Smarter Accounting, Built for Your Success

The Complete Online Accounting Solution for Growing Businesses

Manage finances, track transactions, and stay ahead with smart automation.

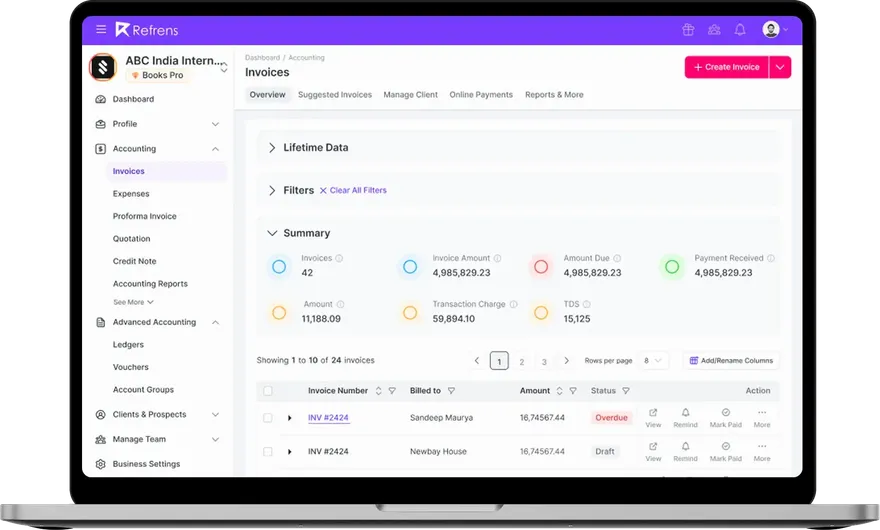

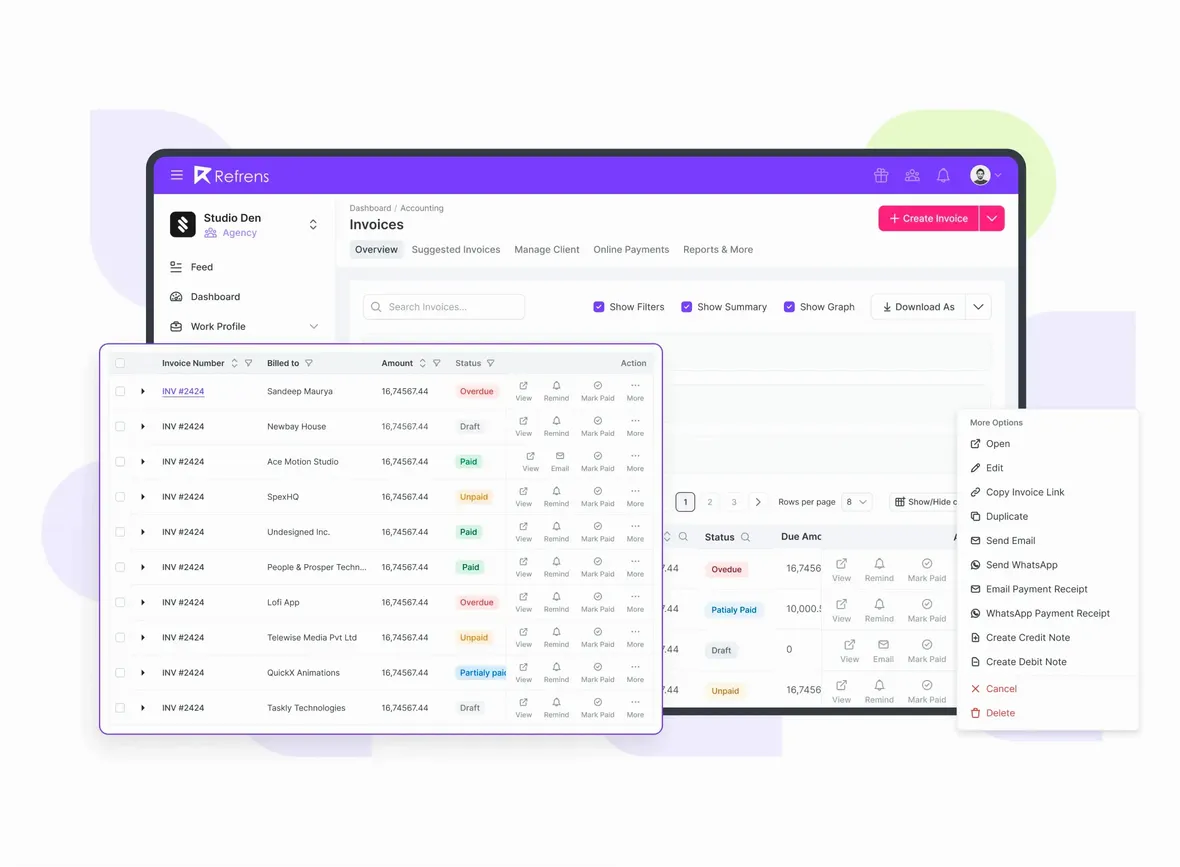

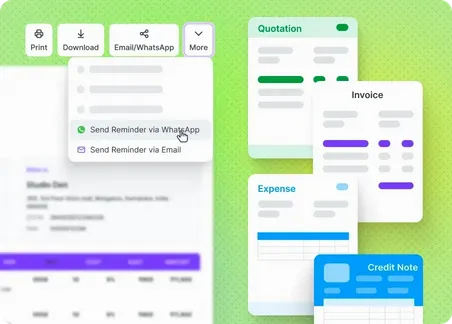

Manage your finances seamlessly with our intuitive accounting platform. Create and send invoices, estimates, and receipts instantly via email or WhatsApp. Customize templates, automate recurring invoices, and stay on top of payments with smart reminders. Easily handle multi-currency transactions and maintain organized ledgers without hassle.

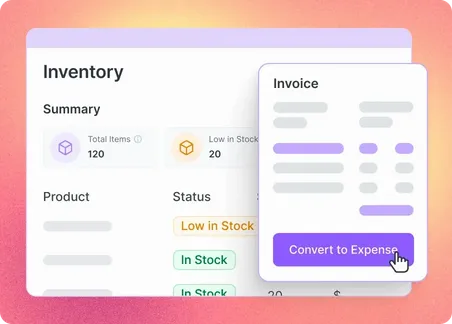

Keep your finances in check with smart inventory and expense tracking. Avoid overstocking or shortages with real-time stock updates. Track business expenses effortlessly and optimize warehouse management to maintain financial clarity.

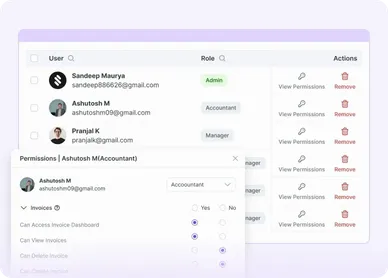

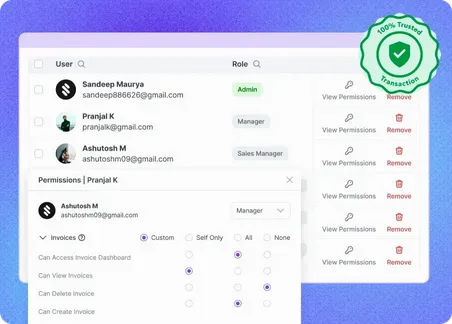

