Integrated Software Suite

Simplify your daily operations with our cloud-based, fully inter-connected software solutions.

What Customers Say About Refrens

Refrens- Powers Your Business Beyond Billing

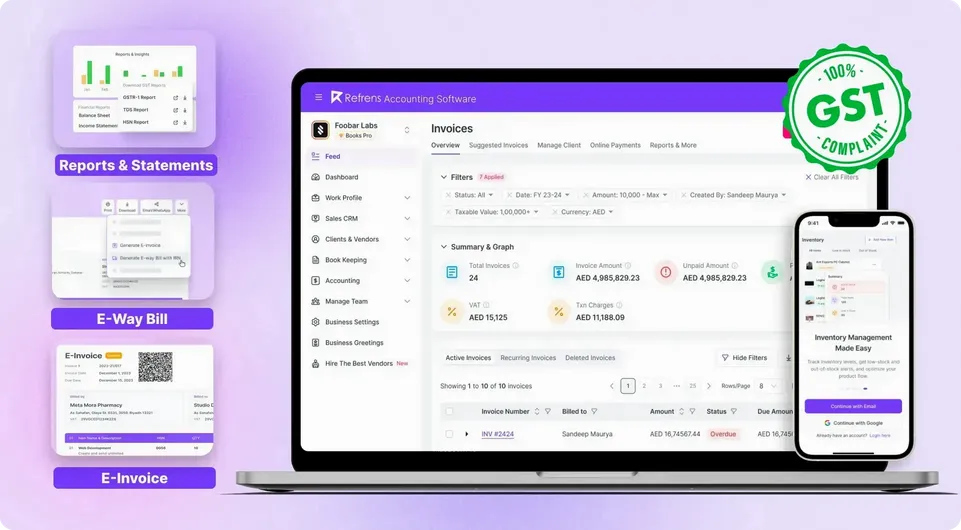

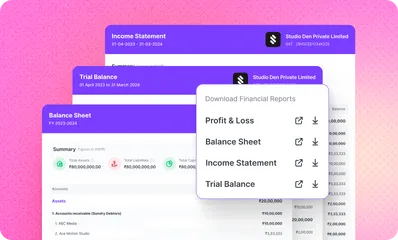

Refrens gives you access to detailed financial reporting, including GSTR-2B matching, tag-wise P&L, month-to-month P&L comparisons, cash flow insights, audit trail, ledger bifurcations, and forex gain/loss calculations. It's built for founders and finance teams to stay audit-ready. MyBillBook provides essential reports like P&L and balance sheet, but lacks reconciliation tools, audit transparency, and advanced business intelligence

