Trusted by Leading Exporters World-wide

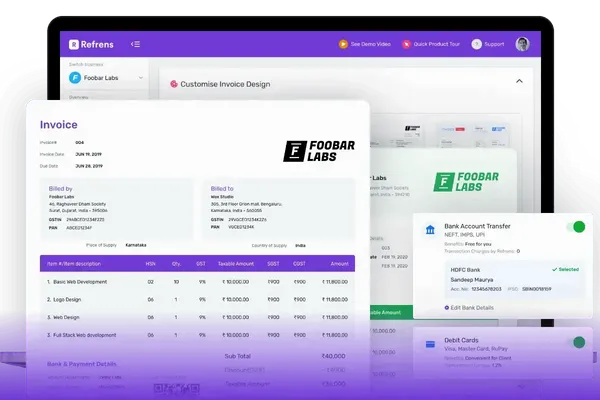

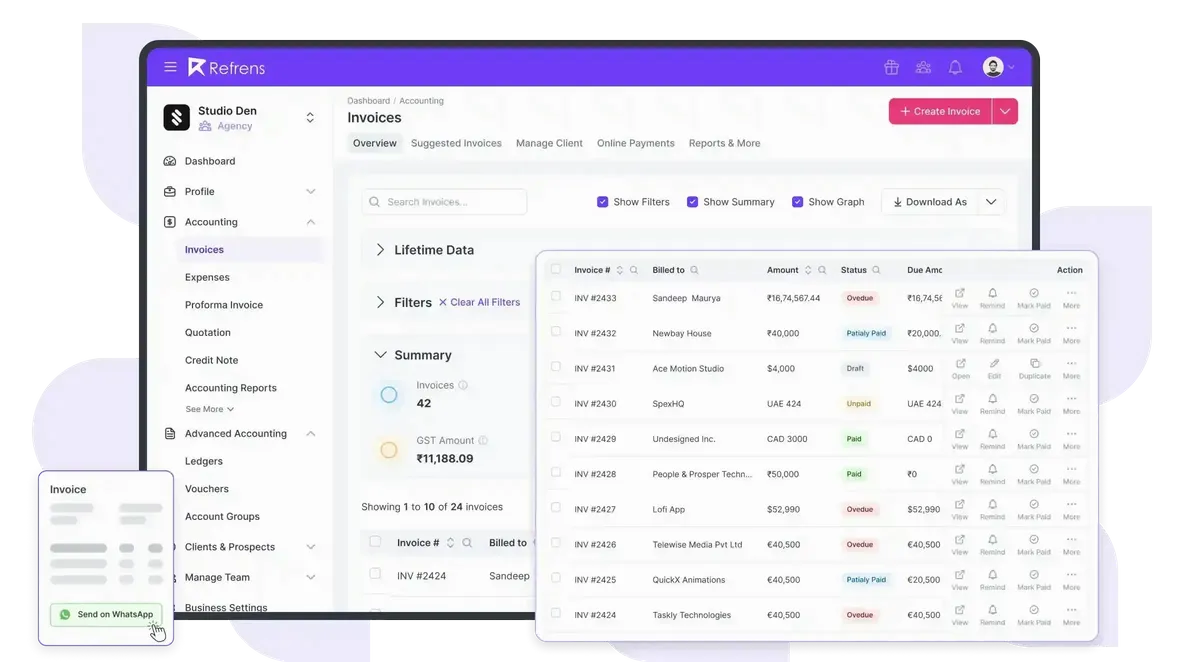

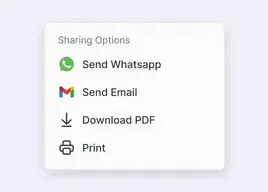

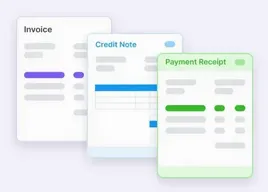

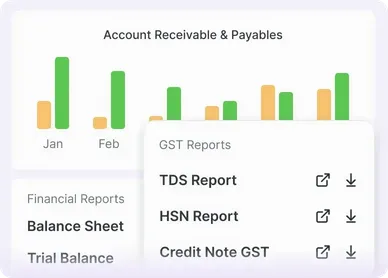

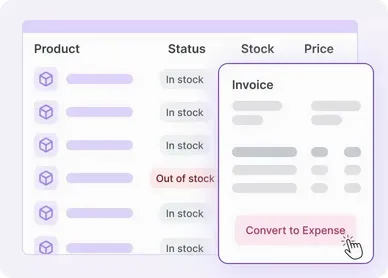

Comprehensive Commercial Invoicing Software

Everything you need in a commercial invoicing software

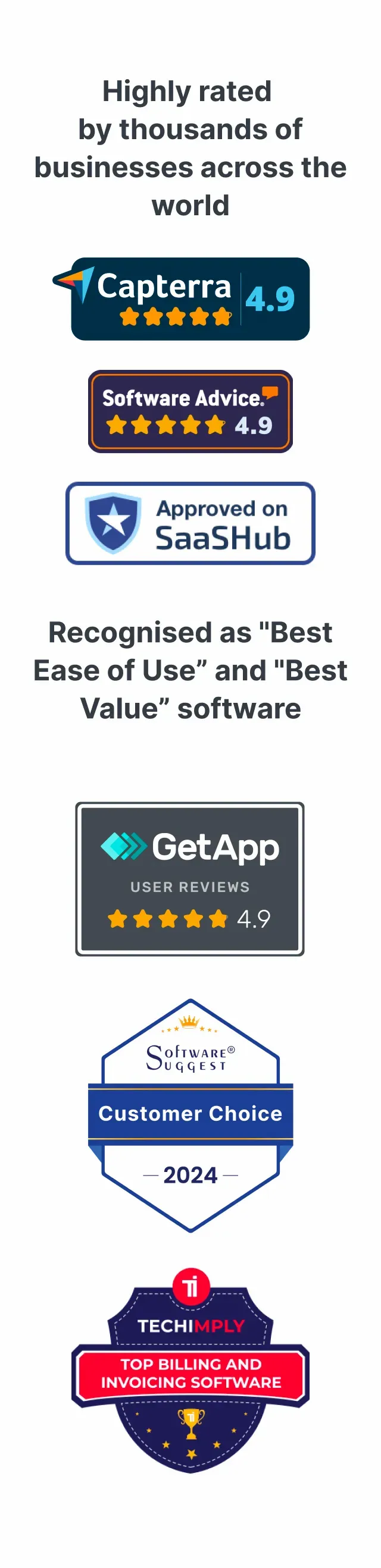

Reviews of Refrens commercial invoice software

Pricing of commercial invoicing software

Only Pay When You Need Premium Features.

The smartest investors in the room are backing our vision

People who understand money, match-making, and all things Internet.

Frequently Asked Questions (FAQ)

Yes. Your data is stored securely with encryption and cloud protection. We are ISO/IEC 27001:2022 certified. Your data stays private and is safely stored on the cloud.

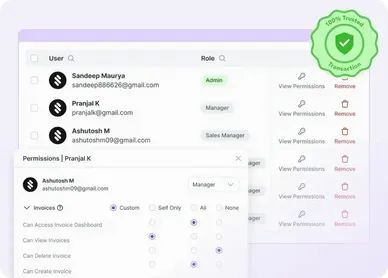

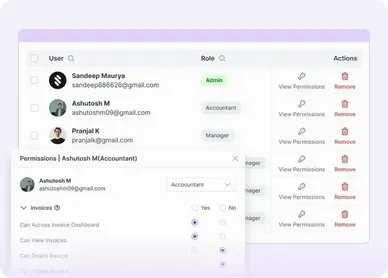

Yes, Refrens allows you to add and manage multiple users under a single business account. This feature is beneficial for businesses that require collaboration among team members or have multiple staff members handling different aspects of invoicing and project management. Each user can have designated roles and permissions, ensuring secure and efficient management of your business processes.

Refrens is always available to support our customers via email support(care@refrens.com), live chat support, and also over phone call and WhatsApp (+91 9104043036).

