Why Choose Refrens as Your Startup Accounting Software?

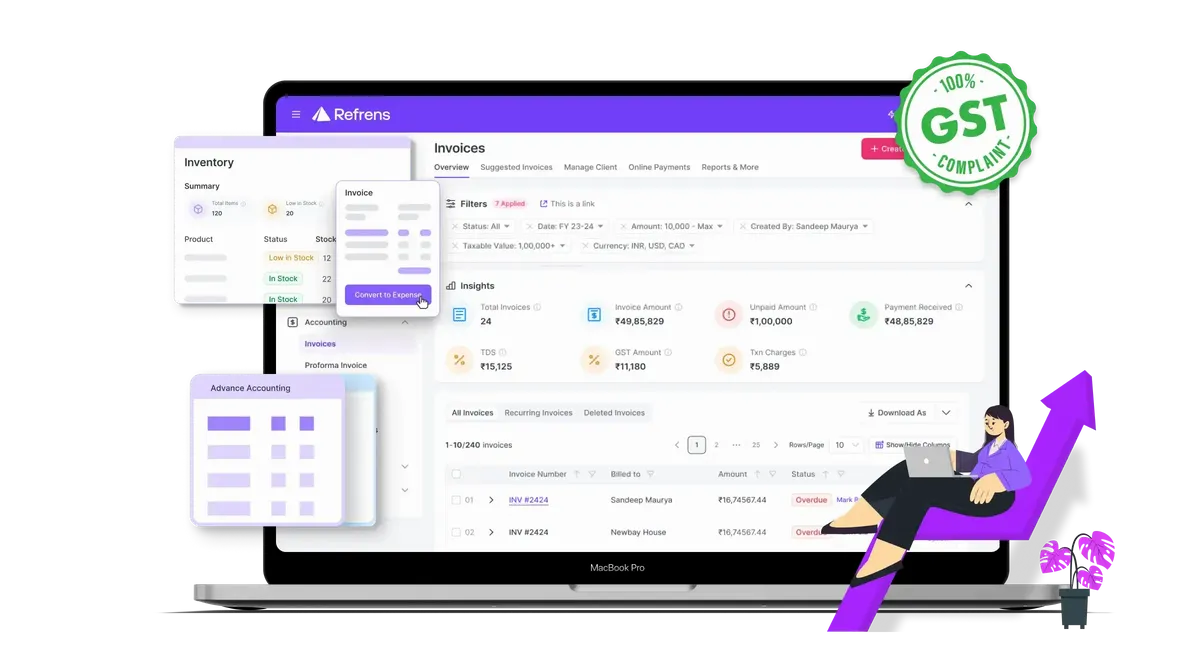

✅ Get real-time visibility into cash flow, P&L, balance sheet, and daybook from a single dashboard.

✅ Track revenue, expenses, and burn rate with live analytics. No more waiting for month-end reports.

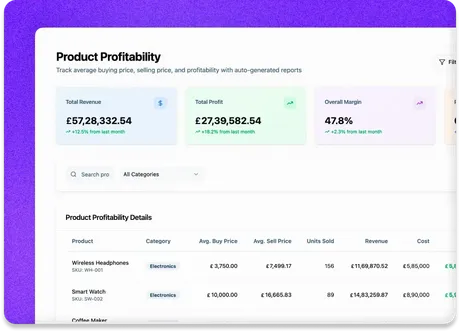

✅ Drill down into client, product, or project profitability to guide strategic decisions.

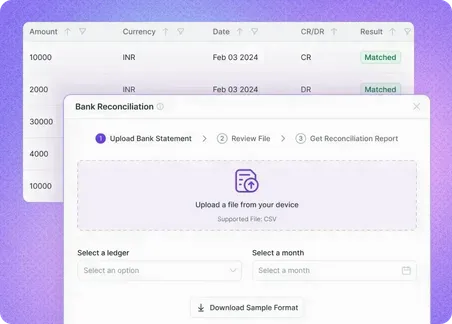

✅ Automate journal entries, reconciliation, and reporting so you can focus on scaling.

