Why You Need Automated Payment Reminders in Your Invoicing Software?

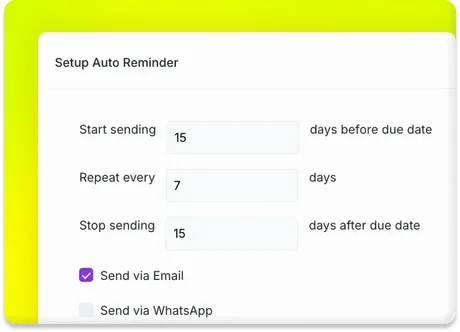

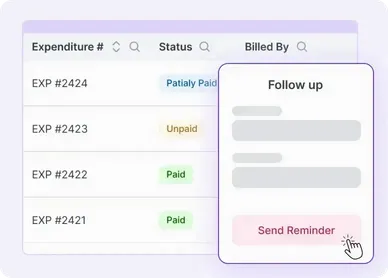

Set automated payment reminders for due and overdue invoices.

Choose when reminders should be sent, before the due date or after it passes.

Keep your payment cycle consistent without manual effort.

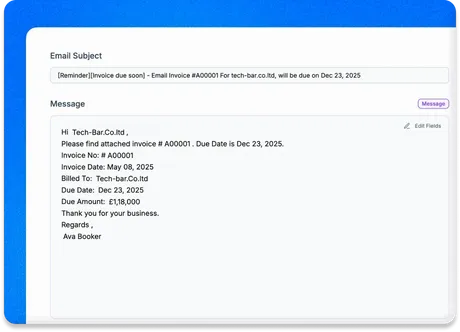

Create personalised messages with your branding, instructions, and notes.

Include client name, invoice number, due date, and payment details.

Preview each message to ensure it matches your tone and looks correct.

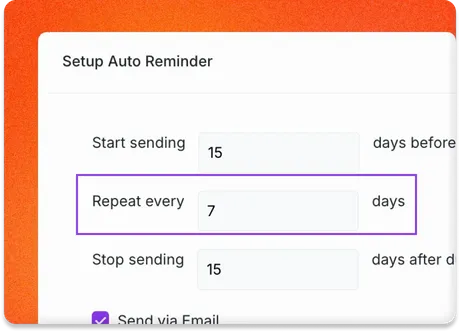

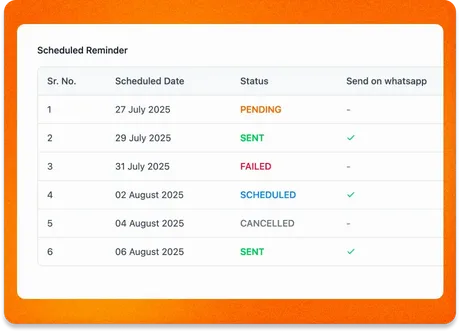

Schedule multiple reminders at different times.

For example: 7 days before due date, on the due date, and 7 days after.

Handle overdue invoice reminders effectively and reduce payment delays.

Adjust reminders based on client history or preferences.

Frequent late payers can receive earlier and more frequent alerts.

Reliable clients receive fewer, more polite follow-ups.

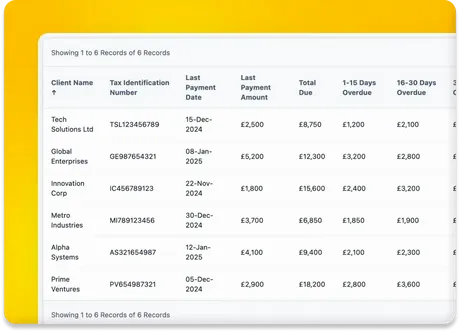

View the status of sent reminders from your invoicing dashboard.

See which reminders were delivered, opened, or converted to payments.

Understand how your invoice reminder strategy is working.

Reminders are linked directly to the invoice due date.

No need to manage reminders separately.

Avoid missed payments with timely, system-driven alerts.

Benefits of Using Invoicing Software with Payment Reminder

Send reminders to reduce overdue invoices.

Get paid faster and improve cash flow.

Use the cash to reinvest or pay expenses on time.

Automate reminders to save time and effort.

Avoid manual tracking of due dates and follow-ups.

Focus on important tasks like client work and operations.

• Assign unique serial numbers to each product unit.

• Track product movement, ownership, and service history.

• Ensure accurate warranty and after-sales support

Refrens may provide analytics on the effectiveness of invoice reminders, including:

Open rates of reminder emails.

Response rates (how many reminders resulted in payments)

Trends in client payment behaviour over time

Businesses can segment clients based on their payment patterns and customise reminders accordingly.

Clients who frequently delay payments may receive earlier or more frequent prompts

Long-standing clients with good history may receive lighter, less frequent reminders

Pricing of Invoicing Software

Only Pay When You Need Premium Features.

Frequently Asked Questions (FAQ)

You can view the reminder activity log within your Refrens account. It shows the status of each automated invoice reminder, including timestamps, delivery channel (email or WhatsApp), and recipient details. This helps ensure your payment follow-ups are reaching clients as intended.

Yes. Refrens allows you to customise invoice reminder intervals based on each client’s behaviour or payment history. This flexibility helps you create a more strategic, client-specific payment follow-up process, reducing the likelihood of missed payments.

First, confirm that the client's email address or WhatsApp number is correct in your records. You can manually resend the unpaid invoice reminder from your dashboard if needed. Also check your reminder log to confirm whether it was successfully delivered.

Yes, Refrens supports automated payment reminders for recurring invoices. Once configured, clients receive timely alerts for each billing cycle, helping you maintain regular invoice collection without extra effort.

Yes, you can configure reminders for partial payments, ensuring that clients are notified about any remaining balances due.

Essential tools offered by Refrens

- Accounting Software

- |

- Invoicing Software

- |

- Invoicing Software with Roles & Permissions

- |

- Invoicing Software with Inventory Management

- |

- Invoicing Software with Recurring Billing

- |

- Invoicing Software with Automated Payment Reminders

- |

- Invoice Generator

- |

- Quotation Generator

- |

- Proforma Invoice Templates

- |

- Purchase Order Templates

- |

- Invoice Template

- |

- Quote Template

- |

- Delivery Note Template

- |

- Construction Quote Template

- |

- Sole Trader Invoice Template

- |

- Electrical Quote Template

- |

- Consulting Invoice Template

- |

- IT Contractor Invoice Template

- |

- Hours Worked Invoice Template