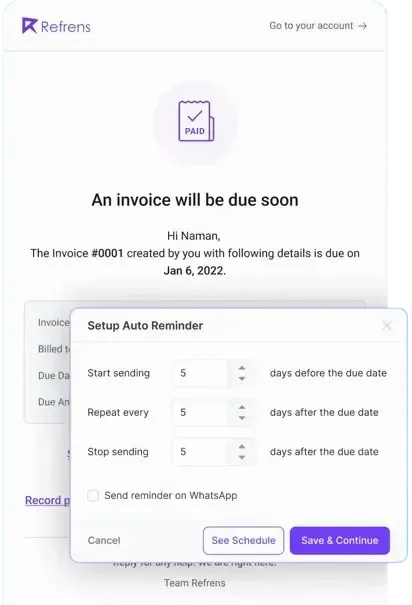

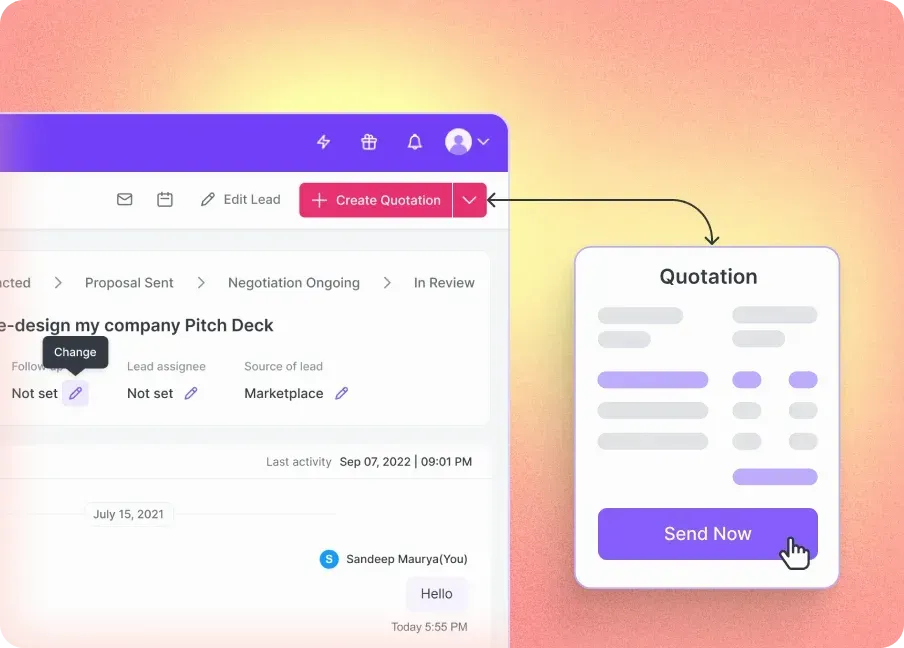

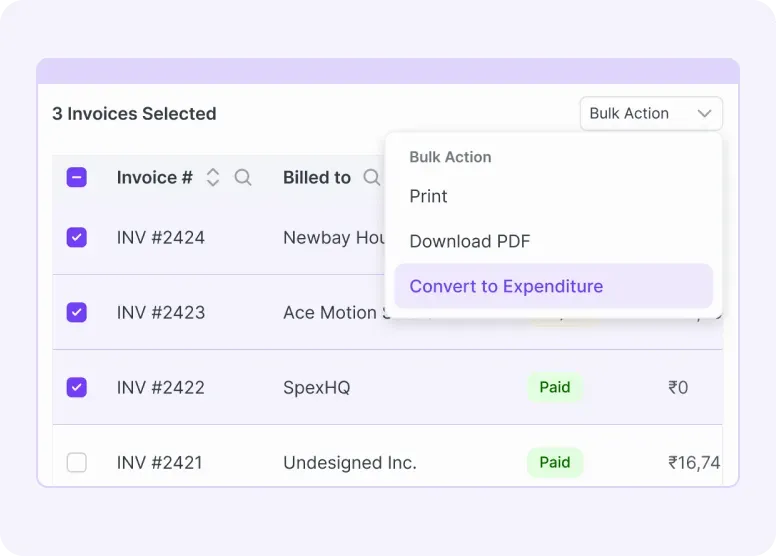

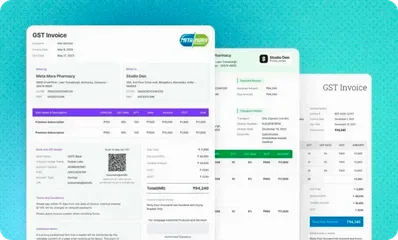

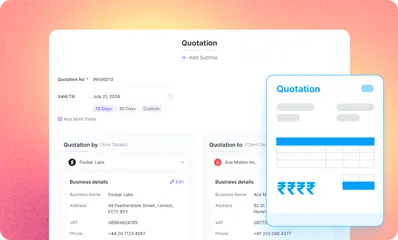

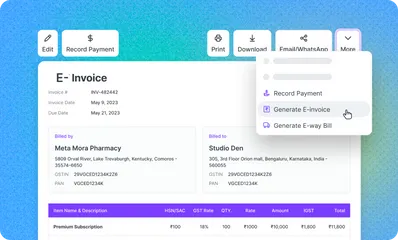

Refrens offers professional quotations, multi-format GST invoices, export invoices, and auto-payment reminders—along with delivery challans, debit/credit notes, and recurring billing. It also allows complete customization and branding, even letting your CA or teammates collaborate in real-time. MyBillBook supports basic GST invoicing and quotations, but lacks depth in export support, document variety, and collaboration flexibility.

