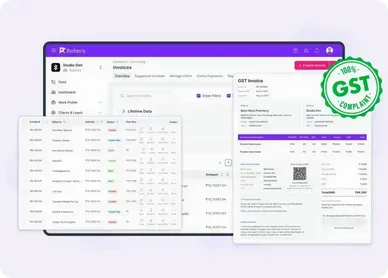

Top professional service providers use Refrens billing software

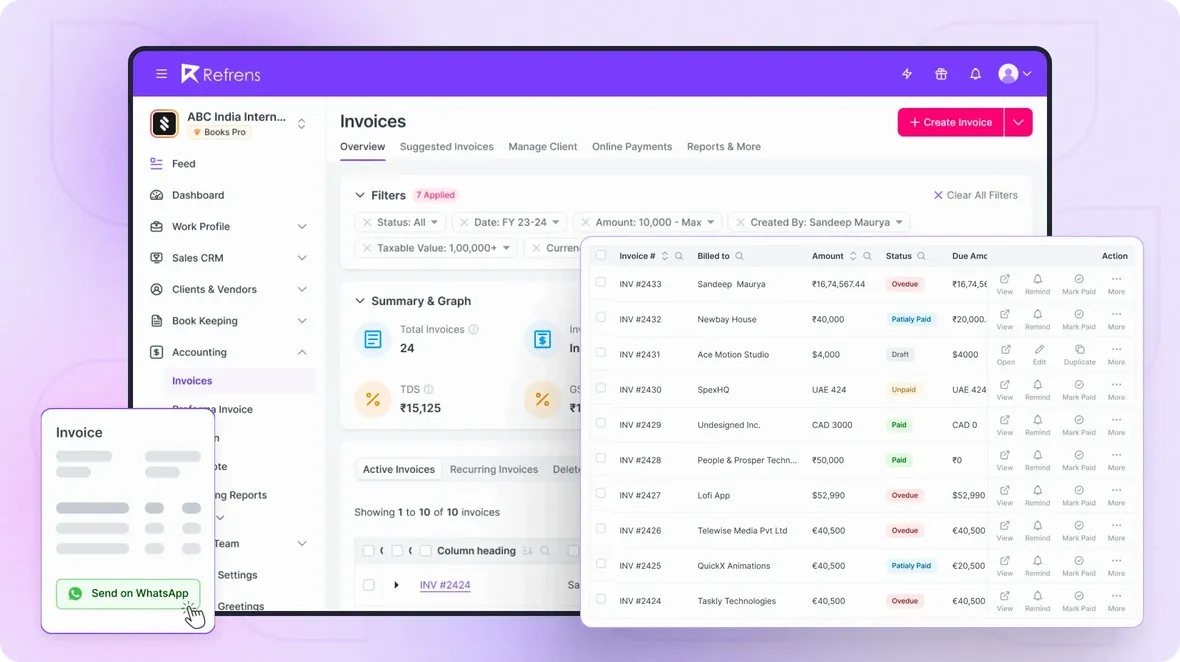

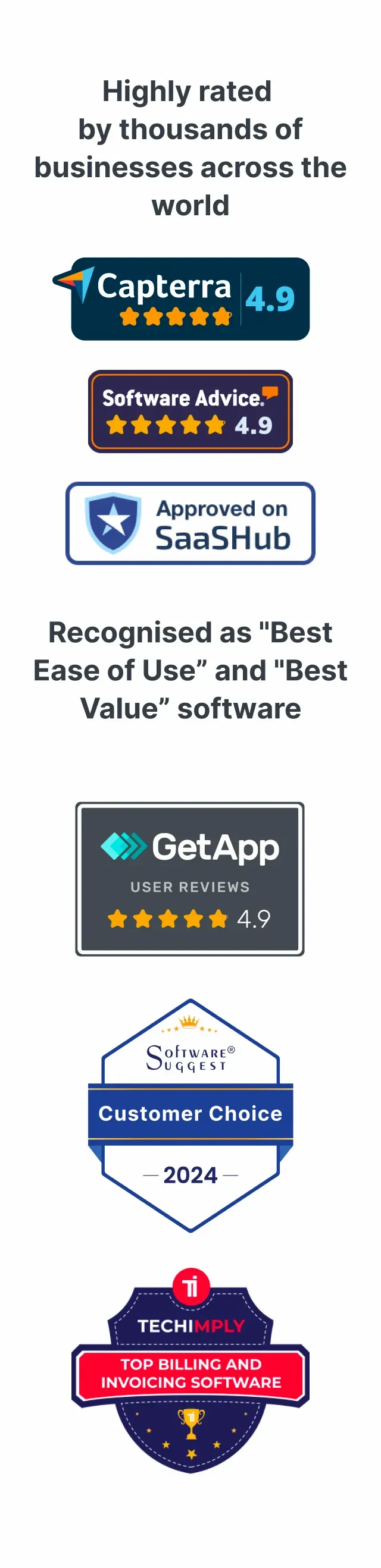

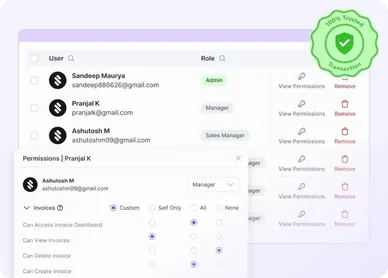

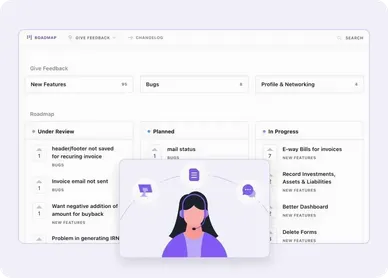

Invoicing features for your professional services business

Why do people love us 💬

Streamline invoicing for your professional services business with our one-stop solution

The smartest investors in the room are backing our vision.

People who understand money, match-making and all things Internet.

Explore More

Frequently Asked Questions (FAQ)

Sign up on Refrens > Click "Create New Invoice" on your Refrens dashboard > Update billing, and shipping, and customize the header > Tailor the invoice to your product or service (columns) > Finalize by adding payment details and customizing the look with templates and colors.

That's it! Creating invoices for your professional services business is super easy with Refrens.

A professional invoice should include clear identification of the sender and recipient, a detailed description of goods/services, pricing, payment terms, and a unique invoice number for tracking purposes. Additionally, it should adhere to professional formatting standards, such as using a clean layout and legible fonts.

