Trusted by 150K+ freelancers, agencies, and businesses across 178 Countries

India’s Top Freelancers, Influencers, and Creators Manage Invoicing on Refrens

Trusted by 150K+ freelancers, agencies, and businesses across 178 Countries

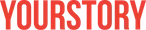

Rated ⭐ 4.8/5 based on 11700+ Ratings

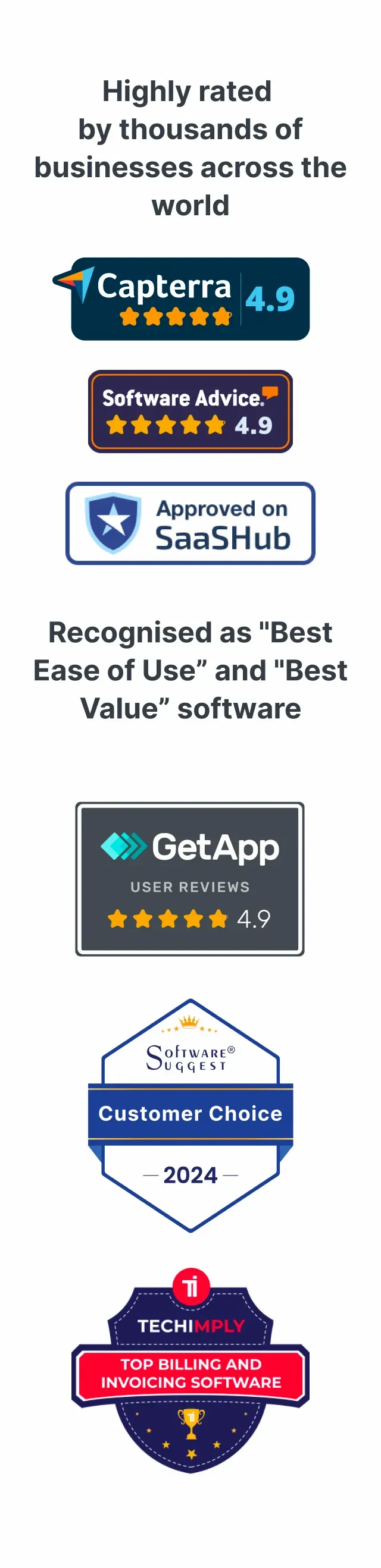

Creation, Sharing, Tracking - All Powered By Automation

Comprehensive Invoicing Solution for Freelancers

Look Professional

Impress your clients with custom-branded invoices & quotes. Choose from elegant templates, and make them uniquely yours.

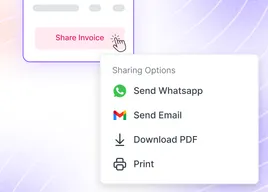

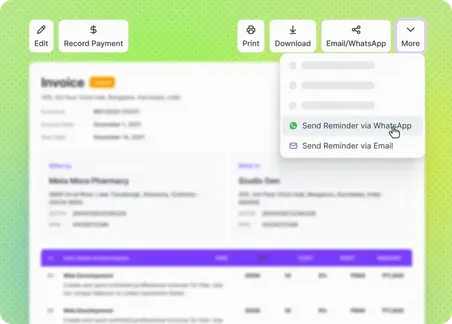

One-click Sharing

Send invoices via WhatsApp, email, links, PDF, or print in a heartbeat. Stay in the know when clients view your invoices!!

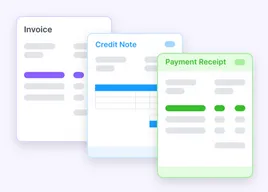

More than Just Invoicing

You can also create quotations & estimates, proforma invoices, recurring invoices, credit & debit notes, delivery challan, payments receipts, purchase order, sales order, and more!

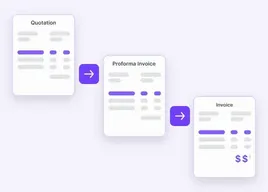

Automated Document Conversion

Convert quotes to invoices, purchase orders to expenses, and more—with just one click. Say goodbye to tedious manual work.

