Financial transactions powered by technology are the lifeblood of fintech firms. If they aren’t managed properly, the business will fail. Also, without a robust inbound strategy (sales and marketing), the team will not be able to build a strong relationship with customers. This will negatively impact the customer base, transactions, and revenue.

That’s where CRM Tools comes in. CRM is a solution designed to streamline and automate various aspects of customer engagement and align the sales and marketing teams, just like in a revenue marketing model. If you are wondering what is revenue marketing and the role of a CRM tool in revenue generation, we have just the information for you.

A CRM platform allows businesses to gather, organize, and analyze customer data, enabling them to generate qualified leads, sales, and revenue. Thus, it is an essential enabler for a fintech’s revenue marketing efforts, making it critical to choose a relevant one.

For instance, before opting for a suitable CRM, a fintech should consider aspects such as –

- Does the platform cater to your fintech needs? For instance, will it help with lead tracking and management, marketing automation, project management, and more?

- Does it have easy-to-digest dashboards?

- Can it help the business effectively track leads through the sales funnel?

- Assess its scalability, customer centricity, integration capabilities, and compliance features. Can it integrate with other software like customer service, accounting, CPQ applications, and other business technology?

- Is it powered by AI and machine learning? This will allow you to effortlessly analyze and draw insights from customer data.

- Will it ensure a high level of data security?

In fact, CRM is one of the most recommended tools in the modern business management toolbox. In this post, we have 8 CRM tools that will narrow down your search and help you pick the most suitable CRM for your fintech firm.

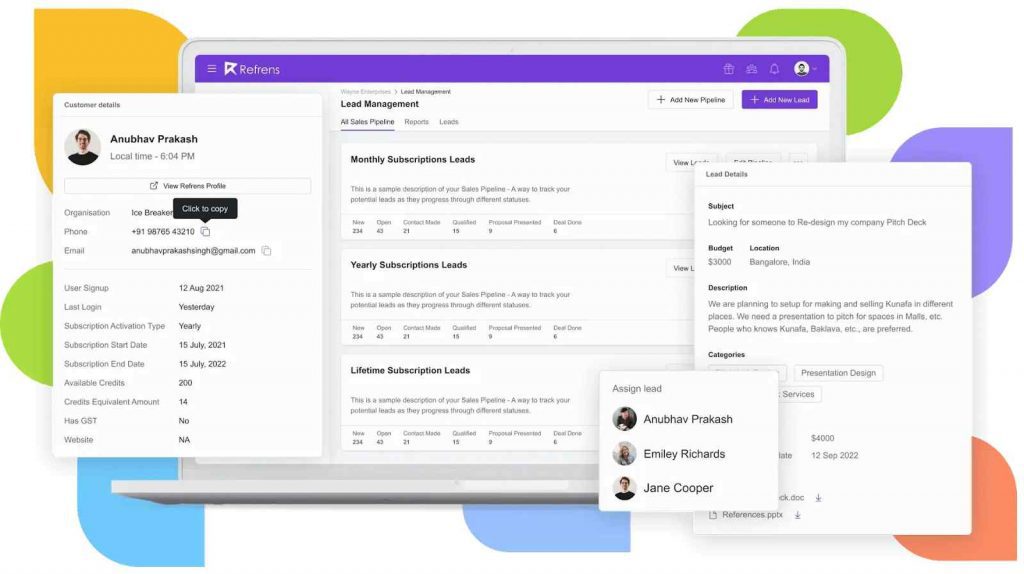

1. Refrens Sales CRM

Refrens Sales CRM Software that revolutionizes the sales process by streamlining the workflow and boosting productivity. It empowers the sales team to manage leads, monitor pipeline progress, and close more deals effectively. Thus, it is an all-in-one CRM that accelerates sales performance.

Here’s why Refrens Sales CRM is apt for your fintech.

- It allows users to effortlessly manage their sales pipeline. They can instantly import leads from various sources and auto-capture them with forms.

- It helps users engage and nurture leads by allowing them to effortlessly segment and assign leads, and stay connected via WhatsApp and Email.

- Sales teams can close deals and drive revenue by staying on top of follow-ups and generating quotations in just one click. This hugely speeds up deal closures and boosts sales.

A few other features offered by Refrens –

- Capture leads

- Lead capture form

- Custom fields

- Label and tag every lead by source

- Intelligent insights and reports

- Automate follow-ups

- And more!

2. HubSpot CRM

HubSpot is perfect for financial institutions because –

The HubSpot CRM, one of the top Sales CRM for small businesses, offers a flexible and customizable platform for financial services, investment firms, and insurance agencies. Its advanced features allow fintech firms to easily track and manage customer relationships and automate work processes.

- It possesses seamless automation capabilities, whether it is campaign tracking or lead scoring and lead nurturing strategies. With this feature, firms can quickly spot top leads and deploy their resources to engage them.

- It has an intuitive UI that ensures ease of use and maximum productivity. This user-friendly tool makes customer relationship management processes effortless.

- It is an all-in-one tool that aligns teams and business processes. The platform has supporting sales, marketing, content management, and service hubs in one code base. The recently added, operations hub helps clean and curate customer data on one central platform.

