Streamline your ZATCA e-Invoicing process with Refrens

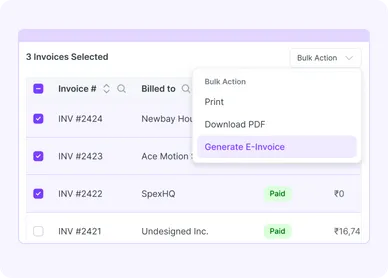

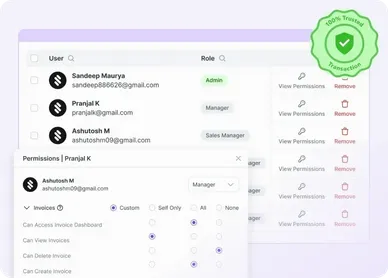

Generate e-invoices within a minute. Ensure 100% compliance. Avoid errors with automated data validations.

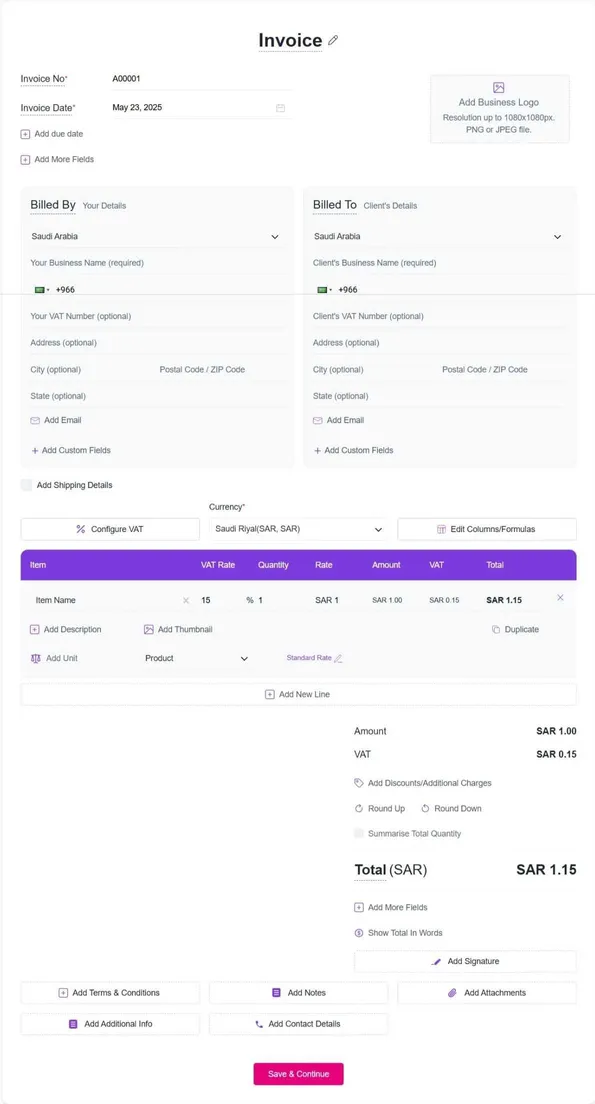

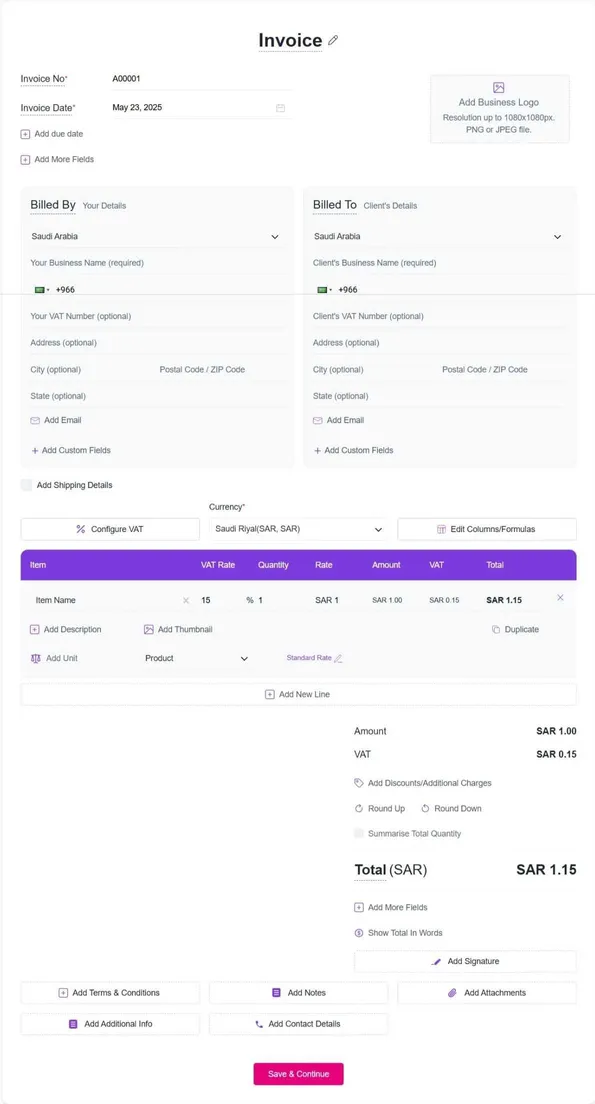