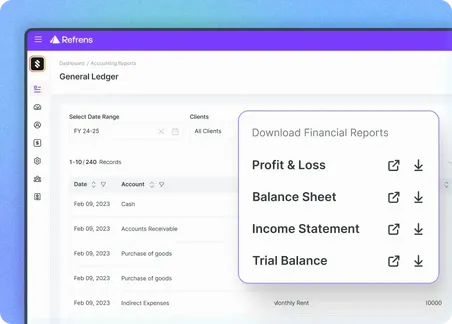

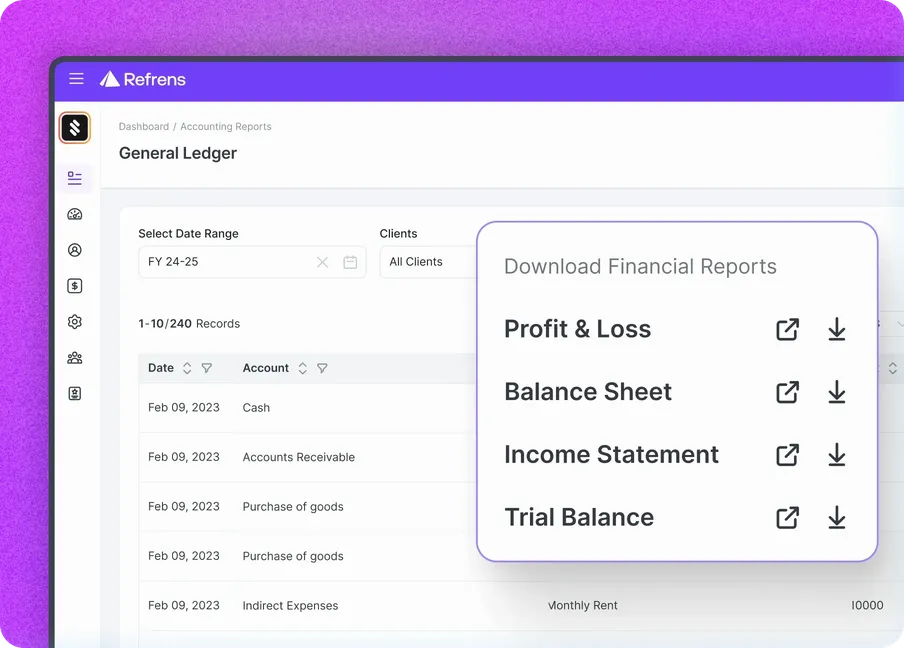

✅ Generate financial statements instantly for board meetings, investor decks, or funding rounds.

✅Get CFO-level insights into your business with AI Accounting Agent.

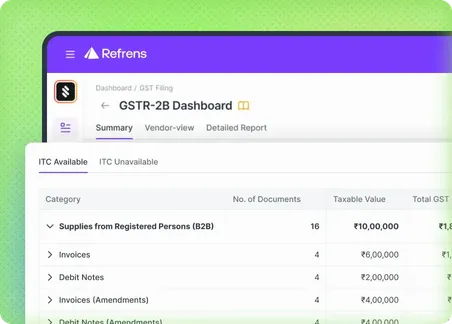

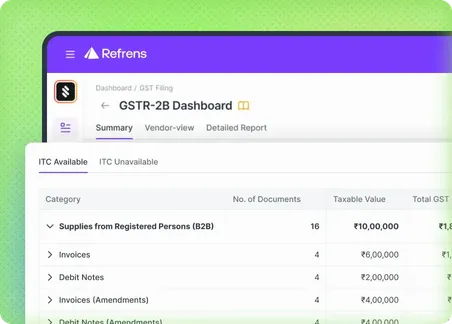

✅ Create GST-compliant invoices and automate GSTR-1, GSTR-3B, and 2B filings in one click.

✅ Reconcile GSTR-2B with purchases to identify mismatches before filing.

✅ Track eligible ITC, reversals, and utilization so you never lose tax credits.

✅ Auto-detect GST type based on place of supply and apply multi-rate GST seamlessly.

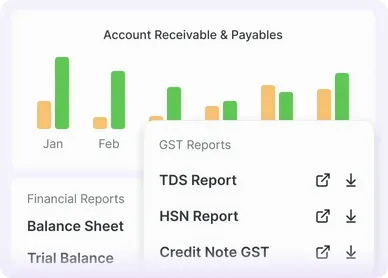

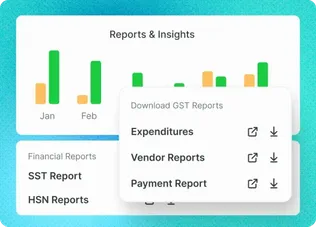

✅ Generate HSN, TDS, and tax summaries for quick compliance reviews.

✅ ISO-certified with enterprise-grade data encryption and security.

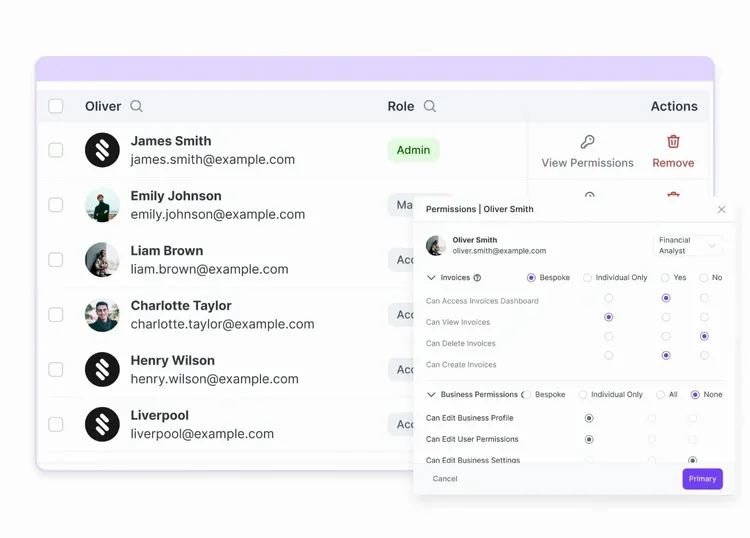

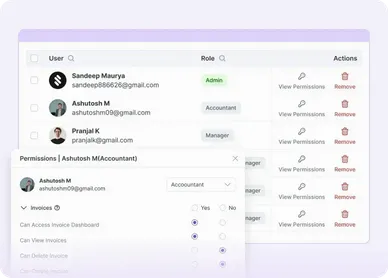

✅ Assign role-based permissions for managers, finance teams, and CAs to maintain control.

