Refrens GST Invoice Maker (Create & Download in PDF format)

Yes, this GST invoice generator is free. You can create 15 invoices for free.

We provide GSTR-1 report which is helpful for filing the taxes. If you need any report that is not currently there, you can request us on chat support, we will get it included in our system.

Yes. All the bills created by you are saved online. You can access all the bills and invoices anytime just by logging to your account.

Yes, you can save and manage all the details of your client under the client management tab. This feature helps you to avoid retying of customer details every time on the invoice.

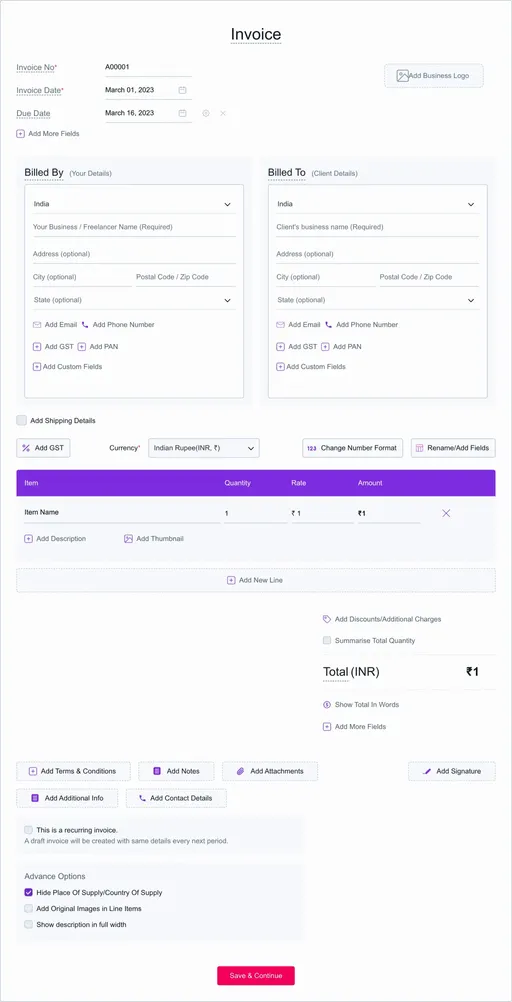

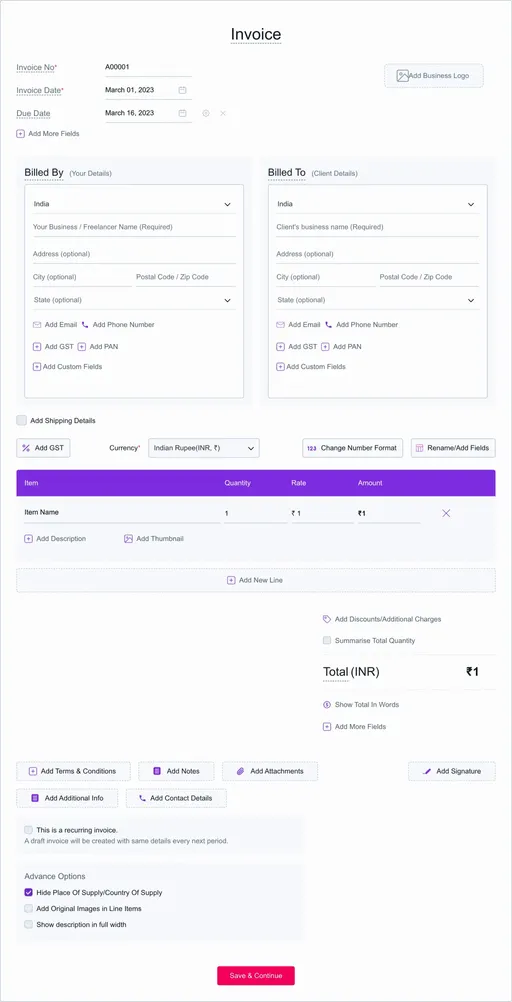

Yes, you can add extra details like shipping details, discount, custom fields for both client and line item. Apart from that, you can also upload your logo, signature and attachments.

Yes. Refrens support multiple invoice formats which also include letterhead. You can also change the colour and font headings of the invoice.

The place of supply includes the location of the buyer or recipient who is receiving the product or service.

Yes. Your data is stored securely with encryption and cloud protection. We are ISO/IEC 27001:2022 certified. Your data stays private and is safely stored on the cloud.

Yes, Refrens account is necessary to use this GST bill format. While creating an account, you can access all the GST invoices bills in one place and also makes the invoice creation procedure easy.