Control who has access to your financial data with customizable role-based permissions. Assign specific rights to team members based on their responsibilities, ensuring security while maintaining seamless collaboration.

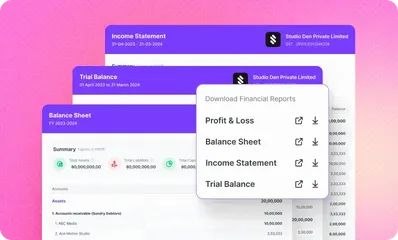

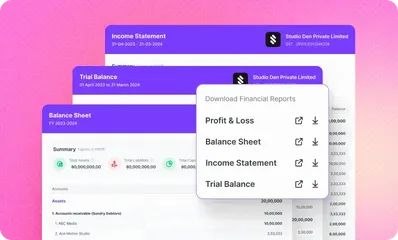

Generate financial reports including profit & loss statements, balance sheets, and trial balances in just a few clicks. Get accurate insights to make better business decisions and track your company’s financial health with ease.

Easily generate tax summaries and financial statements, ensuring compliance with local tax regulations. Automate report generation, minimize errors and simplify tax filing, no matter where your business operates.

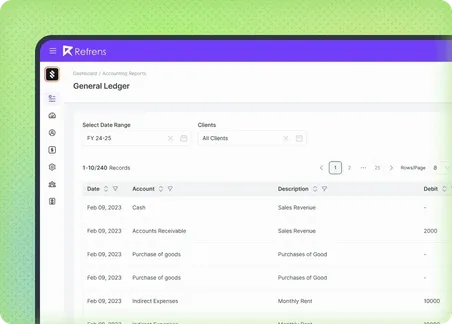

Monitor all your financial transactions in real-time with a detailed general ledger. Stay updated on all your income, expenses, assets, and liabilities for complete financial transparency.