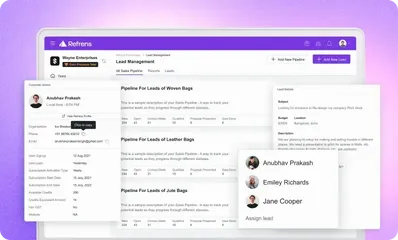

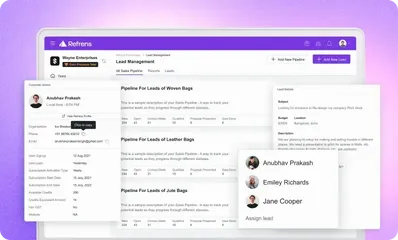

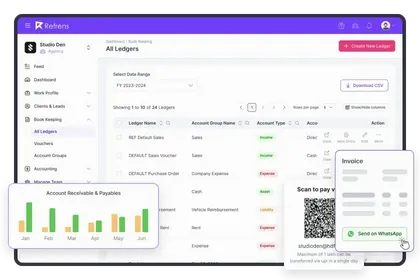

Refrens comes with a built-in CRM, helping you manage your client pipeline, add deal stages, and follow up via WhatsApp or email with smart nudges. Auto-reminders, invoice history, and follow-up analytics boost collections. MyBillBook supports basic reminders, but doesn’t provide CRM features or engagement insights, limiting its use for growing service or B2B businesses.

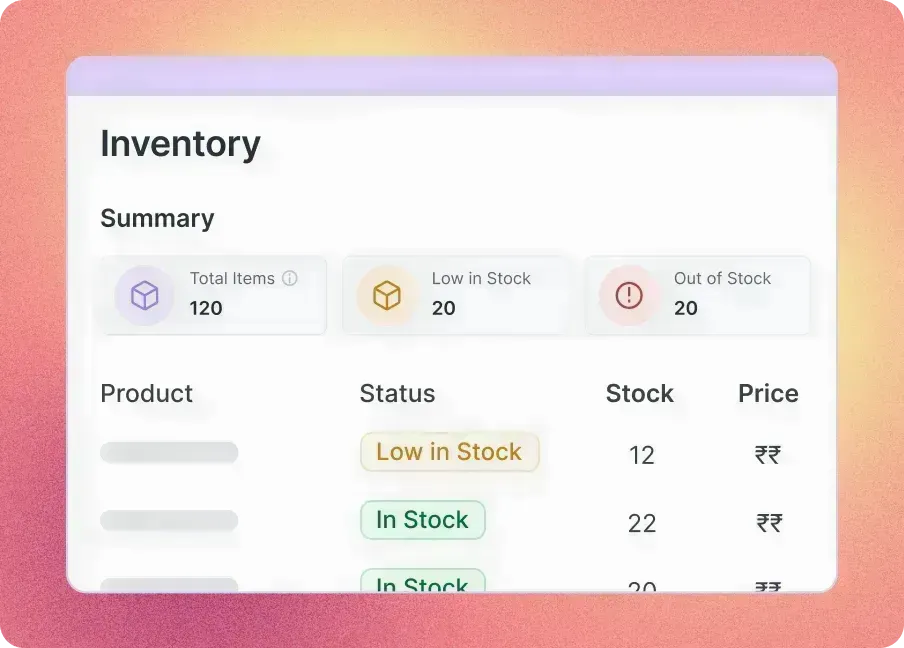

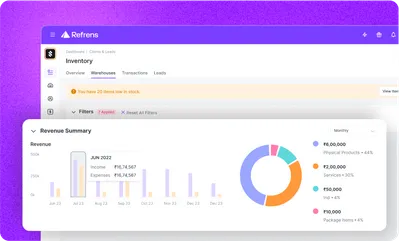

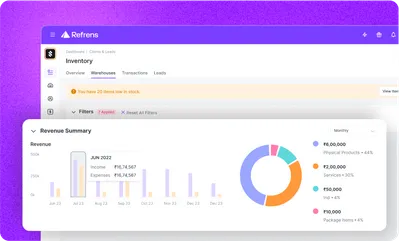

Refrens handles real-time stock tracking, batch & expiry management, multiple warehouses, barcode-ready systems, low-stock alerts, delivery challans, product bundles, and even image-based SKUs. It’s ideal for pharma, FMCG, electronics, and apparel businesses. MyBillBook supports stock and godown management, but misses out on bundled products, batch audit trails, and warehouse-level precision.

