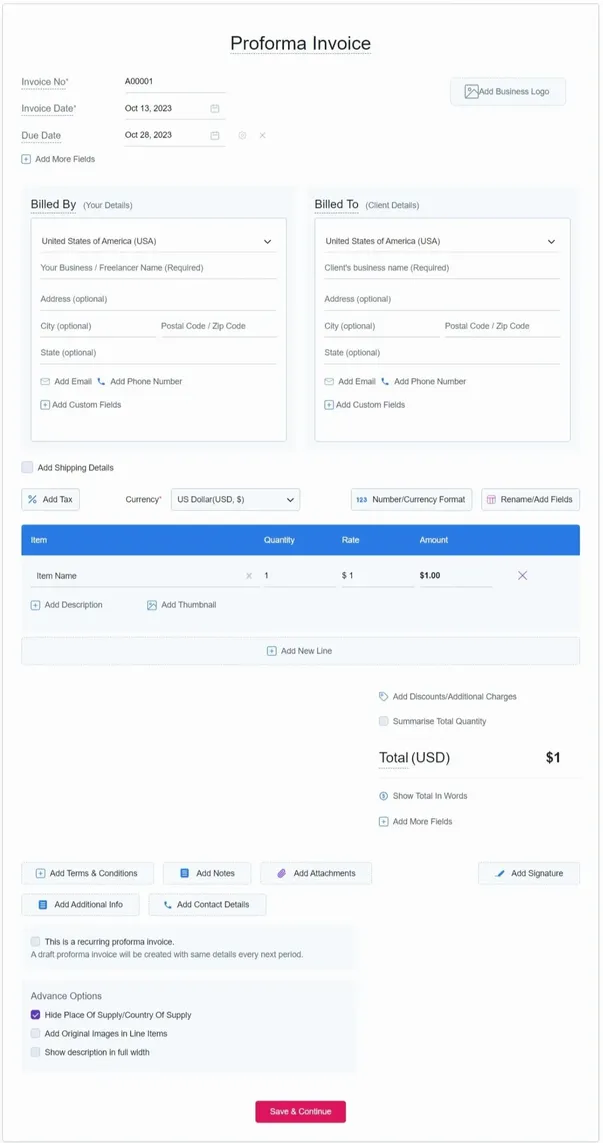

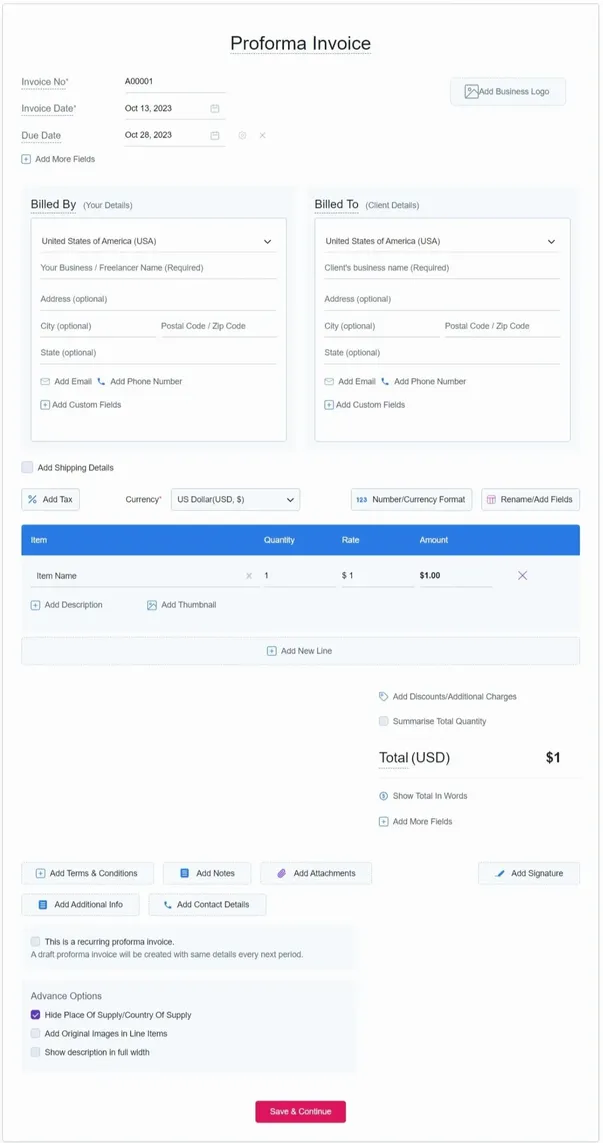

Proforma Invoice Template (Fill and download it in PDF format.)

Yes, with one click. You can generate a regular tax invoice from your proforma invoice. You can continue keeping both in the record.

Yes. There are multiple proforma invoice templates which also include letterhead. You can also change the color and font headings.

Yes. You can easily download it in PDF format or can click on the print option and can save as PDF.

Yes. You can upload your logo by clicking on the logo box from the top right corner. You can upload both .jpg and .png format for logo image.