Customise & Download Your Sole Trader Invoice Template UK

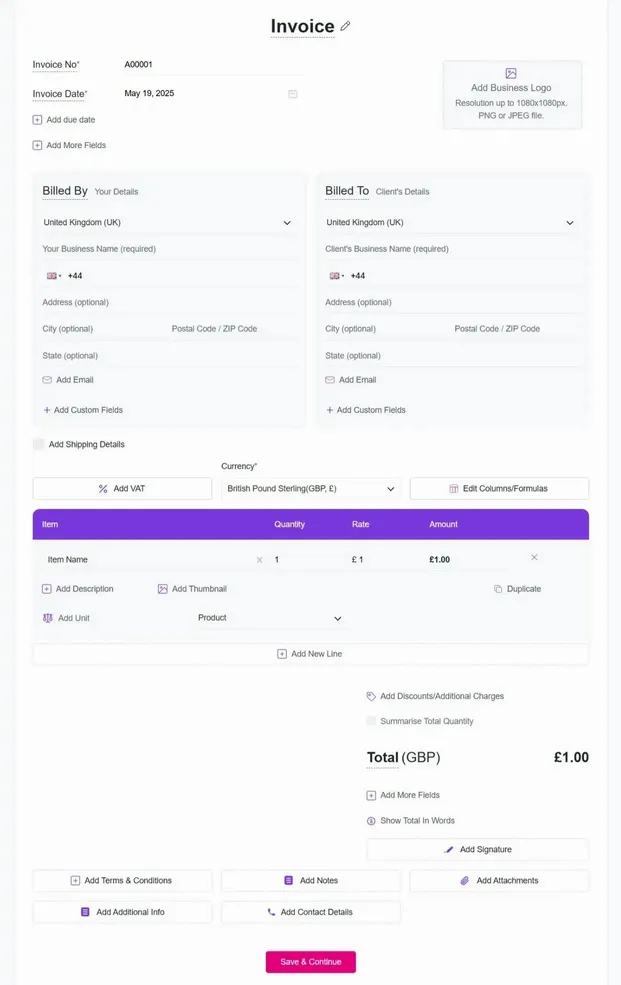

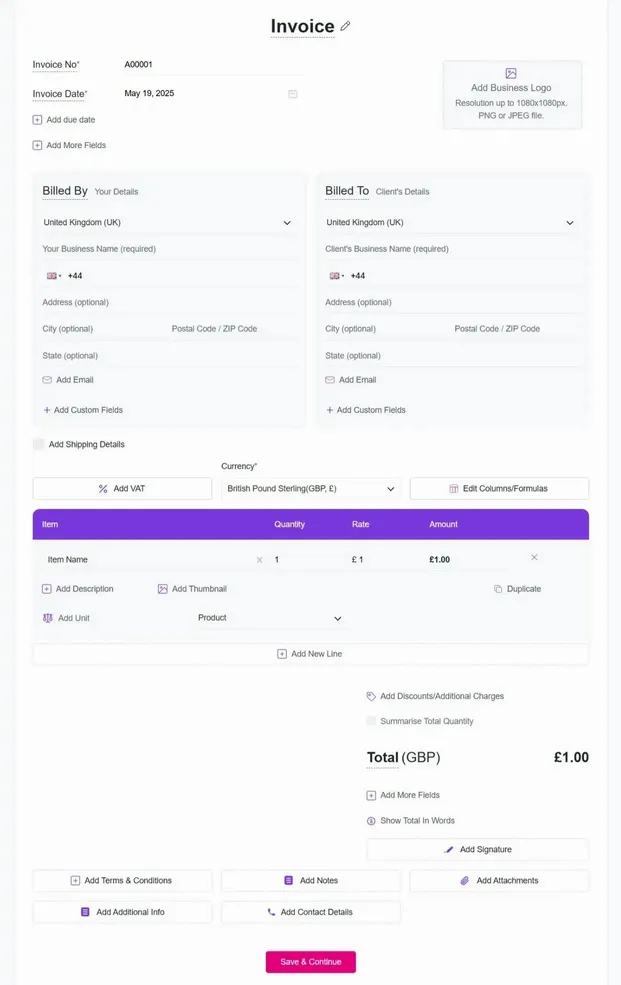

To invoice as a sole trader, simply fill in Refrens’ sole trader invoice UK with your business details, client information, services or products, and total amount due. Once done, send it to your client for easy, professional invoicing.

Refrens provides a sample sole trader invoice template that you can use as a reference. Our template is customisable, allowing you to modify the fields to fit your specific business needs while keeping everything professional.

A sole trader invoice template should include your business name, client details, a breakdown of services or products, the amount due, and payment terms. Refrens’ sole trader invoice ensures that every essential detail is included, making your invoicing process quick and easy.

Yes, you can use the sole trader invoice template for all clients. Simply update client details and service information for each invoice. Refrens makes it easy to create a personalized invoice each time without the hassle of designing one from scratch.

Yes. You can add your project details, like home repairs, design work, consulting, or any service you offer. Refrens lets you customise the invoice fully and make it fit your business.

No. You can add your logo. Your client will only see your business name, logo, and invoice details. There is no Refrens branding on the invoice.

Yes. Refrens also has a mobile app, so you don’t need a computer. You can create and send invoices from your phone anytime, anywhere.

Yes. Refrens is ISO-certified and uses secure cloud storage to protect your data. Only you can access your account and invoices, ensuring full privacy and safety.