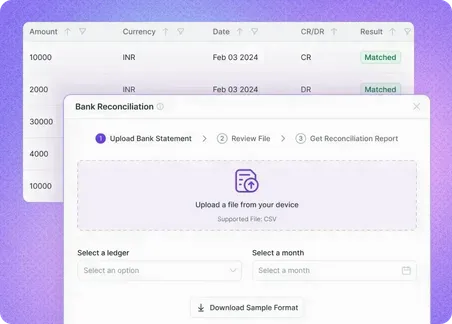

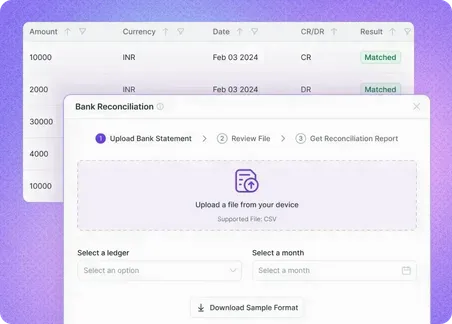

Refrens has built-in GSTR-2B reconciliation, helping you match purchase entries with actual GSTR-2B data, avoiding mismatches and unnecessary tax payments. MyBillBook lacks GSTR-2B auto-matching, which can lead to compliance errors and manual work during return filing.

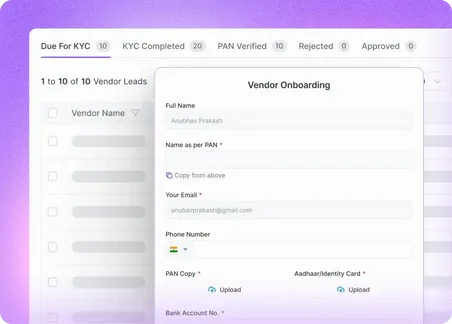

Refrens provides vendor dashboards, RFIs (Request for Information), purchase orders, vendor-wise insights, and invoice approvals—enabling full procurement tracking. Easily track payment dues, reconcile inventory, and monitor supplier performance. MyBillBook only offers purchase entries and vendor lists, lacking real procurement workflows or PO lifecycle management.

Refrens allows tag-wise P&L reporting, so you can track profitability by project, branch, client type, or cost center—essential for data-driven decisions. MyBillBook does not support custom tag-based financial views, limiting your visibility beyond total profits.

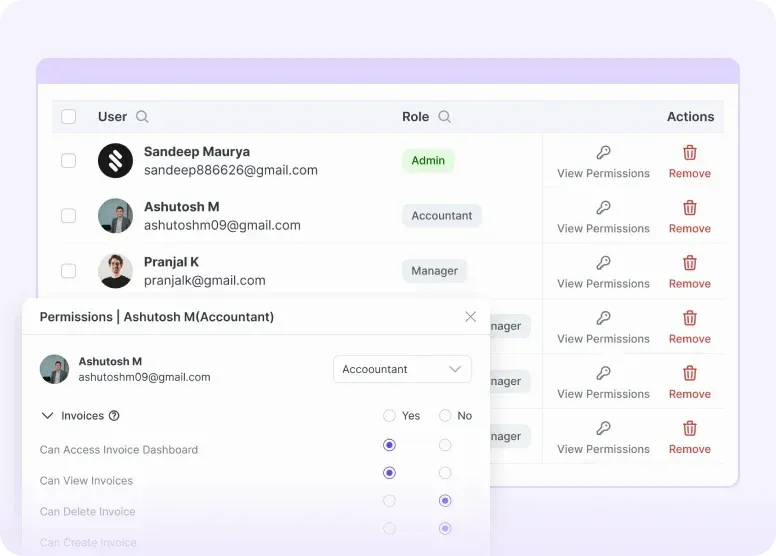

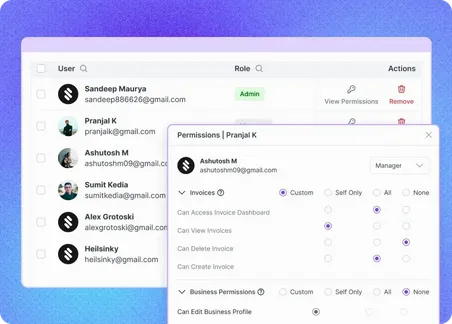

Refrens allows detailed access control—assign roles to team members, restrict views, approve changes, and log all actions via audit trails. Perfect for companies with multiple departments or sensitive data. MyBillBook supports multi-user setup, but lacks in-depth role-based permissions and full team transparency.

