Our Users Rate Refrens ⭐ 4.8/5 based on 11700+ Ratings

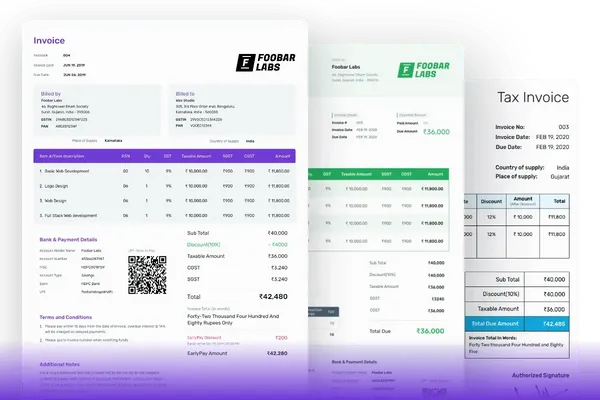

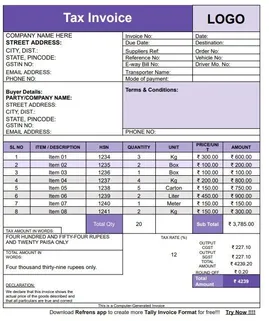

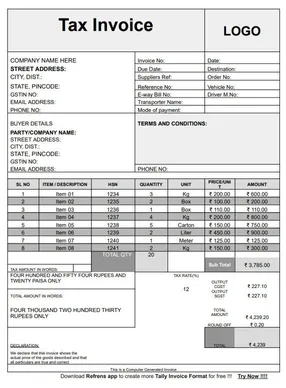

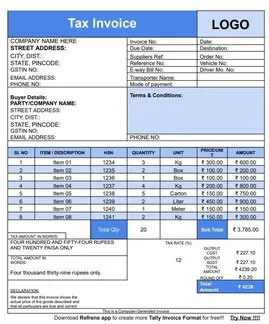

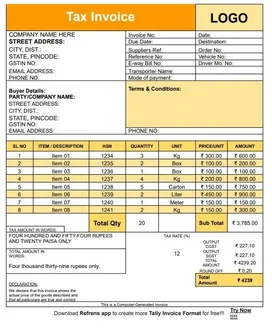

Tally Bill Format in PDF (Add invoice details and download it in PDF format.)

1

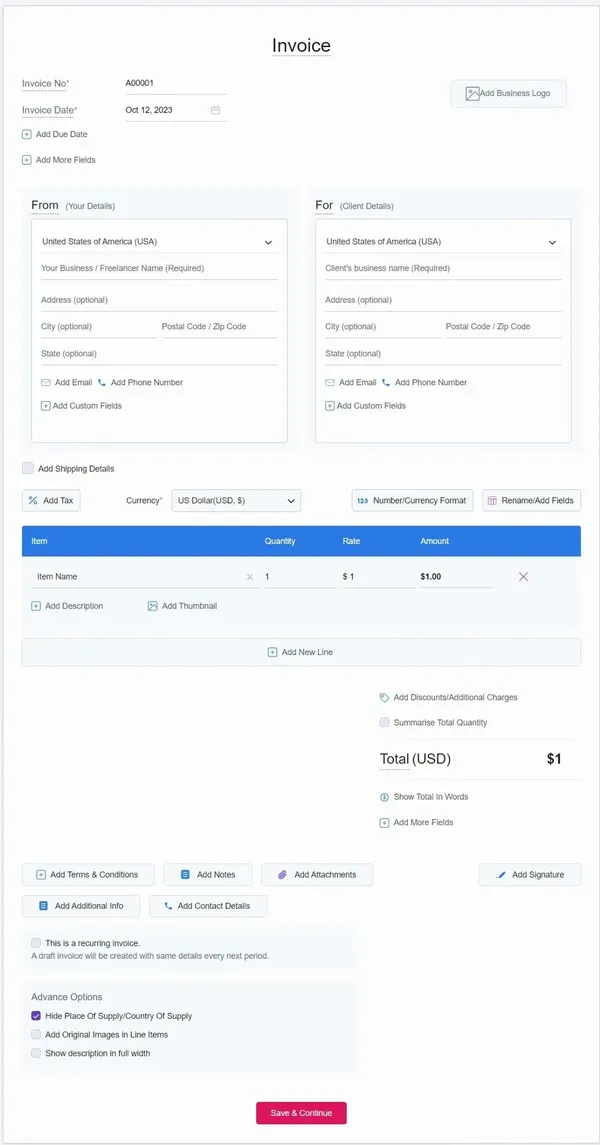

Add Invoice Details

2

Design & Share (optional)

