their finances from anywhere.

Pricing:

- Free Plan: With limited functionality, suitable for small businesses

- Standard Plan: ₹8988/year (For more features such as accounts, reports, books, e-invoices and payments and more)

- Professional Plan: ₹17,988/year (For features like team collaboration)

- Premium Plan: ₹35,988/year ( For more features such as customization, automation, and payroll management )

- Elite Plan: ₹59,988/year (For more features such as warehouse management, and advanced accounting, inventory management)

- Ultimate Plan: ₹95,988/year (For more features like advanced business intelligence)

Rating:

- Capterra: ⭐4.3/5

- G2: ⭐4.4/5

- Software Advice: ⭐4.4/5

- Get App: ⭐4.4/5

| 👍 | 👎 |

| “I am so impressed with Zoho Invoice.The Customer Portal is great to send invoices, timesheets and bills in real-time, and payment can be made directly from the portal.” ~Dedre M. | “When a new invoice line is entered, the empty default line remains and has to be deleted” ~Lynda D. |

| “Easily produces professional invoices and reports for the light user. Faster, simpler and cheaper than the competition. Highly recommended.” ~Phil B. | “Recurring invoices could be easier. I need to set a manual schedule with a changing number of hours (items)” ~Phil B. |

| “Invoicing and the different templates you can choose from it is also very easy to use.” ~Nomsa T. | “Though, Zoho Invoice is great platform for billing and invoicing, It can still be improved. The only thing I don’t like, It is often slow and laggy, which need to be fixed.” ~Rahul K. |

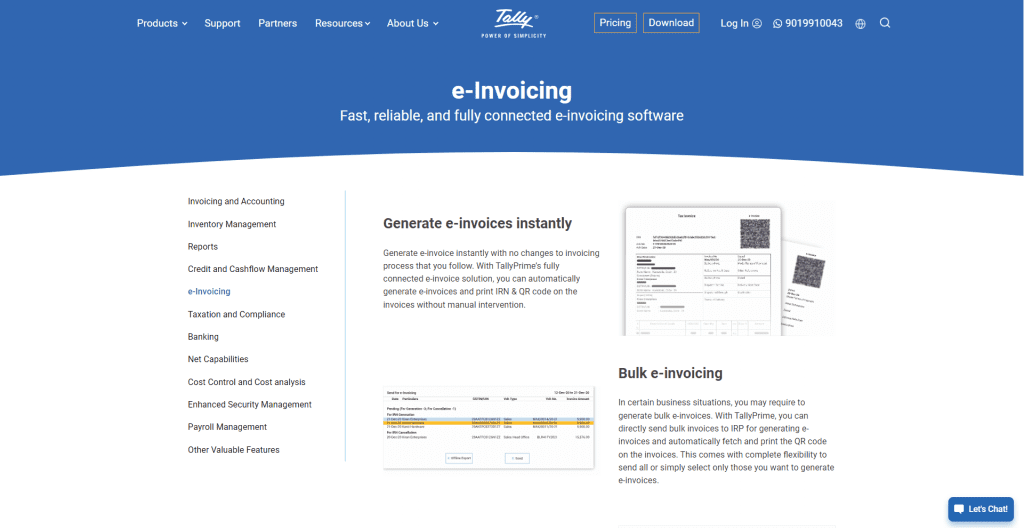

3. Tally E-invoicing Software

Tally is a renowned accounting and inventory management software offering many accounting and inventory-related features, including e-invoicing capabilities. With TallyPrime, generating an e-invoice becomes a seamless process.

The software also provides easy e-invoice tracking solutions and cancellation options. In case your internet gets disconnected during e-invoice creation, TallyPrime will export the data in the form of a JSON file, preventing the need to start over.

Tally also includes various tools like TallyPrime (Business Management Software), Tally Software Services (for software subscriptions), TallyPrime Server (for improved business efficiencies), TallyPrime Powered by AWS (for virtual access to licenses and data), and Shopper 9 (for complete retail enterprise solutions).

Pricing:

- SILVER RENTAL

1 Month: INR 9,000 + 18% GST (INR 1,620)

3 Months: INR 27,000 + 18% GST (INR 4,860)

12 Months: INR 108,000 + 18% GST (INR 19,440)

- SILVER (Perpetual License): INR 22,500 + 18% GST (INR 4,050)

- GOLD RENTAL

1 Month: INR 27,000 + 18% GST (INR 4,860)

3 Months: INR 81,000 + 18% GST (INR 14,580)

12 Months: INR 324,000 + 18% GST (INR 58,320)

Rating:

- Capterra: ⭐4.4/5

- G2: ⭐4.4/5

- Software Advice: ⭐4.4/5

- Get App: ⭐4.4/5

| 👍 | 👎 |

| “It is very easy to use and can be used by anyone who knows the basic accounting rules. ” ~SREEKALA | “This software is not on cloud storage basis.” ~Verified Reviewer |

| “It is fairly user friendly, has a very professional layout and and also has some great features like e-invoicing and auto-bank reconciliation.” ~Evans | “Little bit out dated interface as compared to other products available in the market and features provided are less as compared to others.” ~Akash |

| “Very easily implementable and easy to integrate with invoicing softwares” ~Bhavneet K. | “There should be an option of pulling reports about invoices or any customizable report so that we don’t requirement to refer bank to tally prime for every single search.” ~Sainadh P. |

4. Masters India E-invoicing Software

As a GST Suvidha Provider appointed by the Goods and Service Tax Network (GSTN), Masters India offers seamless integration of your existing ERPs, ensuring 100% ITR claim and providing an end-to-end compliance platform for your e-invoicing needs.