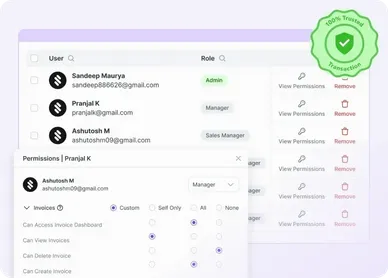

Security and Data Backup

Get secure cloud storage and backup, role-based access control and permissions, regular software updates, and up-to-date security patches on Refrens.

Reliable & Ease-To-Use

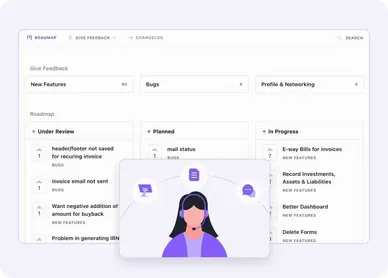

Around-the-clock responsive customer support via chat, email, or phone, a comprehensive knowledge base, an intuitive interface, regular updates, and a public roadmap for user convenience.

Payment Reminders

Our automated payment reminders via WhatsApp/E-mail ensure that you never have to manually follow up with your clients to collect payments on time.

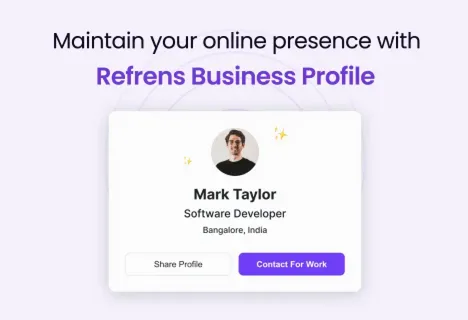

Manage your online presence

Showcase your projects, services, customer reviews, and more with a stunning business profile on Refrens. Automatically collect client reviews and have them displayed on your business profile

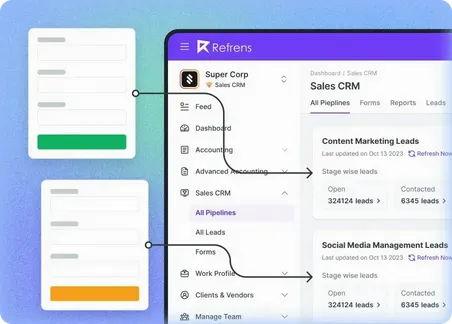

Manage your leads seamlessly

Create lead capture forms, track every stage, and keep everything organized in one place. Send follow-up reminders, generate quotations with a single click, and close deals faster with our lead management system.Everything You Need - In One Place

What freelancers say about us 💬

As a freelancer, Refrens' free invoicing software has been a blessing. Pretty smooth & easy to use.

Refrens' online invoice software has made my billing process a lot more streamlined and less time-consuming. Highly recommend it!

SunainaDigital Marketer

Refrens has exceeded my expectations in terms of ease of use and affordability.

RubitaFreelance Developer

After switching to Refrens, I no longer need to pay for 4 different software to manage leads, communication, accounting, and payments.

AnjaniFounder, Brown Mocha

Tally was too complicated for me. Zoho? too expensive. Refrens just hits that right sweet spot - It’s simple, It’s feature-rich, and it’s value for money.

The smartest investors in the room are backing our vision.

People who understand money, match-making and all things Internet.

Vijay Shekhar SharmaFounder, Paytm

Anupam MittalFounder, Shaadi.com

Kunal ShahFounder, CRED

Frequently Asked Questions (FAQ)

Refrens is a leading platform for managing invoicing, accounting, expenses, inventory, sales, and more. Over 150,000 freelancers, agencies and businesses in 178 countries trust Refrens for their operations.

Data security and privacy are our top priorities. That’s why businesses worldwide rely on Refrens for their daily operations. For more details, visit our privacy policy.

Refrens offers 99% uptime, ensuring smooth and uninterrupted business operations.

Yes, Refrens is designed to grow with your business, adapting to your evolving needs. Our cloud-based infrastructure provides seamless scalability, regularly updated with new features to support your expansion without compromising performance.

Company

Products

- Cloud Accounting Software

- |

- AI Accounting Agent

- |

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

- Inventory Management Software

Refrens for CAs

Made with and in Bengaluru.

Refrens Internet Pvt. Ltd. | All Rights Reserved

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.