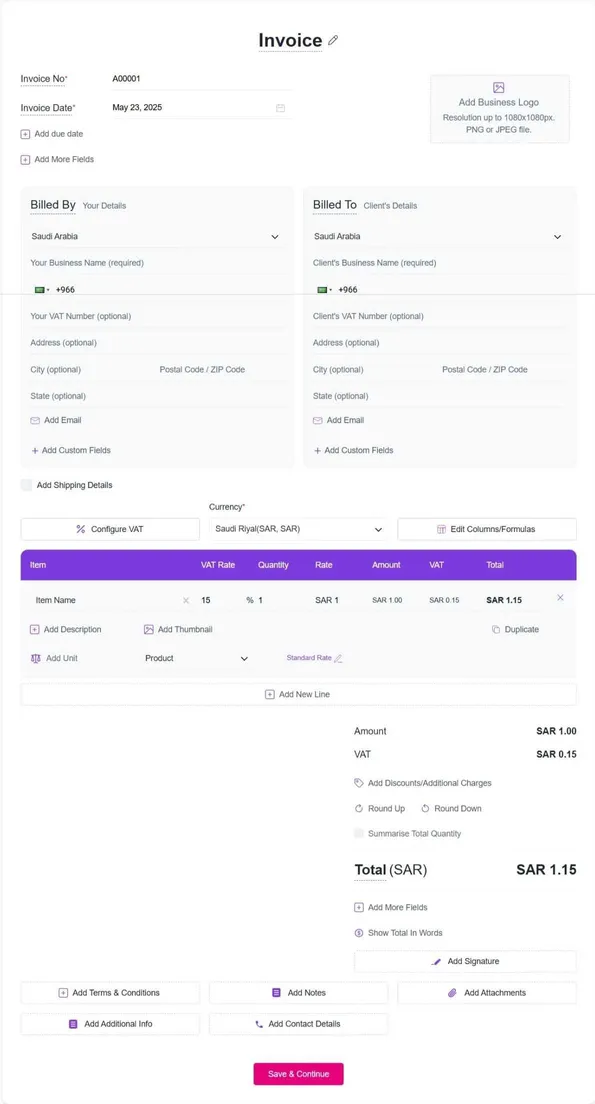

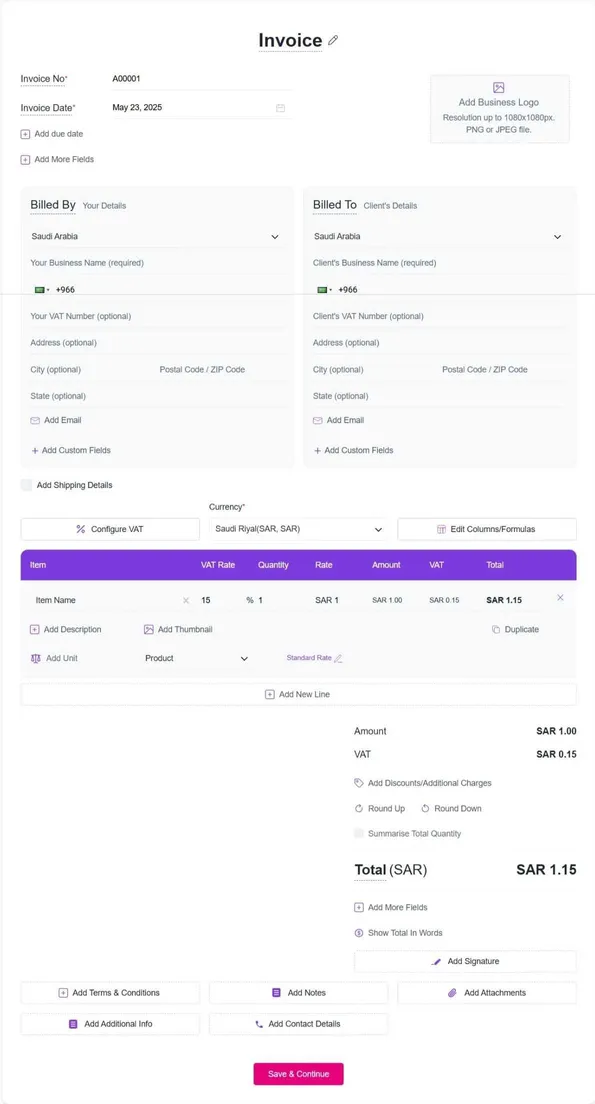

Invoice Generator (Add invoice details and download it in PDF format.)