As a GSP itself, Masters India allows easy generation of e-invoices, real-time compliance reporting, AP process automation, and generation of various reports. It also provides solutions such as GST Software, Invoice OCR Software, Accounts Payable, and APIs like Vehicle Tracking, Vendor API, and GST API to streamline different business activities.

Pricing:

Custom pricing based on your requirements

Rating:

G2: ⭐4.3/5

| 👍 | 👎 |

| “Masters India makes it very easy for GST return. ” ~Prathip R. | “Need to improve backed server response and performance more.” ~Sakthi A. |

| “The software is easy to use provide best analytics relating to various matchings like books and gstr-2b, books and GSTR-2b etc. which can help in proper management of tax credits.” ~Akash T | “Little bit out dated interface as compared to other products available in the market and features provided are less as compared to others.” ~Akash |

5. Swipe E-invoicing Software

Swipe is another software option that provides around 40 features, including e-invoicing services. Its streamlined process makes generating e-invoices easy and efficient.

Additionally, Swipe functions as a free GST billing software, enabling real-time tracking of sales, purchases, and estimates. It can also manage inventory, file GST returns, and create and share professional invoices.

Pricing:

- PRO Plan: ₹1899/year (offers one business account, branding, online payments, GSTR-1, extensive reports, custom fields, bulk uploads, Swipe Drive, iOS app access, and priority support)

- JET Plan: ₹2799/year (everything in PRO plus 1 business account, admin and 2 users, e-way bills, multiple price lists, priority support, bulk downloads, and 1 GB Swipe Drive storage.)

- RISE Plan: ₹3499/year (includes all JET features plus export/multi-currency, recurring subscriptions, POS, batch tracking, serial number/IMEI tracking, and manufacturing capabilities.)

- Enterprise Plan: Custom pricing according to your feature demand (offers all PRO features plus custom features, multi-user support, online store, Tally/Shopify integration, warehouses, GST filings, digital signatures, and extra storage)

Rating:

Capterra: ⭐4/5

G2: ⭐4.1/5

Software Advice: ⭐5/5

Get App: ⭐4.8/5

| 👍 | 👎 |

| “It’s a user-friendly app.It provides multiple services along with e-Invoicing like GST reports and online store..” ~Kranthi | “It cannot cater to larger businesses.” ~Amrit Om |

| “Quick invoices and ease of use has been cracked by swipe from day one .” ~Ganesh | “Unable to GST payment via the Swipez platform it appears the GST authorities have not allowed that facility yet.” ~Mahesh |

| “It’s a user-friendly app.It provides multiple services along with e-Invoicing like GST reports and online store.” ~Kranthi | “ The current templates all look great, but I wish that new templates came out at a quicker pace.” ~Chris S. |

Choosing the right software from the above list can be overwhelming. Hence we have created a comparison guide of Refrens, Zoho, and Swipe to help you choose the software most suitable for you.

Key Challenges of Implementing E-Invoicing Software

Implementing e-invoicing software comes with several challenges –

- Technical Integration: Integrating e-invoicing software with existing ERP, top accounting software, and other business systems can be complex. Ensuring seamless data exchange without disrupting current workflows requires careful planning and execution.

- Training and Adaptation: Employees need to be trained to use the new e-invoicing system effectively. This transition can be time-consuming and may face resistance from staff who are accustomed to traditional invoicing methods.

- Initial Setup Costs: The initial costs for setting up e-invoicing software, including purchasing licenses, training staff, and potentially upgrading existing systems, can be significant, especially for small and medium-sized businesses.

- Data Security: Ensuring the security of sensitive financial data is a major concern. Businesses must implement robust cybersecurity measures to protect against data breaches, unauthorized access, and other security threats.

- Regulatory Compliance: E-invoicing regulations can vary widely between countries and regions. Businesses operating internationally must stay updated on the specific compliance requirements of each jurisdiction to avoid penalties and ensure smooth operations.

- Internet Dependency: E-invoicing relies heavily on stable internet connectivity. In regions with unreliable or limited internet access, this dependency can pose a significant challenge, affecting the timeliness and accuracy of invoice generation and submission.

- Vendor and Customer Coordination: Coordinating with vendors and customers to adopt e-invoicing practices can be challenging. Ensuring all parties are aligned on the standards and processes for e-invoicing is crucial for a seamless transition.

- Scalability Issues: As businesses grow, their invoicing needs may become more complex. Ensuring that the e-invoicing software can scale effectively to handle increased volumes and more sophisticated requirements can be a challenge.

- Ongoing Maintenance and Updates: E-invoicing software requires regular maintenance and updates to stay compliant with changing regulations and to address new security vulnerabilities. Keeping the software up-to-date involves ongoing effort and resources.

- User Experience: If the e-invoicing software is not user-friendly, it can lead to frustration and inefficiency. Ensuring that the software has an intuitive interface and provides a good user experience is critical for widespread adoption and effective use.

Conclusion

As the Indian Economy continues to embrace digitization, it becomes vital for businesses to adopt the right software solution to streamline their invoicing needs, save time and personnel, and focus on scaling their operations.

Whether you require basic invoicing features or comprehensive financial management, the software mentioned above offers a wide range of features to simplify your business operations in an organized manner.

Embrace the digital revolution with e-invoicing software and transform the way you manage your invoices, payments, and financial transactions!