- It is affordable, making it ideal for FSI businesses that usually operate with a lean sales team.

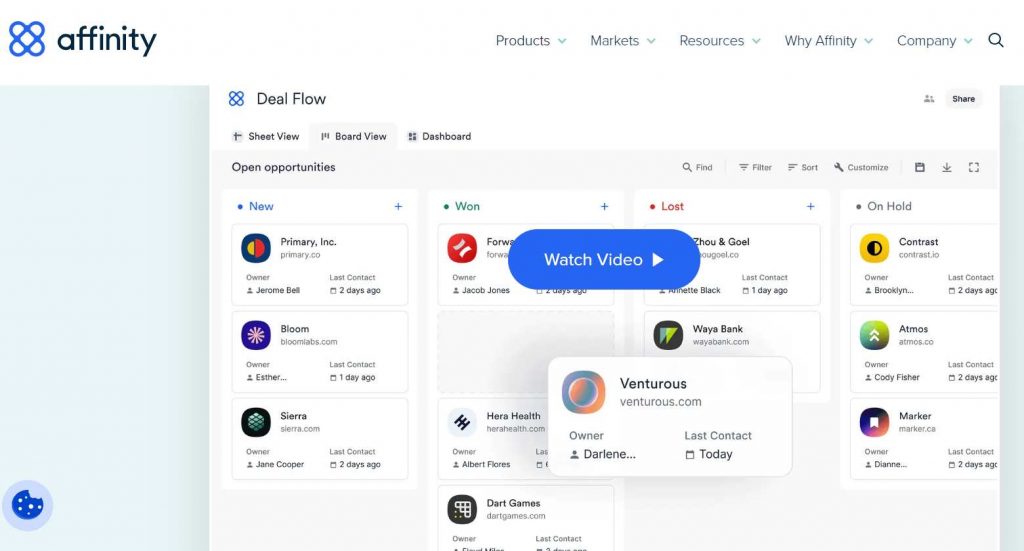

3. Affinity CRM

Affinity CRM is being used by over 2000 firms as it empowers dealmakers in relationship-driven industries to find, manage, and close deals. The intelligent CRM platform offers insights that drive deals. It also boasts of offering freedom from CRM data drudgery that otherwise forces teams to spend a lot of time creating contact profiles.

Affinity CRM is ideal for the financial service industry (FSI) because –

- It is tailored for relationship-driven teams, investors, Top step trader review, and brokers.

- It eliminates the need for manual data entry as it automatically surfaces each interaction the team has had.

- It is an easy-to-use CRM that tracks all conversations, and attachments and sends timely payment reminders. It facilitates collaboration across several team functions.

- The platform can analyze billions of data points based on team relationships and interactions.

- The platform leverages AI and natural language processing to automate data entry while fetching in-depth insights that help in the decision-making process.

- It can easily integrate with Dropbox Business, Mailchimp, Microsoft Teams, Google Drive, and more.

4. Salesforce Sales Cloud

Most financial institutions like Western Union, American Express, and Wells Fargo leverage Salesforce to personalize their customer experiences, streamline business operations, manage risks, and accelerate revenue growth. With the Salesforce CRM, they gain a complete understanding of the business and their customers, enabling them to make data-driven decisions. This, in turn, enhances their digital customer engagement strategies, ensuring personalized interactions across all touchpoints.

Fintech firms often run lean operations. With Salesforce CRM, these firms can make sales, marketing, and service tasks more efficient.

Here’s why Salesforce CRM is great for the fintech software development industry:-

- It offers a complete set of products that cater to the unique needs of FSIs, allowing them to streamline their operations and deliver exceptional customer service.

- It allows centralized management of financial data, offering a consolidated view to teams. This largely eliminates duplicate client data across systems.

- It allows users to access accurate client data at the right time, supporting firms in making informed financial decisions and forecasts. Businesses can effectively predict future income, understand potential risks and opportunities, and take the necessary corrective action.

- Salesforce is a leading software for lead generation, offering robust tools that enable businesses to efficiently capture, track, and convert leads into customers through its comprehensive CRM platform.

- It offers a huge level of flexibility when adapting to the individual needs of wealth management firms, retail banks, insurance agencies, and other financial domains.

- The platform stitches security into everything done to manage security risks and ensure regulatory compliance.

- Salesforce seamlessly integrates with other platforms without meeting for extra custom coding or system hiccups. Firms can add functionalities like virtual signing of documents or multi-criteria search for financial records. All this makes financial task completion easy and quick.

5. Redtail

Redtail is a web-based financial CRM founded in 2003. It is a core financial solution that offers guidance to financial advisors and wealth management firms to run their businesses effectively. The platform allows lead management, contact management, customizable reporting, all necessary integrations, and workflow automation.

Redtail CRM is ideal for fintech firms because –

- It offers features like client management, workflow automation, compliance tracking, and document management.

- It offers tailored functionalities for FSI businesses, enabling them to manage client relationships, sales processes, and customer service.

- It has impressive scalability, integration capabilities, and security and compliance features.

- The platform charges as per each database compared to other CRM software tools that charge users per month. A single database consists of 15 users. This makes the tool favorable for medium and small businesses.