✅ Set up custom approval workflows for invoices, expenses, reimbursements, and payouts.

✅ Add internal comments and track every change with a detailed audit trail.

✅ Collaborate with your CA or accountant directly from the platform without email back-and-forth.

✅ Manage multi-branch accounting under one login with consolidated reporting.

Smart Features Built for Startup Finance

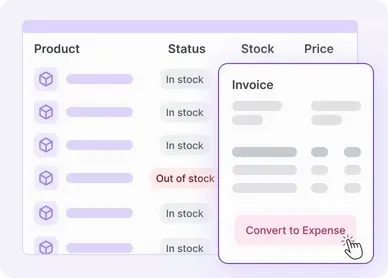

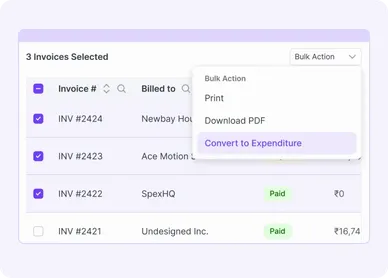

Every invoice, expense, and payment automatically updates ledgers and vouchers. No manual entries, no missed data - your books stay accurate and audit-ready.

Track revenue, expenses, burn rate, and runway in real time. Instantly generate Balance Sheet, P&L, Cash Flow, and Trial Balance to make fast, data-driven decisions.

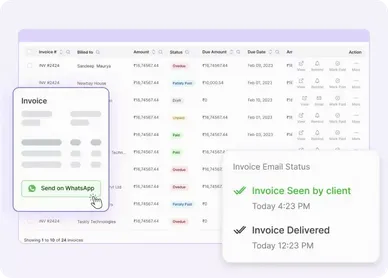

Create GST-compliant invoices, automate GSTR reports and reconcile 2B data with purchase records. Track eligible ITC and avoid missed credit claims with ease.

Auto-match bank transactions with invoices, bills, and expenses. Instantly detect mismatches, verify entries, correct discrepancies with 1-click actions, and keep your accounts accurate and investor/bank ready.

Set up internal approvals for invoices, reimbursements, and payments. Control access for co-founders, finance teams, and CAs with secure, role-based permissions.

Submit, review, and approve team reimbursements effortlessly. Categorize expenses by project or department, monitor budgets, and track settlements in real time.

Break down profitability by project, product, or client. Identify high-performing revenue streams and cost-heavy segments to guide business strategy and scaling decisions.

Auto-generate filing-ready GSTR reports and HSN summaries. Stay ahead of deadlines with automated reminders and download pre-validated JSON files for easy submission.

Shift from spreadsheets or other tools without hassle. Import past data, set up your chart of accounts, and get hands-on support during implementation.

Invite your CA or finance team directly into the platform. Work together in real time, approve entries, and access books securely from any device, anytime.

Automation, Collaboration & Growth Tools

Invoicing, Payments & Compliance

Core Accounting & Bookkeeping

The smartest investors in the room are backing our vision.

People who understand money, match-making and all things Internet.

Happy Customers

Frequently Asked Questions (FAQ)

Refrens is the most comprehensive accounting software for startups. 150k+ entrepreneurs, agencies, accountants, and freelancers use Refrens to manage their finances end-to-end. Whether it is invoicing, payments, or reporting - everything can be managed and automated through Refrens’ accounting software.

We are an ISO certified organisation. We take utmost care of data security & privacy. Our systems are frequently updated with the latest security updates to ensure that your data is safe and secure. Do check out our detailed privacy policy here.

Yes, we provide instant & reliable support over chat, email, and phone. We will also provide a dedicated account manager to help you out whenever required.

Yes, Importing your data from other accounting systems is super easy. However, if you need a helping hand, do reach out to us on chat support or at care@refrens.com.

Absolutely! Our software is designed to seamlessly adapt and scale alongside your business, ensuring that it meets your evolving needs at every stage of growth. We are also committed to continuously enhancing the software by rigorously adding new features, functionality, and improvements so that your business can always stay ahead of the curve.

As your business expands, our software can accommodate an increasing number of users, manage larger volumes of data, and handle more complex tasks without compromising on performance or efficiency. We regularly update our software to incorporate new technological advancements, industry best practices, and customer feedback, ensuring that you always have access to the latest and most innovative solutions.

Additionally, our cloud-based infrastructure offers unparalleled scalability and reliability, with the ability to adjust resources on-demand to cater to your business's specific needs. This means that you can be confident that our software will support your growth without any disruption or downtime.

- Cloud Accounting Software

- |

- AI Accounting Agent

- |

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

- Inventory Management Software