Refrens lets you compare P&L across months, years, or branches, making financial trends easy to spot. MyBillBook lacks direct P&L comparison, forcing users to export data manually or rely on guesswork

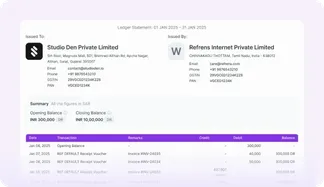

Refrens allows deeper ledger bifurcations, showing breakup of payments, dues, taxes, and adjustments per party or transaction. MyBillBook offers standard ledgers, but lacks customization in ledger views and filters.

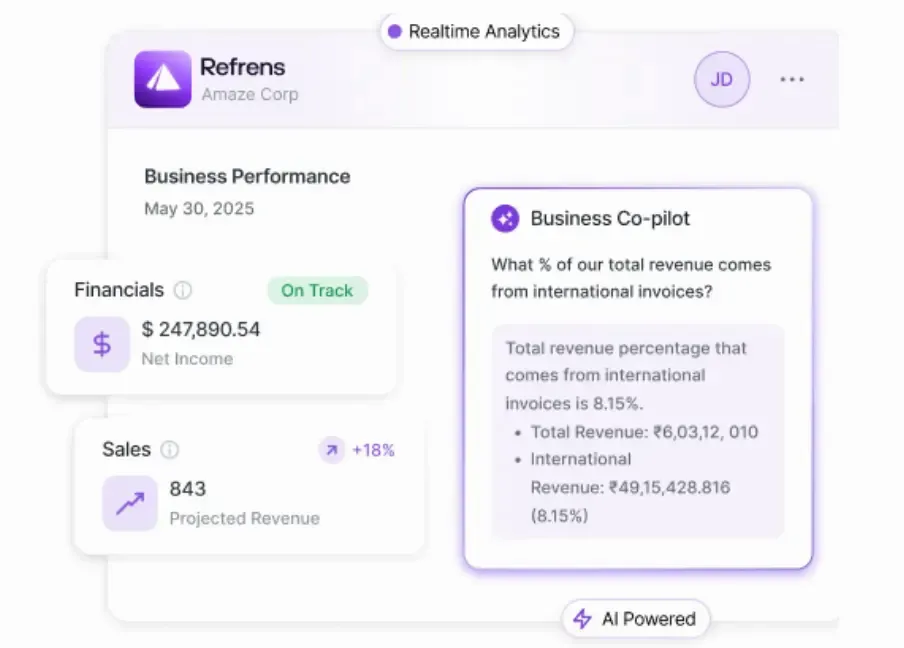

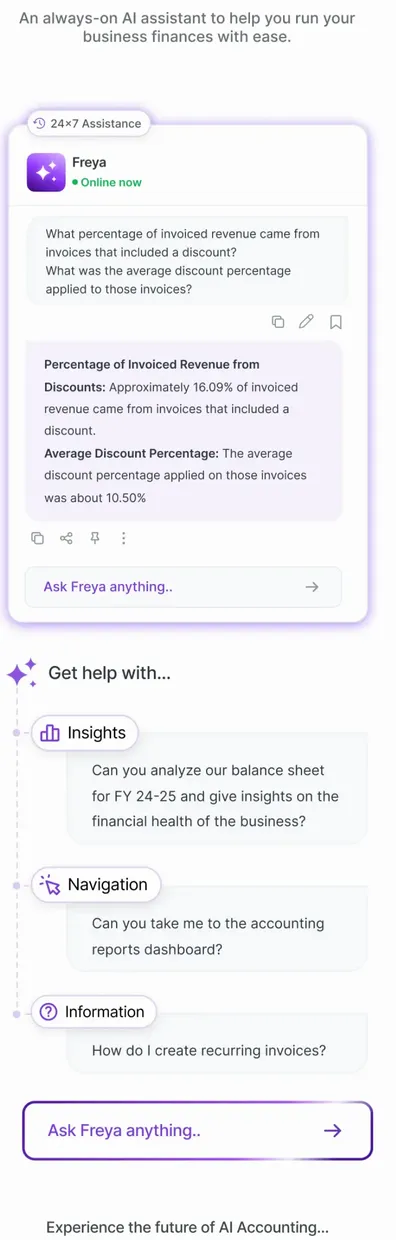

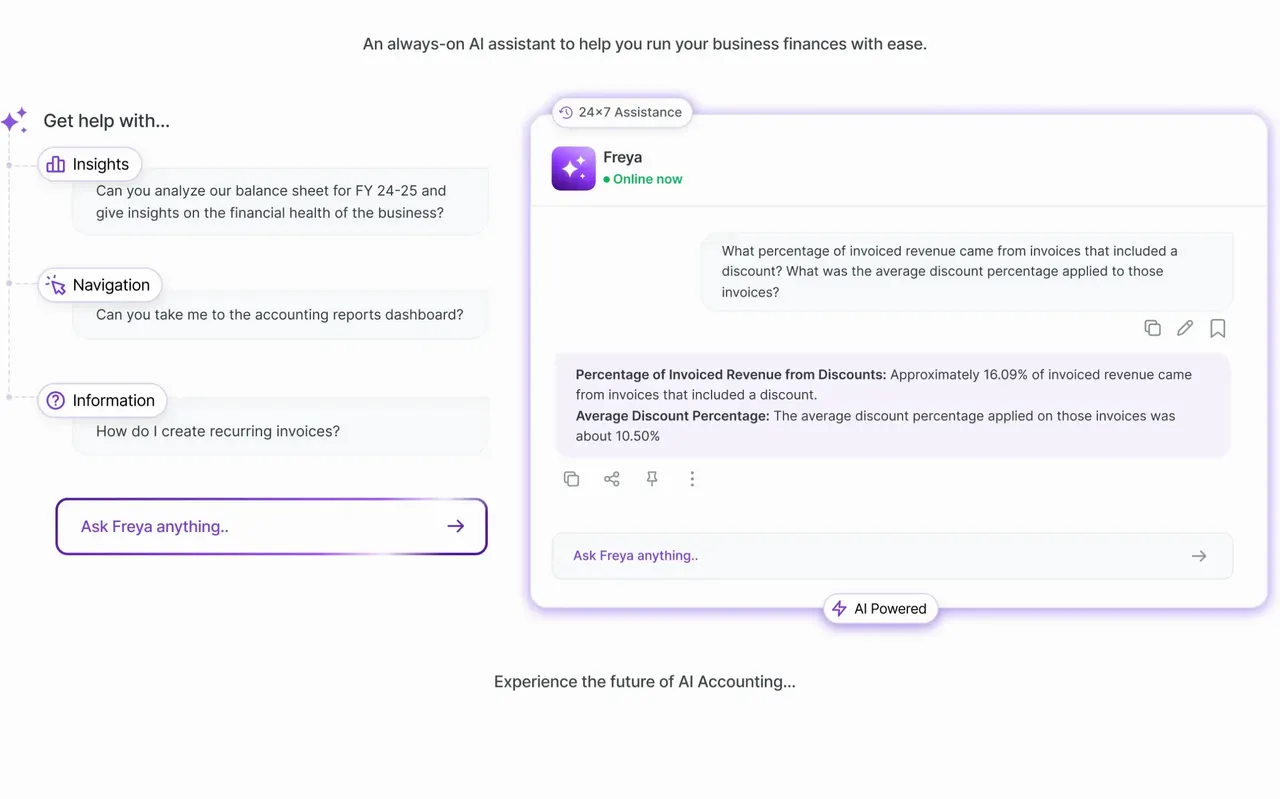

Refrens AI powers recurring invoices, follow-up scheduling, invoice autofill, report suggestions, payment behavior insights, and smart alerts. It's like having a finance assistant working 24/7. MyBillBook doesn’t have AI capabilities, so tasks like reminders and analysis must be done manually.

Refrens lets you raise export invoices with or without payment status, and add port, packaging, and currency conversion details. MyBillBook lacks export-specific formats or international invoice flows, making it less suitable for growing exporters.

Refrens automatically calculates Forex gain/loss on international payments, giving accurate revenue numbers for exporters/importers. MyBillBook doesn’t support multi-currency accounting, putting export businesses at a disadvantage.

Backed by the brightest minds in tech and business

Leaders in innovation, finance, and entrepreneurship.