When you decide to leave Refrens, you have the option to download all your customer data, invoices, quotations, and other documents at any time. This ensures that you have access to your important business information even after discontinuing your use of the platform. Refrens prioritizes data security and allows users to retain their data for their records or for transitioning to another platform if needed.

- Invoice Templates

- |

- Quotation Templates

- |

- Proforma Invoice Templates

- |

- Purchase Order Templates

- |

- Freelance Invoice Templates

- |

- Quote Templates

- |

- Invoice Templates Word

- |

- Invoice Templates Excel

- |

- Printable Invoice Templates

- |

- Blank Invoice Templates

- |

- Tally Bill Format

- |

- Tax Invoice Templates

- |

- IT Service Invoice Templates

- |

- Photography Invoice Templates

- |

- Videography Invoice Templates

- |

- Social Media Invoice Templates

- |

- Digital Marketing Invoice Templates

- |

- Graphic Design Invoice Templates

- |

- Content Writing Invoice Templates

- |

- Web Development Invoice Templates

- |

- Service Invoice Templates

- |

- Rental Invoice Templates

- |

- Medical Invoice Templates

- |

- Landscaping Invoice Templates

- |

- Plumbing Invoice Templates

- |

- Cleaning Invoice Templates

- |

- Law Firm Invoice Templates

- |

- Consulting Invoice Templates

- |

- Estimate Templates

- |

- Interior Design Invoice Templates

- |

- Trucking Invoice Templates

- |

- DJ Invoice Templates

- |

- Catering Invoice Templates

- |

- Auto Repair Invoice Templates

- |

- Towing Invoice Templates

- |

- Musician Invoice Templates

- |

- Handyman Invoice Templates

- |

- Roofing Invoice Templates

- |

- Commercial Invoice Templates