6. DealCloud

DealCloud, the product of Intapp, offers a single-source deal sourcing and fund management to existing 1,100 users, thereby powering their deal-making process from strategy to origination to execution. They provide fully configurable solutions that are built for private equity and growth capital firms, investment banks, private and publicly traded companies, and debt capital providers

DealCloud makes a great solution for fintech –

- It is an ideal CRM tool that supports and organizes critical business development initiatives like phone calls, emails, conferences and trade shows, and meetings.

- It is specially designed for the complex needs of partner-driven capital markets firms.

- It offers vertical-specific solutions to support organizations as they pursue their revenue goals, manage risk and compliance, and deliver client success.

- It acts as a single source of information for dealmakers, enabling them to execute deals and effortlessly connect with external solutions and third-party data providers.

7. Bitrix24

Bitrix24 is an all-in-one free on-cloud and on-premise CRM that’s designed to seamlessly integrate with a business’s top services and apps. It offers unlimited leads, contacts, quotes, invoice management, appointment scheduling, and deals. Hence, most firms prefer to use Bitrix24.

Moreover, Bitrix24 offers complimentary sales, promotion, and customer management tools that help in closing deals quickly. Its strength lies in lead management, sales performance, and tracking and pipeline management solutions.

We would recommend Bitrix24 CRM for fintech businesses because –

- It is a one-stop free CRM tool for managing deals, engaging clients, and closing deals effectively.

- It allows firms to take complete control of their sales processes – from lead acquisition to customer service. Thus, they can acquire leads effortlessly, manage contacts and transactions, automate workflows, and close more deals.

- Bitrix24 is a suite that features more than 30 tools for sales, administration, and marketing. Its business process automation tool streamlines your workflows and sales funnels.

- It offers free CRM website templates, forms, live chats, calls, or messengers that allow businesses to capture leads effectively and manage the entire sales funnel.

- Bitrix24 allows easy migration of data from other systems and integrates with all services and applications used by the business.

8. Wealthbox CRM

Wealthbox CRM is specifically designed for financial institutions and financial advisors. It offers useful features, such as contact management, task tracking, client collaboration, and integration with financial planning tools. It’s one of the most trending web-based CRM software solutions that’s being used by most financial institutions. It is one of the best wealth-tech CRMs recommended by G2.

The CRM offers several features relevant to fintech firms. For instance, it offers calendar events, contact management, advanced security, task management, automated workflows, account administration, activity streams, system reporting, social feeds, advanced searching and filtering, tagging, permissions, and more.

We feel this CRM is ideal for FSI companies because –

- The full-featured CRM offers everything financial advisors and fintech solution teams need to connect with their clients, prospects, and coworkers.

- The platform connects seamlessly with the commonly-used business tools. It integrates with over 100 leading custodial platforms and wealth-tech applications.

- Switching to this CRM is easy and quick. You can do it yourself. No training is needed.

9. Wellyx

Wellyx gym CRM software provides flexibility and comes with complete customization, programmed for adaptability for multiple types of fitness centers. Its state-of-the-art feature enables gym tech businesses to monitor & oversee their customer relationships efficiently.

Wellyx gym CRM software is an excellent fit for fitness formation for various reasons:

Profit with Automation: Wellyx offers top-notch automation functionalities and a profitable dashboard. It includes lead management, lead nurturing, lead scoring, and campaign tracking. This process enables gym CRM software to identify and prioritize clients swiftly and allocate resources for engagements.

User-friendly Interface: Wellyx gym CRM software has designed its interface to be friendly for the sake of ultimate productivity and to enhance it. With Wellyx’s operating design, it’s easy to manage customer relationships, and operational tasks become a breeze for gym staff to smoother business operations.

One Solution for All: Wellyx gym CRM software stands for the ultimate solution for all types of fitness centers, including sales, marketing, POS services, loyalty programs, membership management, access control systems, gift cards, facility rental, digital forms, etc. These are essential for a gym business that is aiming for excellence.

Affordability: Affordability is an important factor for gym centers. Hence, Wellyx gym CRM software gives you premium features at affordable prices. It makes sure that they can access advanced CRM capabilities without breaking the bank.

So, if you want a solution, you are looking at it.

Over to you!

Now it’s time for you to decide on the most suitable CRM for your fintech business. Before picking one from the list we have shared above, make sure you ask yourself the following questions.

- Does the CRM solution suit my budget? Are you getting access to all features for a price point that works for you? Or do you have to pay extra?

- Is the platform secure? Fintech or no fintech, customer data is sensitive. Yet, you need to be extra careful when dealing with financial data. Does your CRM meet the present security requirements and regulations?

- Is the CRM scalable? Can the current features accommodate your growing business needs?

- Is the CRM user-friendly? Does adopting this platform involve a steep learning curve? Remember – user adoption is a big challenge when it comes to rolling out a CRM.

- Does the CRM offer 24*7 customer support? No one wants to be left waiting for a resolution to their problems.

There’s a lot to ponder when picking a relevant CRM for your venture. We are sure the information and the list shared in this post will help you make an informed decision.