An invoice is a business financial document that a seller gives to a buyer. It acts like a bill. The invoice shows what products or services the seller gave, how much each one cost, and the total money the buyer needs to pay. The invoice is important because it asks the buyer for money and keeps a record of the transaction for both the buyer and the seller.

A VAT invoice is a financial document issued by the seller to record the supply of goods or services and request payment from the buyer. In Saudi Arabia, every VAT invoice must include the title Tax Invoice, details of the seller and buyer including their VAT/TRN numbers, a unique invoice number, and the invoice date. It should also list the product or service name, quantity, rate, total amount, and the applicable tax rate, usually 15%. Using an invoice generator ensures that all these details are added automatically, creating a professional digital invoice that meets Zatca and Saudi VAT compliance requirements.

A Zatca invoice is a type of e-invoice mandated by the Zakat, Tax and Customs Authority (ZATCA) in Saudi Arabia for businesses above the VAT turnover exceeding SAR 750,000 in the past three years (Wave 23 under phase 2). It is a digital invoice that includes a QR Code and complies with all Zatca regulations. Even small and medium enterprises crossing this threshold must comply with Einvoicing rules.

A TRN (Tax Registration Number) is a unique identifier issued by the Saudi Arabian government to businesses for VAT purposes. Businesses with an annual turnover exceeding SAR 375,000 must register for a TRN. Companies with lower turnover can register voluntarily if their annual revenue exceeds SAR 187,500. A TRN is essential for issuing compliant Saudi VAT invoices.

The place of supply in a VAT invoice specifies the location where goods or services are considered supplied for VAT purposes. In Saudi Arabia, this determines the applicable VAT rate and compliance requirements. It usually reflects the location of the buyer or where the service is delivered. Including the place of supply correctly on a Saudi VAT invoice is essential for accurate tax calculation and reporting.

A self-billed invoice is issued by the buyer instead of the seller, with both parties’ agreement. It records the supply of goods or services and must include standard VAT invoice details such as invoice number, date, seller and buyer information, product or service description, quantity, rate, and tax amount. Example: Suppose a Saudi company, ABC Trading, orders cleaning services from a supplier, CleanCo. Instead of CleanCo sending the invoice, ABC Trading generates the invoice, lists CleanCo as the seller, includes the service details, applies VAT, and sends it to CleanCo for acknowledgment. This self-billed invoice ensures compliance and proper VAT reporting.

An invoice generator is an online tool that helps businesses create professional invoices quickly and easily. It removes the need for manual preparation in spreadsheets or word processors. The generator allows you to customize invoice templates and instantly produce a polished document ready for sending.

Refrens invoice generator allows you to create invoices for free without taking much time. Head over to Refrens invoice generator and start creating invoices using pre-formatted invoice templates. You can add your logo, brand colors, and multiple invoice templates and use many more such features to keep your brand consistent.

Yes, you can create invoice in Arabic for free. You can customize your invoices to include Arabic text, making it easier to comply with local business practices and communicate clearly with Arabic-speaking clients.

Yes, Refrens account is necessary to use this invoice generator. While creating an account, you can access all the invoices in one place and also make the invoice creation process easy.

Yes, you can create weekly, monthly, and yearly recurring invoices on Refrens. You can also customize the dates as per your requirements.

Yes. Your data is stored securely with encryption and cloud protection. We are ISO/IEC 27001:2022 certified. Your data stays private and is safely stored on the cloud.