You can get started with Refrens for free. Refrens offers a free trial to help you explore all the premium features and see if it fits your business needs.

The cost of billing software varies depending on the software you use and the features you require. Refrens provides value-based pricing depending on your use case. For more details, visit our pricing page OR reach out to us at care@refrens.com.

A service invoice contains sender and recipient details, including an invoice number and issuance date. It outlines services provided with quantities, rates, and the total amount due. Payment terms, tax information, and any relevant terms and conditions are also included for clarity and transparency.

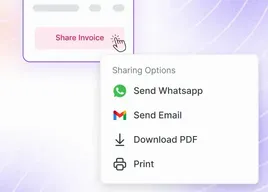

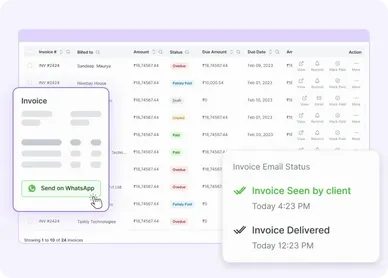

With Refrens, effortlessly send your invoices via WhatsApp, email, or link with just a click.

- Cloud Accounting Software

- |

- AI Accounting Agent

- |

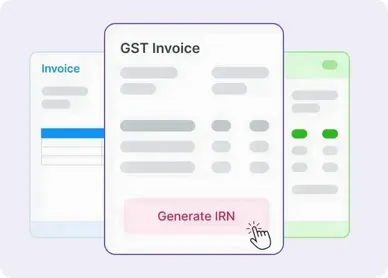

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

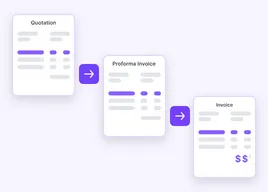

- Quotation Software

- |

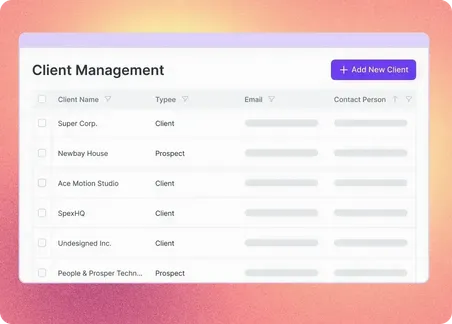

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

- Inventory Management Software