1. Create an E-InvoiceCreate completely customizable professional looking invoices in minutes with our advanced automation.

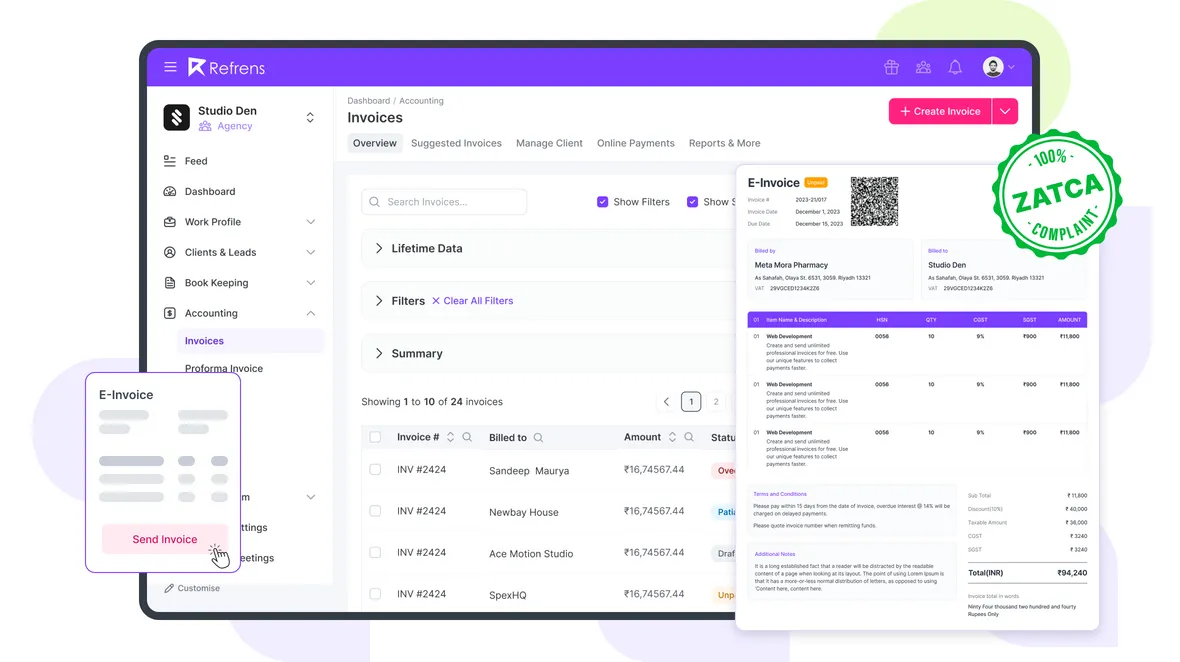

2. Get QR Code Automatically Refrens will automatically generate a QR code for you according to ZATCA guidelines.

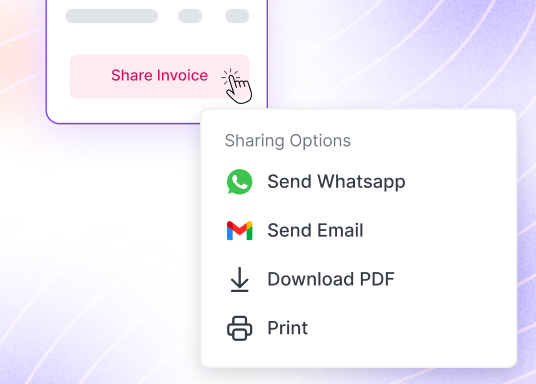

3. Share E-invoice with ClientQuickly share the e-invoice via link/print/pdf over email or WhatsApp in a few clicks.