Add your business, client and item details

Change template, color, fonts, download pdf, print etc

1

Add Invoice Details

2

Design & Share (optional)

Add your business, client and item details

Change template, color, fonts, download pdf, print etc

Free tools and templates by Refrens

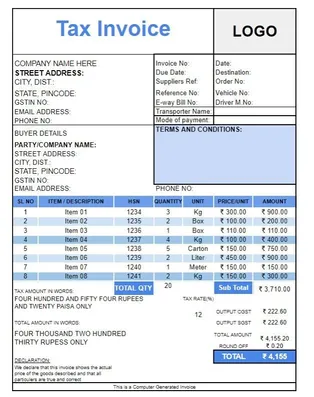

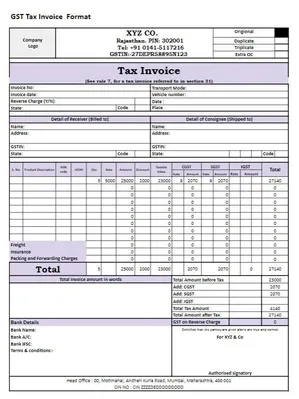

Proforma Invoice TemplatesOnline Purchase Order TemplatesInvoice MakerFree Invoice TemplatesFree Quotation GeneratorOnline Quotation TemplatesExcel Quotation TemplatesFreelance Invoice TemplatesPrintable Invoice Templates in WordBlank Invoice Templates in ExcelGST Invoice FormatTax Invoice TemplatesIT Services Invoice TemplatesPhotography Invoice Templates

Get Your Free Tally Bill Format NowCreate Free Invoice

Templates

- Invoice Templates

- |

- Quotation Templates

- |

- Proforma Invoice Templates

- |

- Purchase Order Templates

- |

- Freelance Invoice Templates

- |

- Quote Templates

- |

- Invoice Templates Word

- |

- Invoice Templates Excel

- |

- Printable Invoice Templates

- |

- Blank Invoice Templates

- |

- Tally Bill Format

- |

- Tax Invoice Templates

- |

- IT Service Invoice Templates

- |

- Photography Invoice Templates

- |

- Videography Invoice Templates

- |

- Social Media Invoice Templates

- |

- Digital Marketing Invoice Templates

- |

- Graphic Design Invoice Templates

- |

- Content Writing Invoice Templates

- |

- Web Development Invoice Templates

- |

- Service Invoice Templates

- |

- Rental Invoice Templates

- |

- Medical Invoice Templates

- |

- Landscaping Invoice Templates

- |

- Plumbing Invoice Templates

- |

- Cleaning Invoice Templates

- |

- Law Firm Invoice Templates

- |

- Consulting Invoice Templates

- |

- Estimate Templates

- |

- Interior Design Invoice Templates

- |

- Trucking Invoice Templates

- |

- DJ Invoice Templates

- |

- Catering Invoice Templates

- |

- Auto Repair Invoice Templates

- |

- Towing Invoice Templates

- |

- Musician Invoice Templates

- |

- Handyman Invoice Templates

- |

- Roofing Invoice Templates

- |

- Commercial Invoice Templates

Helpful Links

Made with and in Bengaluru.

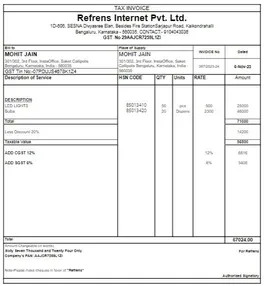

Refrens Internet Pvt. Ltd. | All Rights Reserved

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.