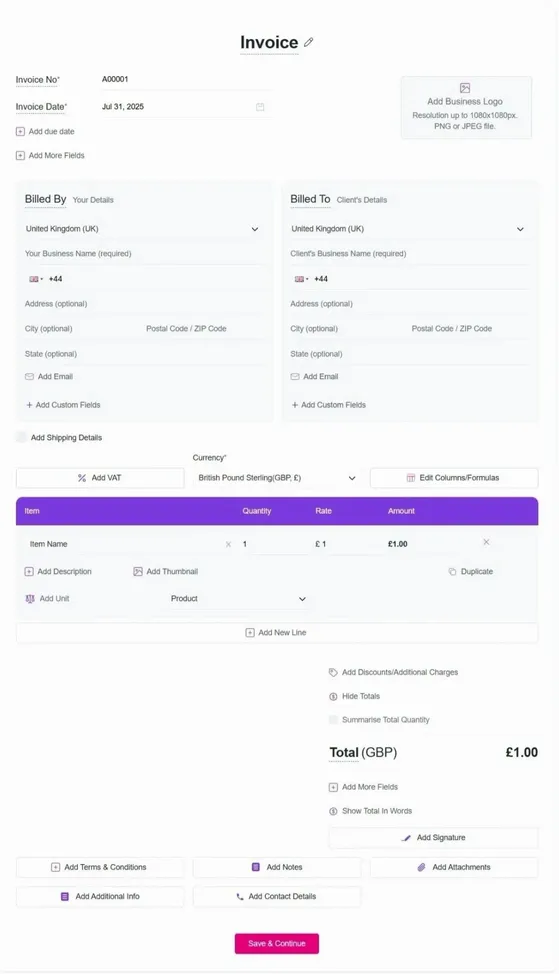

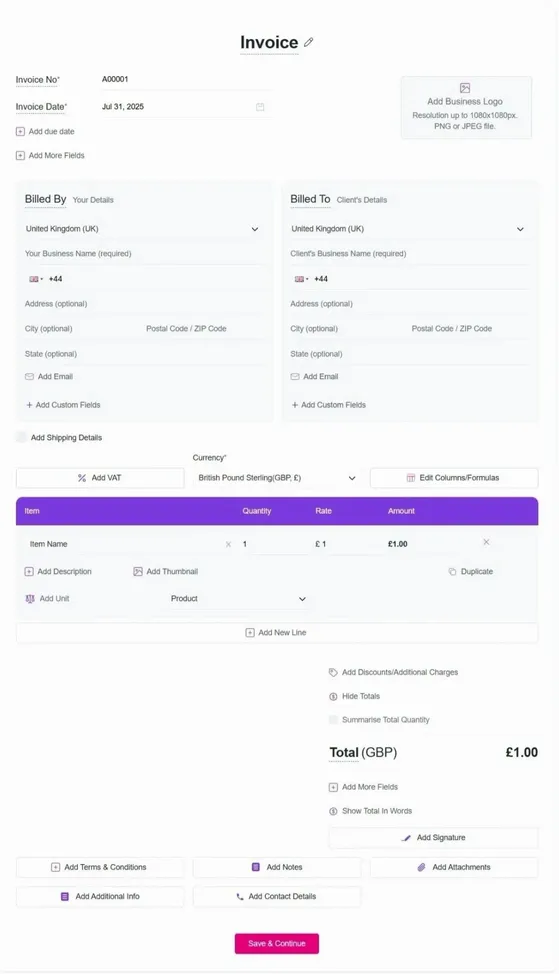

Create Invoice – Fast, Free, and Professional

Yes, Refrens offers a free invoice generator with no hidden costs.

Yes, with our invoice generator free, you can generate invoice online and download it as PDF.

Refrens is among the best free invoice generator tools with quick setup and UK compliance.

Yes, our invoice generator online lets you email invoices in one click.

Refrens' free invoice generator gives clean, ad-free invoices with your logo.

Yes, you need to sign up first to use our invoice maker. Signing up is quick and easy, and Refrens does not ask for any credit card details.

Yes, our invoice generator is built to match UK invoice standards.

Yes, our free online invoice generator supports VAT, perfect for UK businesses.

Absolutely. Our online invoice generator is secure and ISO/IEC 27001/2022 compliant.