How Malaysia Payment Gateway Works?

Lowest Fee to Collect International Payments

Most Trusted Payment Gateway for Individuals & Freelancers to Accept Payments in MalaysiaNo Hidden Charges. No amendment fees. No Forex Charges.

Why Refrens Payment Gateway?

Malaysia Payment Gateway - Accept International Payment

Now collect payment seamlessly. 100% secure & trusted. Used by 10k+ freelancers and agencies.Frequently Asked Questions (FAQ)

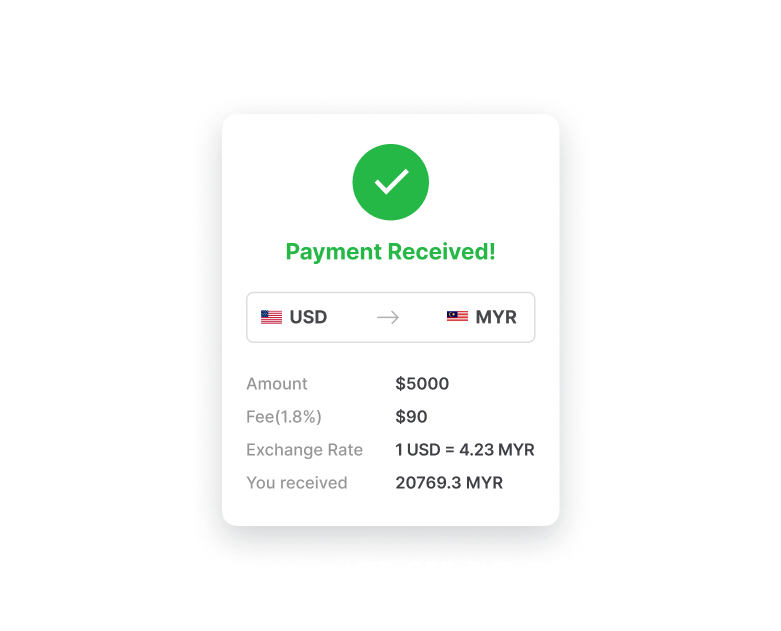

We are charging as little as possible with 0% forex charges. If your client pays via wire transfer or ACH then we charge 1.8% or less, whereas if your client pays you via debit or credit card then we charge 4% or less and all these rates are inclusive of TAX.

For international payments, it takes up to T+2 business transaction days. 95% of payments get settled in T+1 days - Which is among the shortest turnaround times in the industry.

None. There are no hidden charges. We only charge a small payment gateway fee, if you wish to collect payment online through Refrens payment gateway.

Yes. We support all popular currencies like USD, GBP, EUR, SGD and many more to accept the international payments.

Yes, Refrens' online billing software is free to use. You can create, manage, and send invoices, quotations, proforma invoices, purchase orders, and more without any cost. Refrens offers a range of features to help businesses, freelancers, and professionals streamline their invoicing and financial management processes without incurring any charges.

We initiate the process of verifying your bank account after we have received a payment for any of your invoices. Once your account is verified, we initiate the payouts automatically, subject to clearance from bank.

If you are not receiving payments through us, we do not verify the bank account.