Compare Refrens with Other Software Solutions

A detailed comparison to help you choose smarter.Frequently Asked Questions (FAQ)

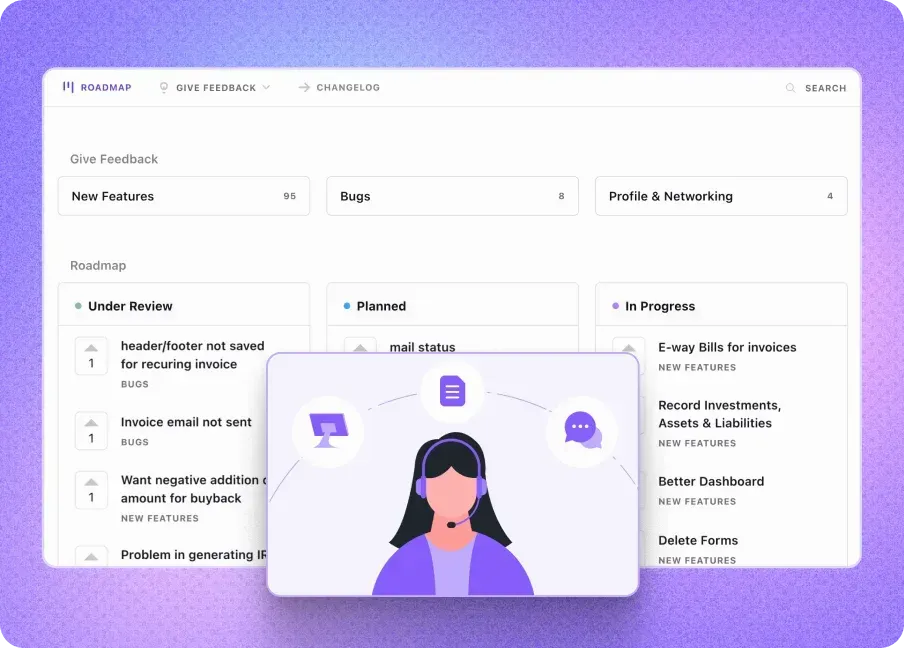

Refrens offers a complete business suite — invoicing, accounting, inventory, CRM, vendor management, and AI insights — in one platform. It’s scalable, customizable, and packed with advanced features that growing businesses need.

Yes! Whether you sell products or offer services, Refrens adapts to your workflow. You can create GST-compliant invoices, manage client relationships, track payments, and even collaborate with your CA in real time.

Refrens offers: Batch-wise inventory GSTR-2B reporting Tag-wise P&L Forex gain/loss Export invoices Role-based access control Vendor RFIs and POs CRM pipeline AI suggestions and automation MyBillBook is limited in most of these areas.

Absolutely. Refrens supports all core documents, including proforma invoices, delivery challans, quotations, credit/debit notes, and recurring invoices, making it ideal for service businesses and exporters too.

Yes. You can import all your data, like clients, products, invoices, and more, via bulk uploads.

Yes. Refrens integrates with Cashfree, Shopify, IndiaMART, and more to help you automate collections, manage leads, and streamline operations from quote to cash.

Definitely. Refrens offers detailed user permissions, approval workflows, and audit trails — perfect for businesses that need controlled access across departments or branches.

Yes. Refrens supports multi-currency invoicing, export formats, and forex gain/loss reporting. It's ideal for exporters or companies working with overseas clients

No. Refrens replaces the need for Tally by offering built-in accounting, cash flow, reconciliation, and audit features. Say goodbye to juggling tools — everything’s in one place.

Refrens offers flexible, customizable pricing based on what your business uses. No forced upgrades or bloated packages — just value that scales with your needs.

Refrens Freya is your built-in AI assistant that helps you with suggesting invoice formats, highlighting overdue payments, and providing financial insights. Think of it as your virtual accountant and business assistant — available 24/7.

- Cloud Accounting Software

- |

- AI Accounting Agent

- |

- GST Billing Software

- |

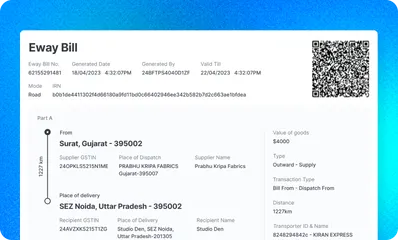

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

- Inventory Management Software