Advanced Accounting Software for Smarter Business Operations

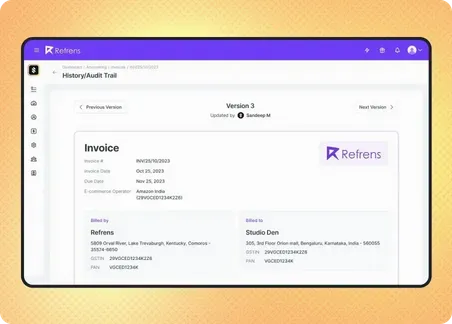

Track every transaction in real-time with a detailed audit trail. Ensure financial accuracy, review changes, and maintain compliance effortlessly.

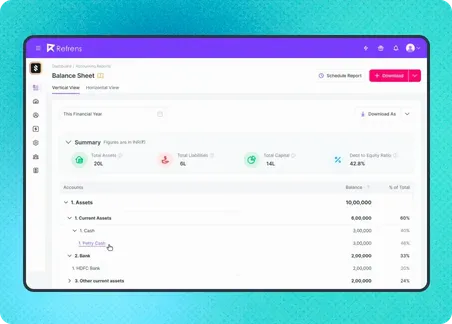

Create professional balance sheets with a clear view of assets, liabilities, and equity. Generate and review trial balances to ensure accurate bookkeeping and quick error detection.

Download financial reports, income statements, and cash flow summaries in PDF format with just one click. Present professional reports to stakeholders and make data-driven decisions confidently.

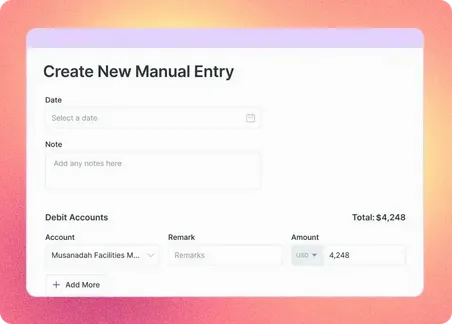

Record both manual and automated journal entries with ease. Keep track of transactions and adjustments for accurate financial reporting.

Your financial data is secure, backed up, and accessible whenever you need it. With advanced encryption and role-based access, you stay in control while ensuring business continuity.

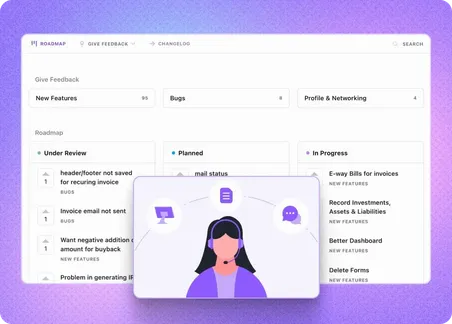

Designed for businesses of all sizes, Refrens’ accounting software is simple, intuitive, and reliable. Need help? Our 24/7 support via chat, email, and phone ensures you always have the guidance you need.

Online accounting software with flexible pricing options

Only pay when you need premium features

Refrens Accounting Software Tools

Frequently Asked Questions (FAQ)

The best accounting software depends on your specific business needs, preferences, and budget. Refrens is a popular choice for many businesses due to its user-friendly interface, comprehensive features, and affordability. However, there are many other accounting software options available, each with its own strengths and suitability for different types of businesses. It's essential to evaluate your requirements and compare features before selecting the best accounting software for your business.

We are an ISO certified organisation. We take utmost care of data security & privacy. Our systems are frequently updated with the latest security updates to ensure that your data is safe and secure. Do check out our detailed privacy policy here.

Yes, we provide instant & reliable support over chat, email, and phone. We will also provide a dedicated account manager to help you out whenever required.

Yes, Importing your data from other accounting systems is super easy. However, if you need a helping hand, do reach out to us on chat support or at care@refrens.com.

Absolutely! Our software is designed to seamlessly adapt and scale alongside your business, ensuring that it meets your evolving needs at every stage of growth. We are also committed to continuously enhancing the software by rigorously adding new features, functionality, and improvements so that your business can always stay ahead of the curve.

As your business expands, our software can accommodate an increasing number of users, manage larger volumes of data, and handle more complex tasks without compromising on performance or efficiency. We regularly update our software to incorporate new technological advancements, industry best practices, and customer feedback, ensuring that you always have access to the latest and most innovative solutions.

Additionally, our cloud-based infrastructure offers unparalleled scalability and reliability, with the ability to adjust resources on-demand to cater to your business's specific needs. This means that you can be confident that our software will support your growth without any disruption or downtime.

While accountants may use a variety of accounting software depending on their clients' needs, Refrens is a popular choice among accountants for its robust features tailored to streamline financial management. With Refrens, accountants can efficiently handle invoicing, expense tracking, financial reporting, and more, all within a user-friendly interface. Its cloud-based platform allows for easy collaboration with clients, while its advanced security measures ensure data confidentiality. Overall, Refrens is a versatile tool that empowers accountants to deliver high-quality financial services to their clients effectively.